- Opening Bell

- August 19, 2025

- 4min read

Reserve Bank of New Zealand: Rate Cut Expected, More Easing to Follow

The Reserve Bank of New Zealand (RBNZ) is poised to deliver another interest rate cut this week, with markets anticipating one more reduction before the end of the year. Despite a subdued growth outlook and a cooling labor market, the central bank is expected to signal that its easing cycle is nearing completion.

RBNZ Policy Outlook

The RBNZ will meet on 20 August to decide on monetary policy. Following its July meeting, where it left the Official Cash Rate (OCR) unchanged at 3.25%, expectations now point toward a 25 basis point cut to 3.0%.

This move is largely priced into markets and aligns with the central bank’s own forward guidance. The focus will shift to the Bank’s updated economic projections and forward-looking statements, which may hint at one final cut later this year.

By November, the OCR could reach 2.75%, marking the likely end of the current easing cycle.

Inflation Trends in Line with Projections

New Zealand’s headline inflation rose from 2.5% to 2.6% in the second quarter, closely matching the RBNZ’s earlier forecasts.

More importantly, non-tradable inflation, a key indicator for policymakers, slowed from 4.0% to 3.7%, exactly as expected. The Bank anticipates this figure will decline further to 3.4% by year-end, before falling just under 3.0% by late 2026.

While service sector inflation has shown some persistence in prior quarters, current projections remain consistent with the view that the OCR will stabilize at 2.75%.

Growth Outlook: Still Fragile

Economic growth surprised to the upside in the first quarter, with GDP expanding 0.8% quarter-on-quarter, above both market and RBNZ expectations. However, forward-looking indicators such as PMIs and business sentiment surveys point to a more subdued performance in the second quarter.

Exports remain under pressure, particularly with the 15% reciprocal tariff imposed by the US, affecting goods worth nearly 2% of GDP. Meat and dairy, which represent around 12% of total exports, bear the brunt of these measures.

For Q2, growth is expected to remain modest, likely in the 0.1–0.4% range, keeping attention firmly on inflation and the labor market rather than output strength.

Labour Market Weakness Supports Further Easing

Despite positive GDP data, the labour market is showing clear signs of cooling:

- Unemployment rose to 5.2% in Q2, the highest since 2020.

- Wage growth slowed to 2.4% year-on-year, down sharply from 4.3% a year earlier.

This weakening in the jobs market aligns with RBNZ expectations and bolsters the case for continued policy easing.

NZD/USD Outlook: Driven by the US Dollar

While domestic developments provide a backdrop for NZD movement, the New Zealand dollar’s trajectory remains tied primarily to US monetary policy.

Markets are aligned with the expectation of two more RBNZ cuts this year, limiting room for NZD-specific downside. Instead, the Federal Reserve’s policy path will likely dictate momentum.

Our outlook suggests the Fed may cut rates by 75 basis points before year-end, which could support commodity-linked currencies like the NZD.

However, risks remain tied to US-China trade relations. A renewed escalation could weigh on global sentiment and commodity currencies, though recent signs of de-escalation provide some relief.

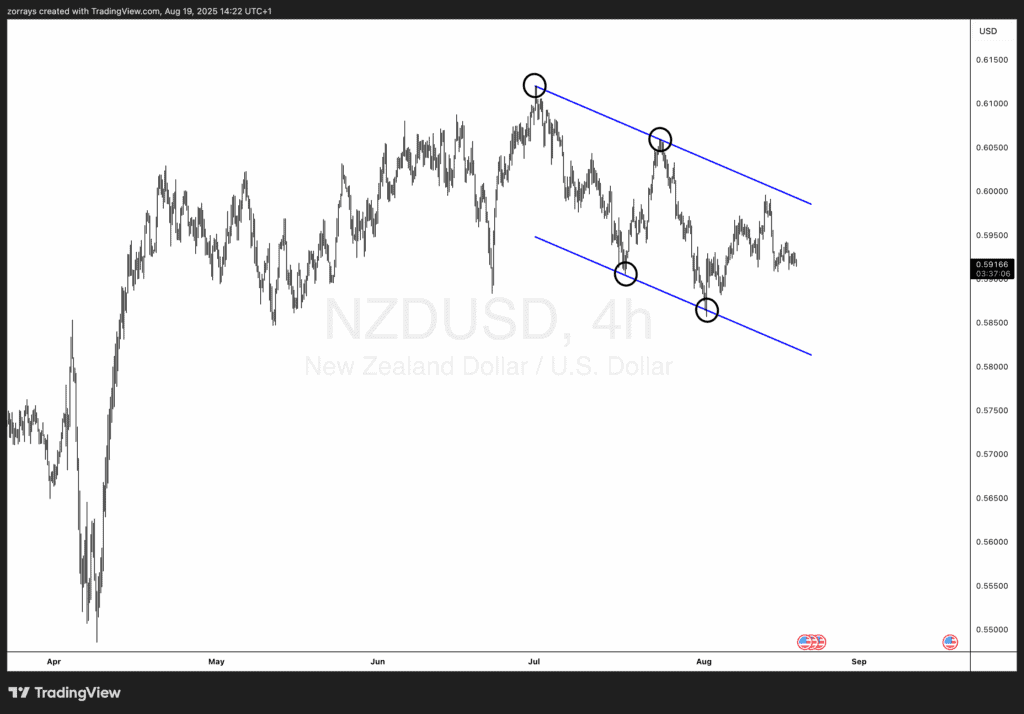

Technical Analysis: NZD/USD

The NZD/USD 4-hour chart highlights a descending channel, reflecting the broader bearish structure in place since July.

- Price action has consistently respected both upper resistance and lower support trendlines.

- Recent rejection near 0.6000 confirms the downtrend remains intact.

- Immediate support lies around 0.5850, while a break below could open the way to 0.5750.

- On the upside, a breakout above 0.6000 would be required to shift momentum and target the 0.6100–0.6150 zone.

For now, NZD/USD remains in a bearish channel, but potential Fed-driven USD weakness later this year could provide a medium-term bullish catalyst.