- Opening Bell

- September 24, 2024

- 6 min read

RBA Holds Cash Rate Steady at 4.35% Amid Persistent Inflationary Pressures

The Reserve Bank of Australia (RBA) has maintained its cash rate at 4.35% during its most recent monetary policy meeting, while the interest rate paid on Exchange Settlement (ES) balances remains unchanged at 4.25%. The decision, anticipated by many analysts, highlights the central bank’s ongoing concerns about inflation, which remains above target despite some recent signs of moderation.

Key Takeaways from the RBA’s Statement:

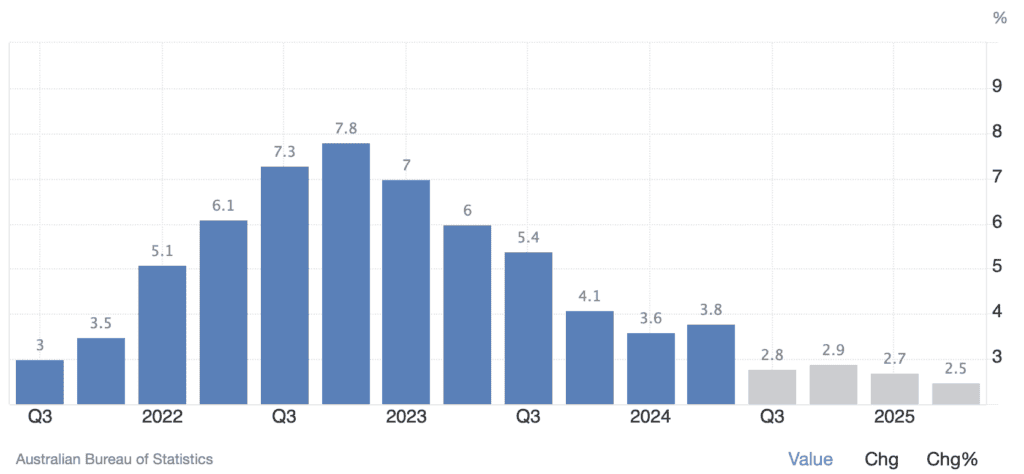

- Persistent Inflation: Inflation has moderated from its 2022 peak but is still stubbornly above the RBA’s 2–3% target range. Underlying inflation, as measured by the trimmed mean, stood at 3.9% in the year leading to June, with headline inflation slightly easing in July due to temporary cost-of-living relief from federal and state measures.

- Growth Concerns: The Australian economy continues to struggle with weak growth, with GDP data from the June quarter confirming sluggish economic expansion. Real disposable incomes have been declining, and restrictive financial conditions are dampening discretionary consumption.

- Labour Market: The labour market remains tight, though there are emerging signs of easing. The unemployment rate has climbed slightly to 4.2% in August, up from a low of 3.5% earlier in the year. Despite this, the participation rate is at record highs, and vacancies remain elevated, signaling a resilient labour market.

- Uncertainty and Risks: The RBA acknowledged the high level of uncertainty both domestically and globally. While some central banks have begun to ease monetary policy, the economic outlook, particularly in China, is softening, adding further uncertainty to global commodity prices and economic stability.

Inflation Outlook and Challenges

Source: Trading Economics

The RBA continues to forecast that inflation will not sustainably return to the midpoint of its target range until 2026. Despite progress in containing inflation, the central bank emphasised the need for ongoing vigilance to ensure inflation expectations remain anchored. Wage pressures have eased slightly, and productivity growth has been slow, but inflation remains a concern as firms’ pricing strategies and wage growth respond to broader economic conditions.

Key inflation insights:

- Underlying Inflation: Persistently high, with little movement over the last year.

- Headline Inflation: Declining due to temporary relief measures but expected to pick up again without sustained intervention.

- Forecasts: Inflation is expected to approach the 2–3% target by 2026, reflecting the longer-term challenges of balancing demand and supply in the economy.

Global and Domestic Uncertainty

The RBA pointed out significant uncertainties both at home and abroad. The risk of a slower-than-expected pickup in household consumption looms large, and there are concerns about how firms will manage pricing amid slower economic growth. On the global front, geopolitical issues and the softening Chinese economy are contributing to volatility, especially in commodity prices—a key factor for Australia’s trade balance.

RBA’s Commitment to Price Stability

The RBA reiterated its commitment to restoring inflation to target levels, underscoring its mandate for price stability and full employment. The Board remains determined to keep policy settings restrictive for as long as necessary to rein in inflation, leaving the door open for future rate adjustments depending on evolving economic conditions.

Points of emphasis:

- Sustainability: Inflation must return sustainably to the target range.

- Policy Vigilance: The RBA is closely monitoring domestic and global risks.

- Data-Driven Decisions: Future rate moves will be guided by incoming data on inflation, labour markets, and broader economic trends.

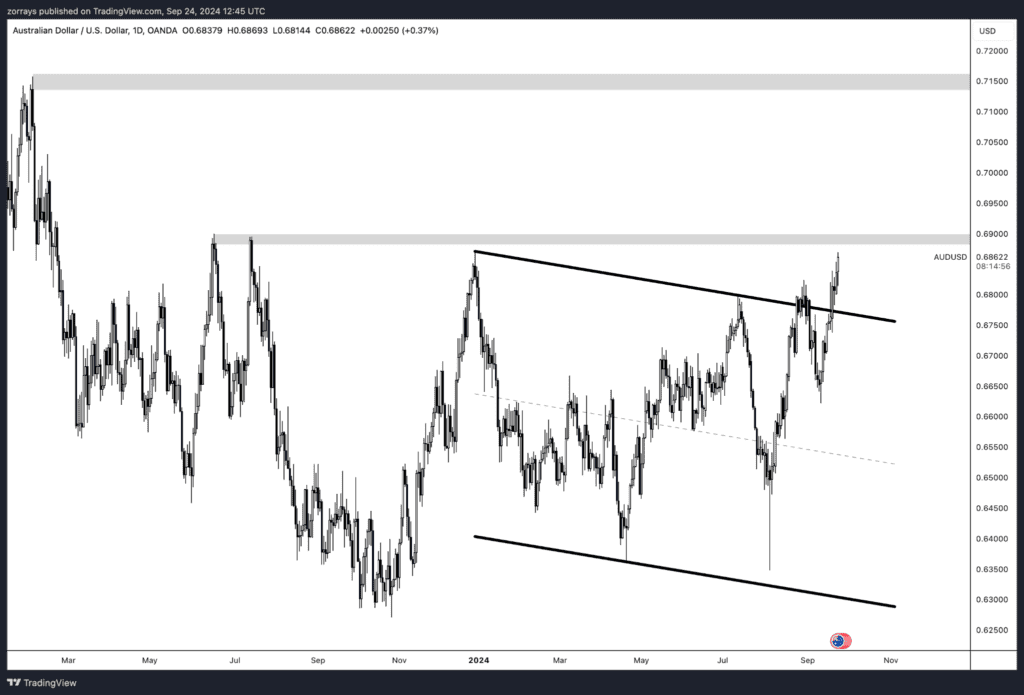

AUD/USD Technical Analysis – Bullish Momentum and Key Resistance Levels

In the current AUD/USD daily chart, we observe a clear bullish breakout above a long-standing descending channel, signalling the potential for further upward movement. The price has recently broken above a descending trendline that had served as a key resistance level within a broader bull flag pattern. This breakout is significant because it suggests that bullish momentum could carry the pair higher towards key resistance zones.

Key Observations:

- Bull Flag Pattern: The chart displays a textbook bull flag formation. After a sharp rally, the price entered a period of consolidation within a downward-sloping channel. This is often seen as a continuation pattern, indicating a pause before another leg higher. With the recent breakout above the channel, the potential for this pattern to play out is strengthened.

- Immediate Target – 0.6900 Resistance: The next significant level to watch is the 0.6900 resistance. This area had previously acted as a support-turned-resistance zone, and it is likely that traders will take profit or face some rejection here. If the bullish momentum continues and price decisively breaks this level, it would confirm the completion of the bull flag and signal further upside potential.

- Next Major Resistance – 0.7150: Should the pair break through the 0.6900 level, the next long-term target lies around the 0.7150 resistance level. This zone represents a more substantial area of resistance that capped price movements throughout much of 2023. Reaching this level would require sustained bullish momentum, supported by a broader market sentiment shift or continued weakness in the US dollar.

Short- and Long-Term Outlook:

- Short-Term: The immediate outlook is bullish, with the break of the descending channel signaling potential upside towards the 0.6900 resistance level. However, traders should watch for a possible retracement if the price stalls at this resistance zone.

- Long-Term: If the 0.6900 resistance is breached convincingly, we could see the pair continue its rally towards 0.7150, a key resistance area. This would suggest a larger bullish reversal in the AUD/USD pair, likely driven by stronger fundamentals or a shift in market sentiment over the coming months.

Key Support Levels:

- 0.6650: If price fails to hold above current levels, a key support zone can be found around 0.6650, the previous low before the recent rally.

- 0.6400: Further below, the 0.6400 level acts as a more significant support zone, and a break below this level could invalidate the current bullish scenario.

Conclusion:

The AUD/USD is currently showing strong bullish momentum, supported by the breakout from the bull flag pattern. In the short term, traders should monitor the 0.6900 resistance level closely, as a break above this could pave the way for a rally towards the 0.7150 level in the longer term. However, if the price fails to maintain its upward trajectory, we could see a retracement towards the 0.6650 support zone. Overall, the bias remains bullish as long as the price remains above the descending trendline and within the current bullish channel.