- Opening Bell

- November 6, 2024

- 5 min read

Trump’s Second Rodeo and What It Means for Markets

With Donald Trump securing victory in the U.S. presidential election, financial markets are responding swiftly to what many view as a significant shift in policy direction. A Republican sweep across the Presidency, Senate, and potentially even the House is reinforcing expectations of a pro-business agenda, likely centered around tax cuts, deregulation, and a strong stance on trade.

This outcome has already led to a notable rise in the U.S. dollar as investors anticipate policies aimed at stimulating domestic economic growth. Treasury yields are also climbing, reflecting expectations of an inflationary environment fuelled by fiscal spending and renewed trade measures. As markets digest this news, the dollar’s strength is likely to be sustained in the near term, positioning it as a favored currency in the global FX market.

Impact on the Dollar

The immediate effect on currency markets has been a stronger dollar across major currencies. Most G10 currencies, including the euro, Japanese yen, and British pound, have shown declines against the dollar, with losses between 1% and 1.7%. The Canadian dollar has been less affected, reflecting the benefits Canada may gain under a Republican administration that supports stronger economic ties and could shield Canada from some international trade conflicts.

EUR/USD Outlook

A Trump presidency presents unique challenges for Europe. As it stands, the euro has been the weakest among G10 currencies in recent trading, as the European economy braces for potential renewed trade barriers. With Trump likely to re-emphasise trade tariffs, particularly on major economies like the Eurozone, Europe’s export-dependent economy may face significant hurdles, especially in Germany.

If the Republicans succeed in taking both the Senate and the House, markets expect the EUR/USD exchange rate to continue struggling. A Trump-driven trade agenda, coupled with Europe’s stagnant growth, may keep the euro under pressure. In a scenario where the Republicans take the House, there could be downward pressure on the euro, possibly pushing it toward parity with the dollar in the long term if trade conflicts persist. Short-term, the EUR/USD could drift to the 1.0550–1.0600 range.

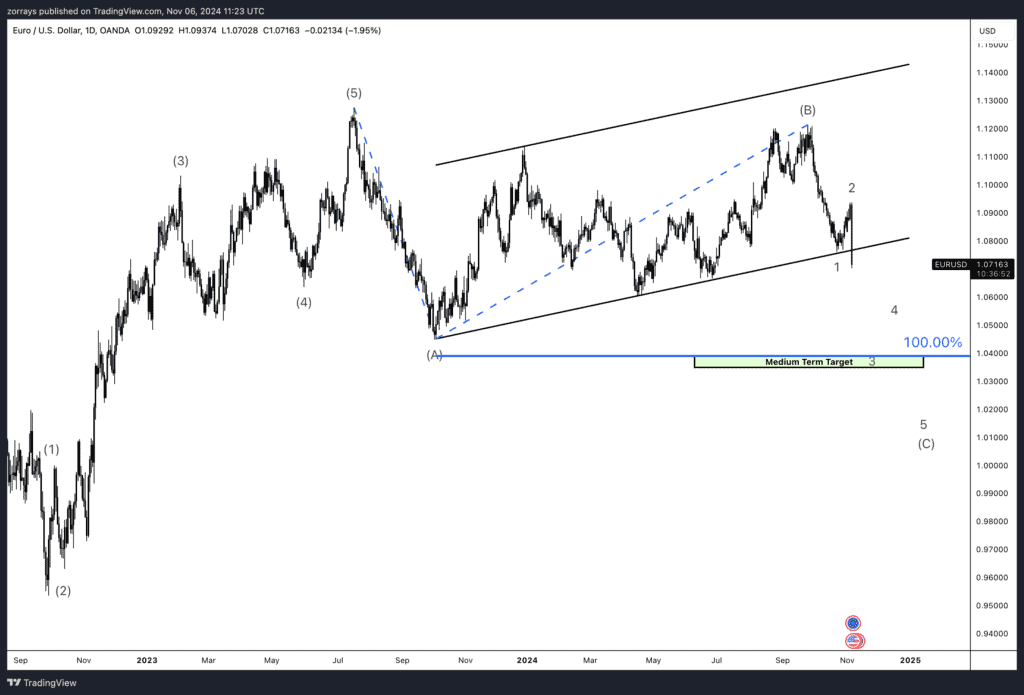

Technical Analysis

This EUR/USD chart shows a bearish flag pattern, suggesting further downside potential for the euro as it consolidates within a downward sloping channel. The fundamental backdrop of a strong U.S. dollar, buoyed by expectations of Trump-led fiscal policies, adds to the bearish sentiment. Technically, this move appears to be part of a larger Elliott Wave correction, specifically a Wave C pattern. Notably, Wave C is projected to extend to the 100% Fibonacci extension of Wave A, a classic target level for corrective waves. This aligns with a medium-term target zone around the 1.0400 level, which may complete Wave 3 of C. If this scenario plays out, it would signify a significant continuation of the euro’s downtrend against the dollar.

Stock Market and Trump’s Policies

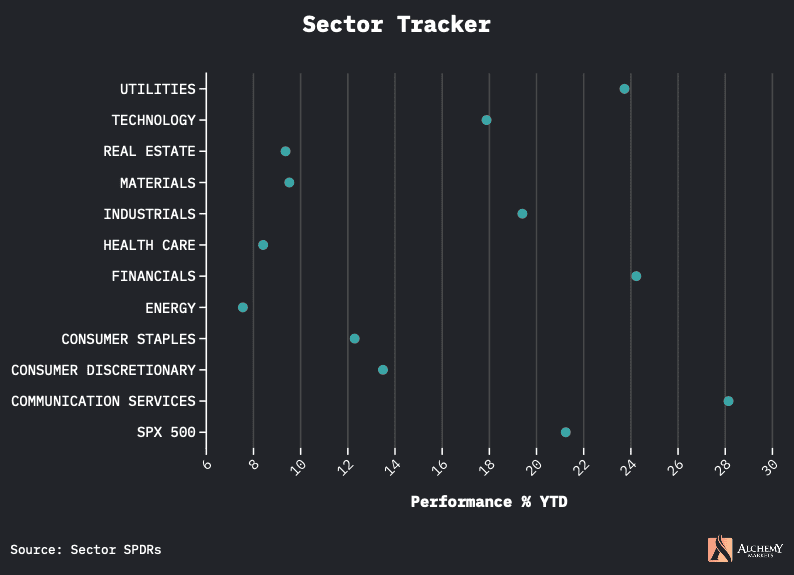

Trump’s 2024 policy agenda is expected to focus on tax cuts, deregulation, and support for traditional energy sectors. These policies could spark short-term gains in certain sectors, especially energy, defence, and industrials.

- Tax and Spending Policies: Trump’s tax agenda emphasizes extending the 2017 tax cuts, which could boost corporate profits in sectors like finance and consumer goods. However, if tax cuts expand the deficit, it might lead to higher long-term Treasury yields, impacting the broader equity market. While this could benefit stocks in the short term, growth stocks may face headwinds if interest rates rise in response to a higher deficit.

- Energy and Infrastructure: Trump’s support for fossil fuels could benefit oil, gas, and coal companies, potentially leading to higher stock prices in these sectors. This approach contrasts with clean energy momentum, as Trump’s policies may reduce support for renewable energy investments. Fossil fuel stocks could gain traction, while renewable stocks may encounter challenges due to reduced federal backing.

- Trade Policy and Geopolitics: A Trump presidency may bring a stronger focus on protectionist trade policies, especially concerning China. Increased tariffs and potential supply chain shifts could create volatility in technology and consumer goods sectors that depend on global trade networks. The strength of the dollar might also impact U.S. exports and related sectors.

- Federal Reserve Influence: Although the Federal Reserve operates independently, Trump has previously shown a preference for lower interest rates. In the short term, this might be positive for equity markets, but if inflation becomes an issue, the Fed may be forced to adjust, which could lead to market volatility as investors respond to shifts in monetary policy.

In summary, Trump’s potential policies may create a favorable environment for traditional industries, defense, and energy stocks. The anticipation of tax cuts and deregulation could lead to a short-term rally, but concerns about deficit-related interest rate hikes may add caution for longer-term equity markets, especially for growth-focused sectors.

As the election results become clearer, financial markets will likely adjust further, but for now, the outlook remains positive for the dollar and certain stock market sectors under Trump’s policy agenda.