- Opening Bell

- August 21, 2024

- 5 min read

Shifting Sands: USD Faces Pressure Amid Key Data Releases

As financial markets keep a watchful eye on the ebb and flow of global currencies, the U.S. dollar is showing signs of weakness. With key economic data on the horizon, traders are bracing for what could be significant shifts in market sentiment. The coming days could prove pivotal as the Federal Reserve’s focus on dual mandates and the release of crucial U.S. jobs data stir the waters.

USD: Pressure Mounts as Data Releases Loom

The U.S. dollar has been gradually losing ground, with another round of selling on Tuesday. This decline comes amid speculation surrounding the upcoming release of revised U.S. employment data by the Bureau of Labor Statistics (BLS). The anticipation centers on the potential downward revision of job growth figures for the year ending in March 2024. Analysts suggest that employment gains during this period might be overstated by anywhere from 500,000 to 1,000,000 jobs.

If these revisions indicate a less robust job market, it could alter the Federal Reserve’s perception of economic conditions, particularly in terms of labor market tightness. This potential shift could signal that the economy has more slack than previously thought, particularly as the U.S. economic momentum cools. The revised data is expected at 10:00 EST and poses a significant risk to the dollar’s value.

Adding to the day’s events, the Federal Reserve will release the minutes from its July 31st FOMC meeting. This was a meeting where the Fed re-emphasised its dual mandate of promoting maximum employment and maintaining price stability. Market participants will be keen to see how the Fed balances its comfort with current inflation levels against concerns over employment. These discussions could provide further insight into the Fed’s future monetary policy direction.

The downward trend in the U.S. Dollar Index (DXY) appears to be gaining traction. Traders are increasingly betting on what could be the start of a new market trend. A critical level to watch is the 101.00 mark on the DXY, which could signal further movement in the dollar’s trajectory.

EUR: Eurozone’s Balance of Payments Provides Support

On the other side of the Atlantic, the euro is benefiting from a robust balance of payments position. Recent data showed that the eurozone’s current account surplus reached a record high of over EUR 50 billion in June. This positive trend has been building over the past two years, with the eurozone’s basic balance (current account plus foreign direct investment and portfolio investment) now at its highest recorded level.

The European Central Bank’s (ECB) trade-weighted euro index also reflects this strength, sitting at an all-time high. Were it not for the persistent strength of the U.S. dollar, the EUR/USD exchange rate would likely be much higher.

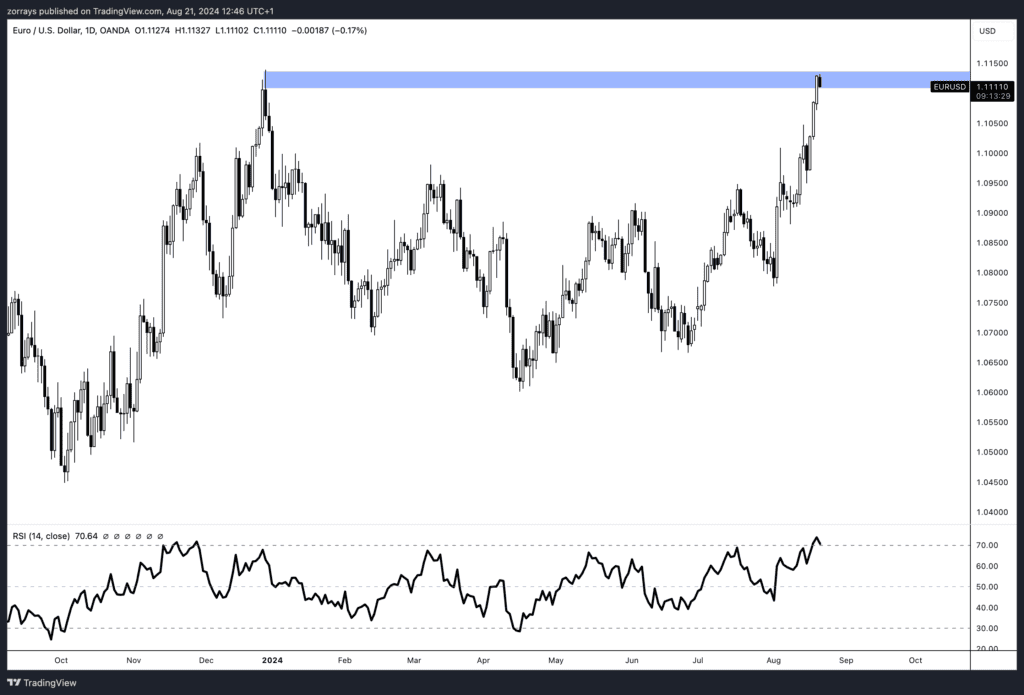

However, the EUR/USD pair is encountering significant resistance in the 1.1110/1140 range, a level that could define the upper bounds of the exchange rate in the medium term as it is in the overbought territory on the RSI. As the U.S. economy shows signs of slowing and markets anticipate the first Fed rate cut in September, the euro could potentially break through this resistance. With realised volatility at low levels, a break higher could lead to sharp upward moves, and many traders are reluctant to bet against the euro in the current environment.

FAQs

Q: What could the revised U.S. jobs data mean for the dollar? A: If the revised jobs data shows a significant downward adjustment, it could indicate a weaker labour market than previously thought, potentially leading to a softer U.S. dollar.

Q: Why is the euro gaining strength? A: The euro is benefiting from a strong balance of payments position in the eurozone, with record current account surpluses and robust foreign investments.

Q: What is the significance of the 101.00 level on the DXY? A: The 101.00 level on the U.S. Dollar Index is seen as a critical support point. A move below this level could indicate further weakness in the dollar.

Q: How could the Fed’s focus on its dual mandate affect markets? A: The Fed’s dual mandate of balancing employment and inflation could influence its policy decisions. If the Fed prioritizes employment concerns, it might adopt a more dovish stance, affecting the dollar.

Q: What is the basic balance in the eurozone’s balance of payments? A: The basic balance refers to the sum of the current account, foreign direct investment, and portfolio investment. A positive basic balance supports a stronger currency.

Q: Could the EUR/USD pair break through the 1.1110/1140 resistance level? A: While resistance is strong, the combination of a slowing U.S. economy and low volatility could enable the EUR/USD pair to break higher, leading to potential sharp gains.

Conclusion: As economic data and central bank communications unfold, the currency markets are poised for potential volatility. With the U.S. dollar under pressure and the euro supported by strong fundamentals, traders will need to stay vigilant in the days ahead. The upcoming data releases and policy insights will be key to understanding the future trajectory of these major currencies.