- Opening Bell

- November 26, 2025

- 2 min read

NZDJPY Eyes Breakout as RBNZ Signals End of Cuts

NZDJPY begins the session with a firmer tone after the Reserve Bank of New Zealand cut rates but signalled that the easing cycle is likely finished. The shift has supported the Kiwi as markets reassess the rate-differential outlook, especially against currencies still influenced by policy uncertainty.

The yen remains the swing factor. Investors continue to weigh whether the Bank of Japan will tolerate further currency weakness or lean more firmly towards stabilisation. At the same time, broader risk sentiment is sensitive, and renewed risk-off flows could still favour JPY despite New Zealand’s improving stance.

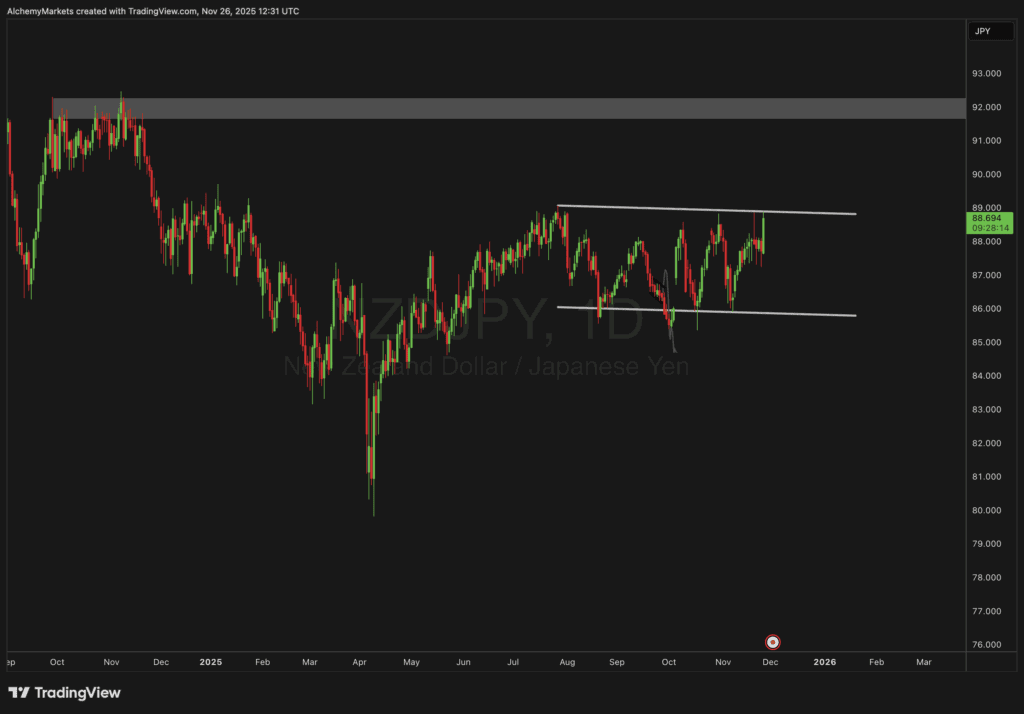

Chart: NZDJPY – Daily Timeframe

On the charts, NZDJPY is pushing against the upper boundary of a broad bull-flag structure, formed over recent months. The lower trend line has held several times, and the pair is now attempting another test of the top of the channel. A clean break would open the path towards the wider resistance zone near 92, an area that capped rallies earlier this year.

If the flag top continues to contain price, consolidation may follow, keeping the pair within its existing range until the next macro catalyst. For now, the market’s focus remains on whether the shift in RBNZ guidance is enough to carry the move through overhead resistance, or whether Japanese flows will reassert themselves.

NZDJPY stays on watch as one of today’s early interest points, sitting at the intersection of central-bank divergence and a technical breakout zone.