- Opening Bell

- June 26, 2024

- 3 min read

Nvidia and Nasdaq: Market Recovery or Dead Cat Bounce?

Last week, Nvidia’s CEO sold $95 million worth of NVDA shares from June 13-21, marking the first time in nine weeks that Nvidia’s stock closed lower.

This coincides with a bearish weekly close for the Nasdaq 100, forming a shooting star candlestick. To many investors, this is a foreboding signal for bearish price action to happen in the coming weeks.

Of course, things aren’t quite so simple; the Nvidia stock price and Nasdaq 100 are now making headway back to the upside, creating a concoction of FOMO and also panic in the markets.

Investors are finding themselves in a scenario reminiscent of Schrödinger’s cat: is the market recovery alive or dead? Let’s attempt to make sense of this situation with some technical analysis.

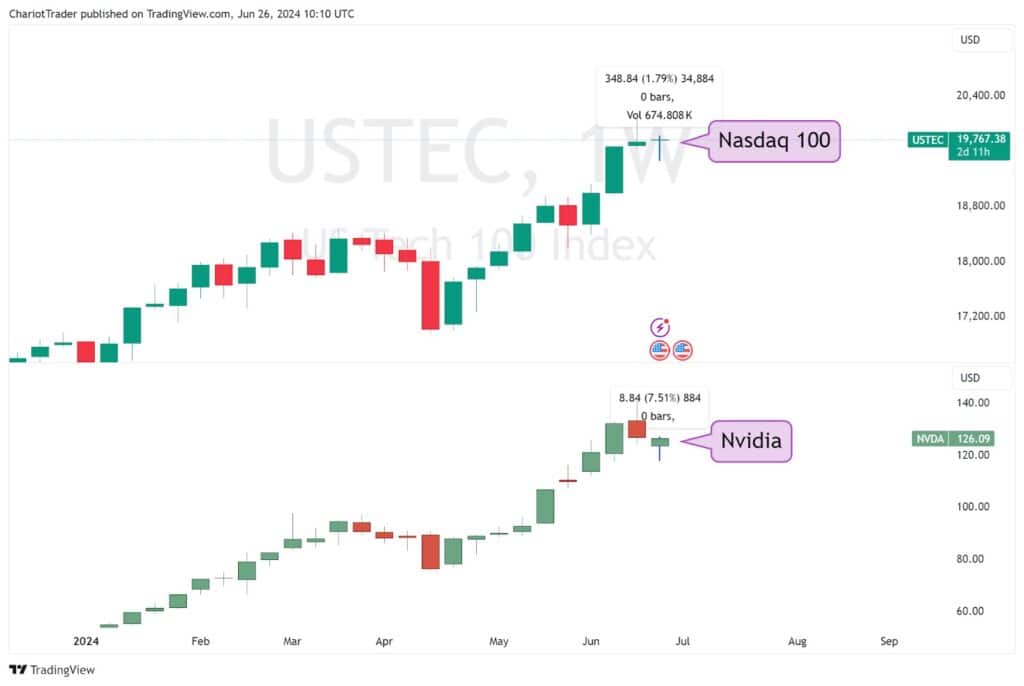

Weekly Analysis of the Nasdaq 100 and Nvidia

Nvidia has rebounded by approximately 880 pips (7.50%), leading investors to question if the correction is over or if this is just a dead cat bounce.

Similarly, the Nasdaq 100 has recovered by 1.79%, surpassing its previous week’s close.

However, with a bearish weekly close, we now have potential resistances up ahead that may act as a dead cat bounce target.

Let’s scale down to the daily timeframe for a better view.

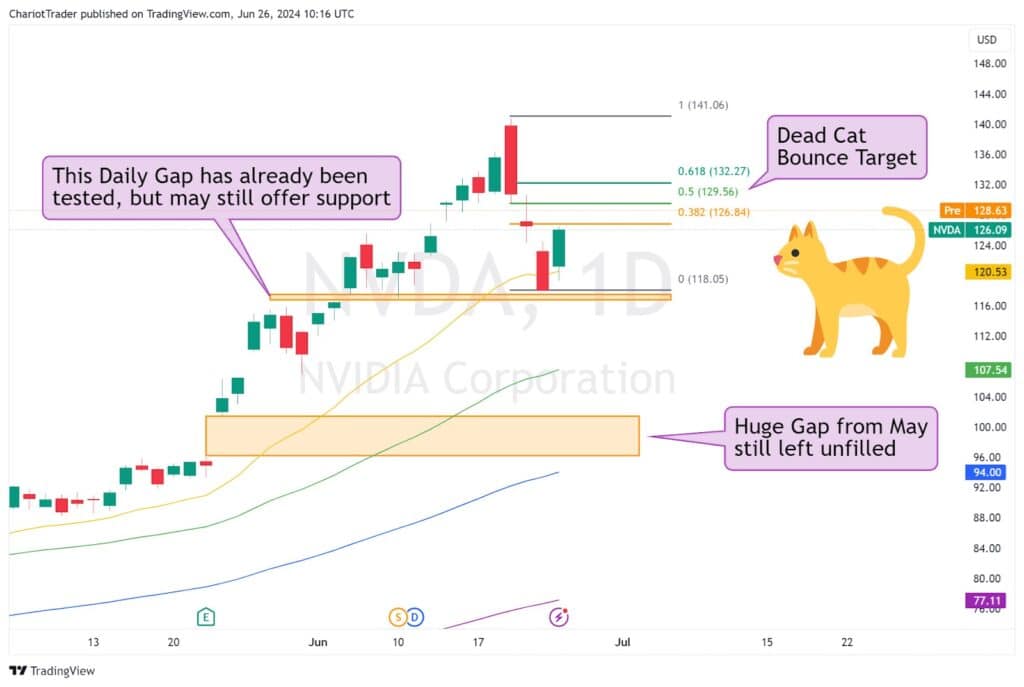

Technical Analysis of Nvidia (June 26th, 2024)

On the Nvidia stock, there are two potential dead cat bounce targets.

The first target is the 0.382 Fibonacci level, which aligns with the previous day open at approximately $126.84, making it a compelling area to watch for a rejection.

The second target would be at the 50% mark of the price fall at $129.56. If Nvidia cannot close above this level, then a dead cat bounce scenario would be more probable.

If Nvidia begins to roll over, the key areas I’d be personally watching are the daily gaps located at approximately $116.50 – $117 and $96.20 – $101.40.

As long as Nvidia does not form a daily close under these zones, the asset may begin to see reaccumulation and continue its bullish trajectory.

Technical Analysis of Nasdaq 100 (June 26th, 2024)

For the Nasdaq 100 (USTEC), we can see that the price has managed to climb up to retest the 50% Fibonacci level already – rejecting off of it as the market opens.

If the price cannot reclaim the 50% level, then the idea of a dead cat bounce is validated for the Nasdaq 100. This in turn also supports the idea of 0.382 Fibonacci Level being the dead cat bounce target for the Nvidia stock (see above).

I’d watch for the Nasdaq 100 to retest the daily 20 EMA, which is a respected moving average by this asset. Since all of June, the price has remained above the moving average and has not retested it.

If this EMA is broken, we may see a fall towards the Point of Control (POC) at $19,062, formed in the last 30 days. This POC also aligns with a brief consolidation we saw in early June, creating a zone where the index was most heavily traded during this time.

Beyond the POC, we have strong trading volume going down towards approximately $18,400, which indicates a strong possibility for buyers to step in from anywhere between $18,400 to $19,000.