- Opening Bell

- September 2, 2025

- 2 min read

UK Yields Surge 5.69%, FTSE (UK100) and DAX (DE30) on Watch

UK 30-year gilts (UK government bonds) ripped to 5.69% yesterday, the highest borrowing cost in 27 years. Germany’s bonds also weren’t spared, with 30-year yields hitting a 14-year high.

So is this good for UK and German stocks?

Not really. Higher yields mean tighter financial conditions and higher discount rates, which tend to cap equity rallies and put pressure on stretched valuations.

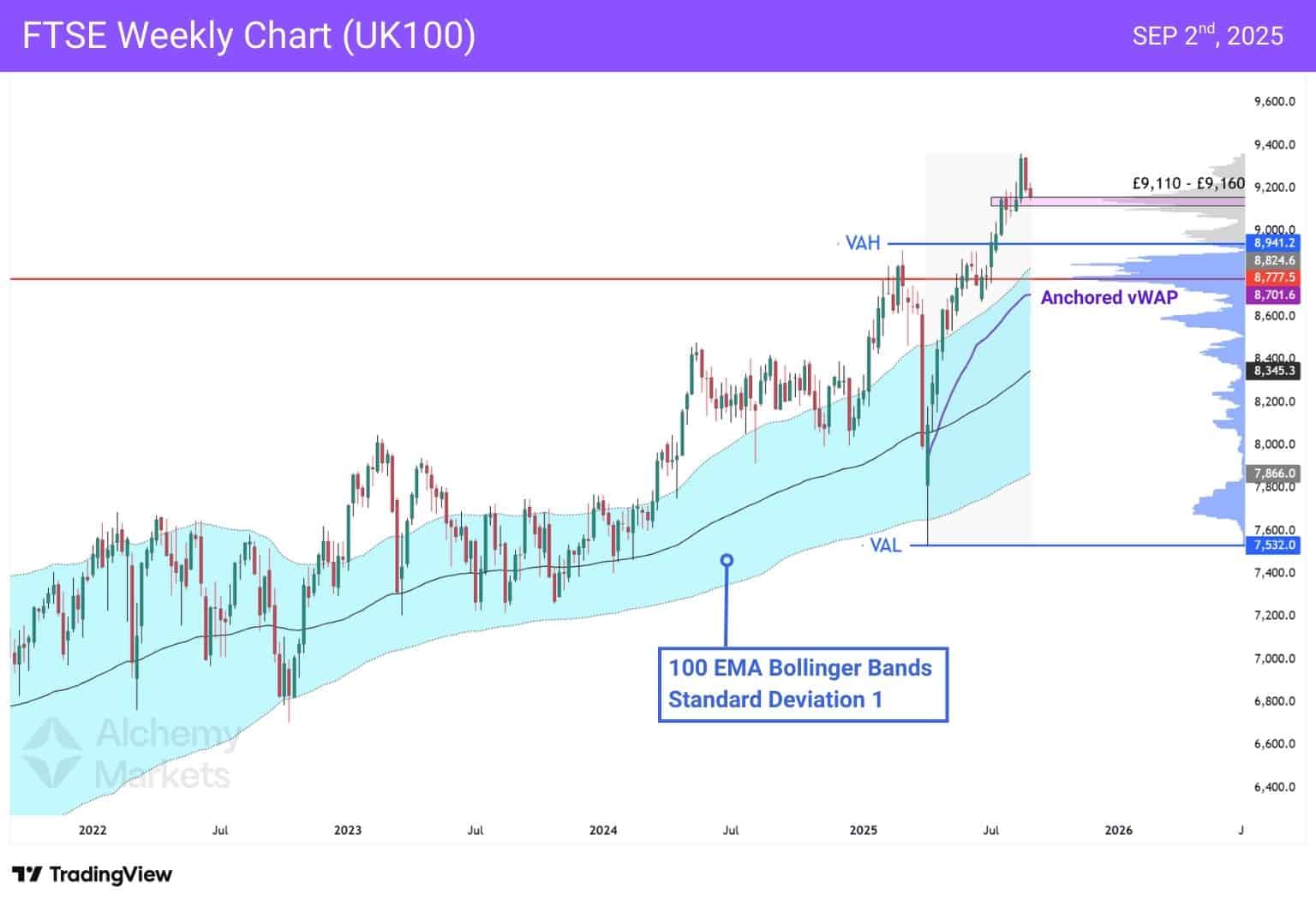

FTSE (UK100) Reacts Negatively, But is At Support

The FTSE is trading right at a critical support cluster. Around £8,770–£8,820, price is sitting on the anchored VWAP and Point of Control (POC), where most trading volume has built up. This is the line in the sand.

- Upside cap: £8,941 (Value Area High), near the prior ATH of £8,909.8 — this zone is tough resistance.

- Support to hold: £7,866 is the macro pivot. Lose it, and sellers may drive the index toward the 100-week EMA Bollinger Bands® (stdev 1) at £8,345, a level that also lines up with a High-Volume Node.

- The 100 EMA BB has been reliable, catching major cycle lows in the past. As long as the FTSE stays above its lower band, the long-term uptrend remains intact.

DAX (DE30) Nears Support, Hints Distribution

The DAX is still pinned under €24,500, with the POC since April lodged at the highs. That suggests distribution rather than clean accumulation, raising the risk of a long squeeze.

- Bull trigger: Weekly close above €24,500 with rising volume/value migration, unlocking the ATH zone (€24,300–€24,650).

- First defence: Ascending trendline support, but vulnerable under the current top-heavy profile.

- Key pivot: €23,180 — the prior macro ATH and Value Area Low. Below it, downside layers open at €22,290 → €21,565 → €20,840, with €20,285 as the macro uptrend breaker.

- The 50-week EMA Bollinger Band (stdev 1) still maps the bigger picture. Historical lows have formed at the lower band, so only a clean break under €20,285 would mark a structural trend shift.

Closing Thoughts

The name of the game this week, for the Euro indices, is the bonds market.

With UK and German yields surging, equities are left clinging to technical support. Both UK100 and DE30 remain in long-term uptrends as long as their EMA Bollinger Bands hold — but until bond pressures ease, rallies will struggle to break free.

Currently, the UK100 respects EMA 100 and EMA 200 bands more. The DE30 on the other hand is cleaner to examine, with it respecting the EMA 50, 100, and 200 bands cleanly.