- Opening Bell

- October 28, 2025

- 4min read

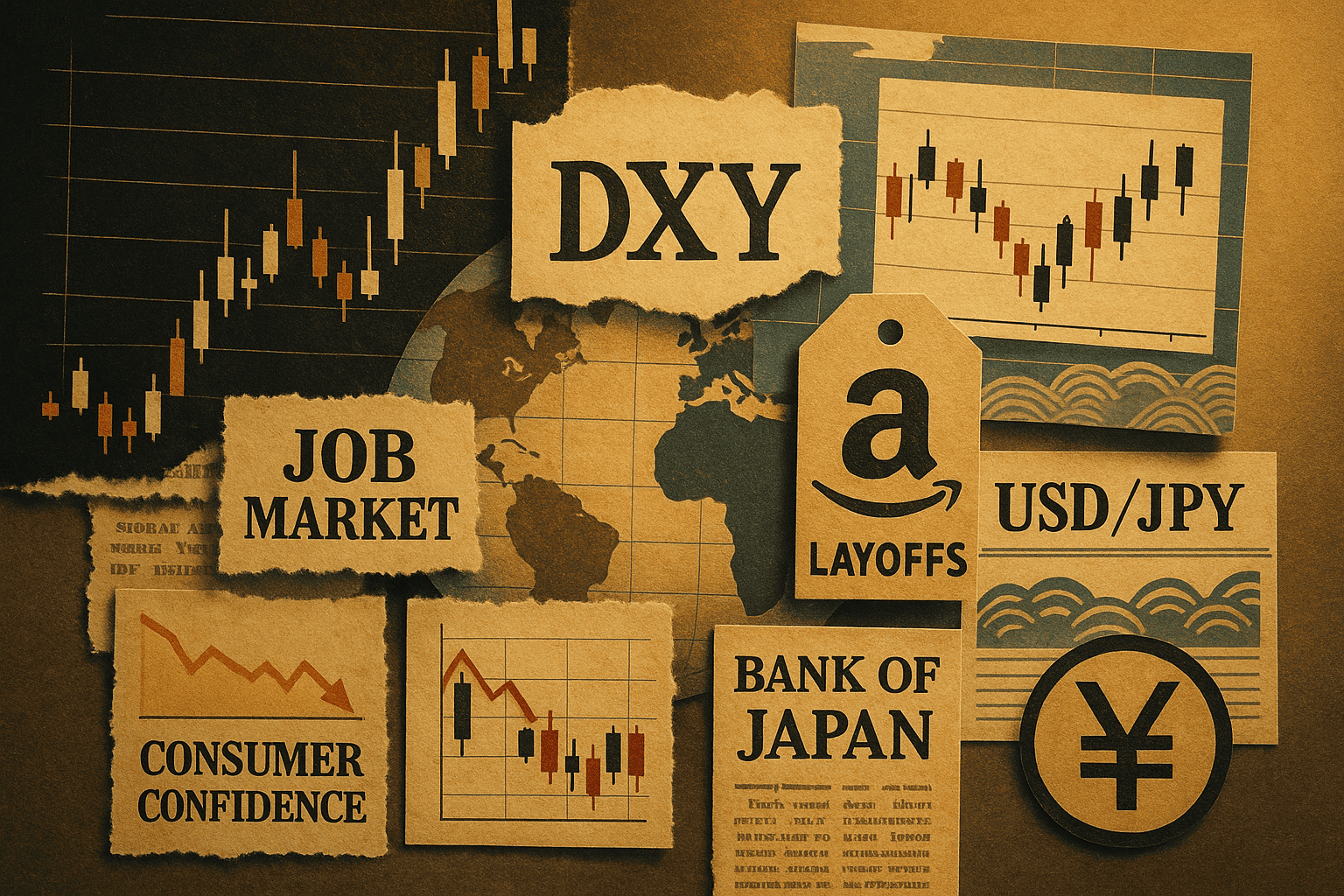

USD/JPY and DXY Face Pressure Ahead of Key Data and BoJ Meeting

Markets opened cautiously today with the U.S. dollar on the back foot, as traders brace for a round of data releases and central bank events that could shape the week’s direction. Overnight, USD/JPY took center stage, leading the dollar lower after Japanese Finance Ministry officials hinted they were “watching the yen closely” — language often read as a soft form of verbal intervention.

However, traders have seen this movie before. Japan’s Ministry of Finance has made similar remarks in the past without following through with actual market action. So while the yen’s brief strength may grab headlines, it’s unlikely to trigger a lasting reversal in USD/JPY on its own.

The real event to watch is Thursday’s Bank of Japan policy meeting, where no immediate rate change is expected. Still, markets are pricing in roughly a 38% chance of a 25bps hike in December — a sign that sentiment is slowly shifting toward a more hawkish outlook. Even a hint from the BoJ that policy normalisation remains on the table could give the yen a mild boost later this week.

Macro Picture: U.S. Data in Focus

The U.S. calendar looks light on hard data, leaving traders to rely on anecdotes and company headlines to gauge economic momentum. Reports that Amazon may cut up to 30,000 jobs have added to growing concerns over the labour market, while consumer sentiment surveys continue to show rising anxiety about job prospects.

Later today, the Conference Board’s Consumer Confidence report for October will offer a clearer snapshot of household sentiment. A soft print could reinforce the view that consumers are turning cautious, putting pressure on the dollar.

Put simply: weak consumer confidence could spell a softer dollar session today.

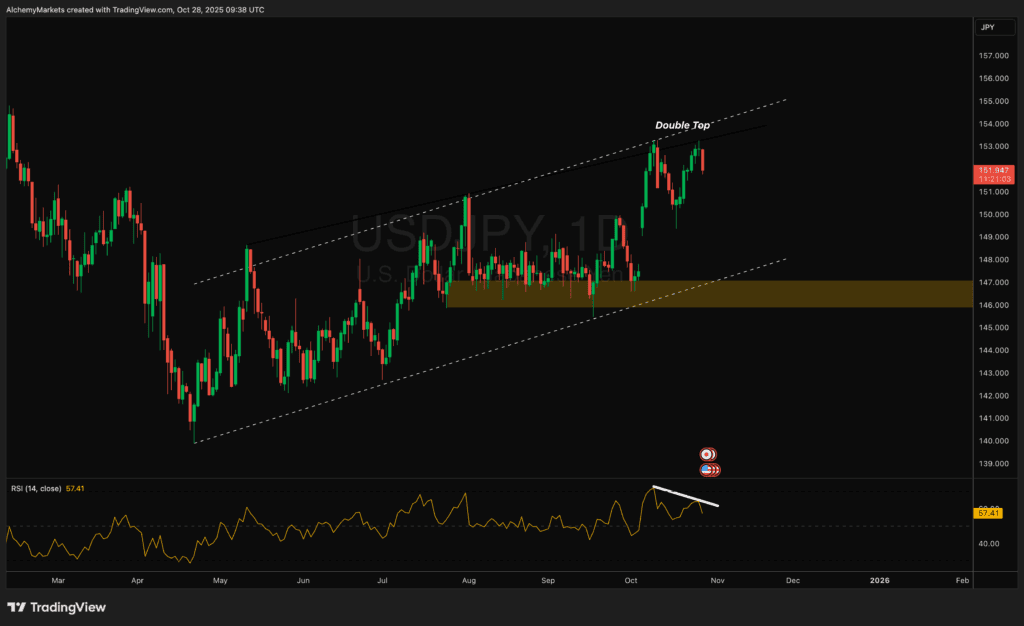

USD/JPY: Double Top Signals Potential Reversal

Technically, USD/JPY has carved out a double top pattern support by RSI divergence just below the 154.00 mark, suggesting potential exhaustion in the recent uptrend. The pair continues to trade within an ascending channel, but momentum looks to be fading near the upper boundary.

If selling pressure deepens, traders may look toward the 150.00–147.00 zone as key support — an area that aligns with the mid-range of the broader channel. This zone also overlaps with the highlighted consolidation region from early autumn, making it a critical level for bulls to defend.

Still, unless the BoJ surprises markets with firmer language or policy action later this week, any yen strength is likely to be measured rather than dramatic.

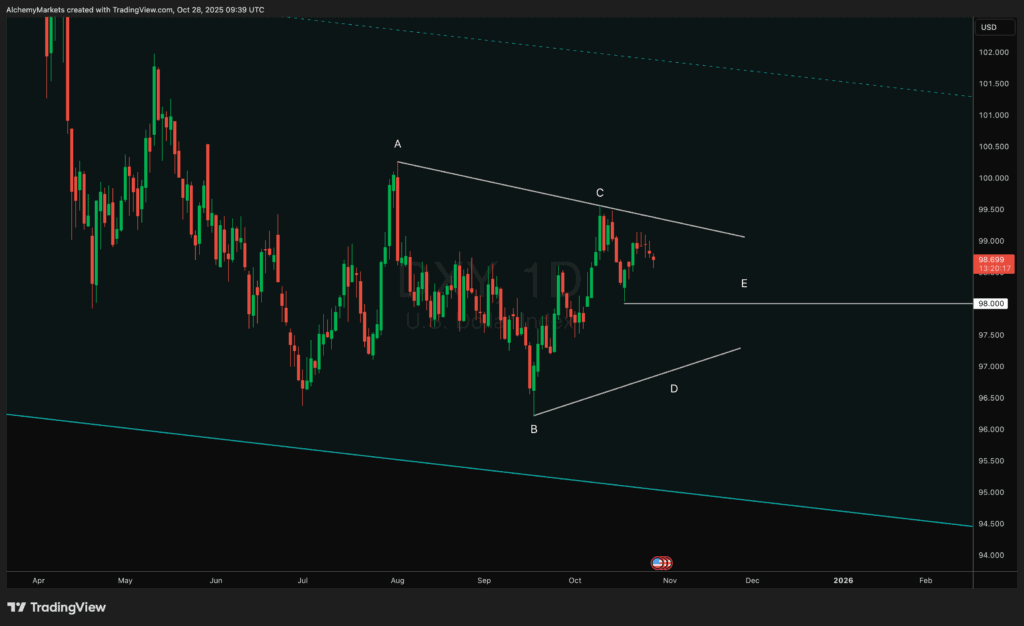

DXY: Dollar Index Eyes 98.00 Support

The U.S. Dollar Index (DXY) has been consolidating in a running triangle formation, reflecting indecision among traders. With softer macro data expected and a cautious risk tone, the index could make a move toward its next key support around 98.00.

A break below that zone could open the door for further downside, but for now, DXY remains in a technical squeeze between lower highs and higher lows. The pattern suggests the dollar is waiting for a clear catalyst — either stronger U.S. data or a shift in global monetary tone — to define its next leg.

Given today’s backdrop of potential soft data and muted risk appetite, the path of least resistance for the dollar appears lower in the short term.

Bottom Line:

- Verbal intervention from Japan has given the yen a brief lift, but the upcoming BoJ meeting will be the real test.

- U.S. data — particularly consumer confidence — could add pressure if sentiment weakens.

- USD/JPY’s double top hints at short-term fatigue, while DXY looks set to test its 98.00 support as the running triangle continues to tighten.

It’s shaping up to be a cautious day for the dollar, with traders keeping one eye on data and the other on central banks.