- Opening Bell

- July 26, 2024

- 3 min read

Sticky Inflation? U.S. Core PCE Data Expected to Be Higher

The Federal Reserve’s key measure for assessing inflation, the Core PCE index, will have its month-over-month data released shortly. As we approach this crucial release, it’s advisable to exercise caution in trading, as unexpected results could cause market volatility.

The current projection for the Core PCE index is a 0.2% increase, slightly up from the 0.1% reported in June. So, should investors be worried about this reading? Does it imply that inflation is still sticky?

Markets Volatility Expected To Be Mute, Unless There is a Surprise Reading

The markets have likely already factored in the expected Core PCE data, so significant volatility may not occur with a 0.2% reading.

However, if the actual data deviates significantly—such as a reading of 0.3% or 0.0%—it could trigger unexpected market reactions. A higher-than-expected reading could indicate more persistent inflationary pressures, potentially affecting the Federal Reserve’s policy outlook, while a lower-than-expected reading could suggest inflation is cooling more than anticipated.

In either case, a surprise outcome could lead to increased market volatility as investors adjust their expectations.

| Announcement | Previous | Forecast |

| Core PCE Index m.m | 0.1% | 0.2% |

Inflation has Been Steadily Slowing Down

Source: ForexFactory, Alchemy Markets

Despite the expected uptick in the Core PCE m/m data, the overall trend since February 2024 has shown a progression in slowing inflation. This suggests that investors are anticipating a steady inflation trend, which should not cause major shifts in market sentiment barring any unexpected data surprises.

0.3% Reading Would Be Dangerous

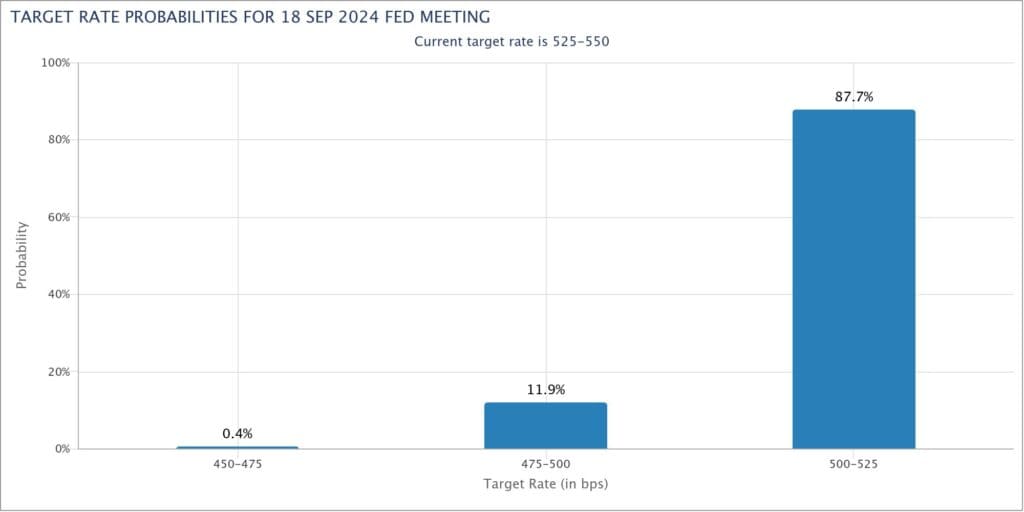

The FedWatch Tool currently indicates a 100% expectation for at least a 25 basis points (bps) rate cut by the Federal Reserve in September. Additionally, 11.9% of market participants expect a 50 bps cut, while a smaller 0.4% anticipate a larger cut of 75 bps.

This overwhelming expectation for rate cuts reflects market exuberance, with investors heavily betting on easing monetary policy. However, a surprise Core PCE reading of 0.3% or higher could significantly disrupt these expectations, triggering a notable market reaction as it would cast doubt on the likelihood of imminent rate cuts and suggest stronger inflationary pressures than anticipated.

Source: CME Group

Closing Thoughts

Although the markets are expected to remain relatively calm following the Core PCE data release, it’s crucial to exercise good risk management in your trades. A surprise reading could unsettle investors and lead to unexpected market reactions.

Data Release Time

- New York Time: 8:30 AM

- UK Time: 1:30PM

- UTC+0: 12:30PM

- Hong Kong Time: 8:30PM

FAQ

What is PCE?

PCE stands for Personal consumption expenditure, which is a measure of the change in the prices consumers are paying for goods and services, excluding food and energy.

What is the importance of Core PCE?

The PCE is a leading indicator for inflation, and is also the most important statistic the Federal Reserve considers when making interest rate decisions. A lower PCE reading is bullish for stocks, cryptos, and for FX pairs which are paired against the U.S. Dollar.

What moves the markets – the Forecast or the Actual Data?

The actual Core PCE data tends to have a greater impact on the markets than the forecast. While the forecast sets expectations, it’s the actual data release that can cause significant market reactions, especially if it deviates from the anticipated figures. When the data aligns with forecasts, market reactions are often muted since the information is already priced in. However, unexpected readings can lead to sharp market movements as investors reassess the economic outlook.

You may also be interested in:

EUR/USD Analysis – Temporary Dollar Strength