- Opening Bell

- December 9, 2025

- 2 min read

Strong JOLTS Data Keeps Fed Cautious – What It Means for DXY and the U.S. Dollar

The latest U.S. JOLTS Job Openings report showed 7.658 million openings in October, beating expectations of 7.2 million and rising from 7.227 million previously.

The data points to continued strength in labour demand, suggesting the jobs market remains resilient despite slower overall growth.

What JOLTS Is and Why It Matters

JOLTS tracks the number of job openings, hires, and quits across the U.S., revealing how tight the labour market is.

It’s a lagging-to-coincident indicator — meaning it reflects conditions one to two months in the past, not what’s happening right now.

So while it shows employers are still hiring, it’s not the full picture the Fed will base its policy on.

Implications for Tomorrow’s Fed Meeting

Markets expect the Fed to cut rates by 25 basis points tomorrow.

But with job openings still strong, the Fed is unlikely to sound dovish.

Instead, they may stress a data-dependent or cautious stance, signaling patience before further cuts.

- Dovish message: Dollar weakens.

- Data-dependent / hawkish tone: Dollar strengthens.

The Fed’s tone will matter far more than the rate move itself.

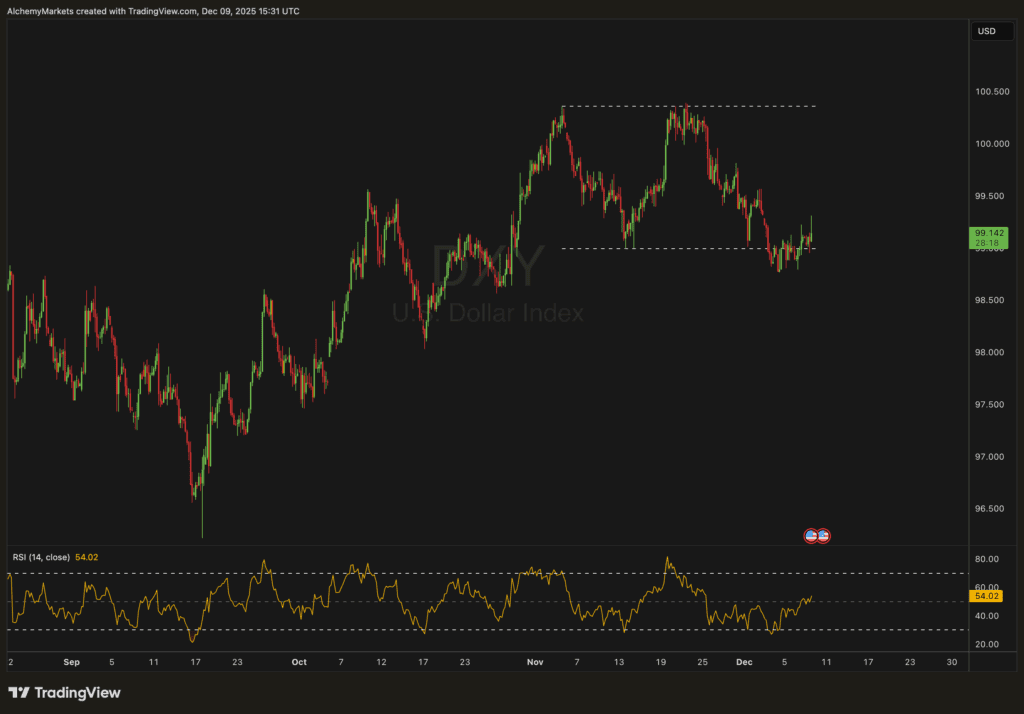

DXY Technical Setup

As shown on the chart, the U.S. Dollar Index (DXY) has been trading in a sideways range between 99.00 and 100.50.

After bouncing from the lower end, it’s now around 99.26.

- If Powell delivers a hawkish cut, DXY could rise toward 100.50 or even break higher.

- If he sounds dovish, the index could drop back below 99.00.

Bottom Line

Today’s JOLTS beat confirms the labour market is still firm — giving the Fed room to stay cautious.

Expect a 25 bp cut with data-dependent guidance, which likely keeps the U.S. dollar supported and trading back toward the upper end of its current range.