- Opening Bell

- June 18, 2025

- 4 min read

CAUTION TODAY: Powell on the Hot Seat as Global Conflicts Rage

Stay alert, traders — the FOMC rate decision hits at 6PM UTC today.

A rate cut is unlikely this round, but all eyes are on Jerome Powell’s tone. The market will be listening closely for any dovish or hawkish signals, especially regarding a potential cut in September.

We’re in turbulent times:

- Global tensions are high — Ukraine-Russia, Israel-Palestine, and the ongoing Israel-Iran proxy fronts.

- Tariff disputes between global powers continue to rattle sentiment.

- Oil prices have surged as conflict risks tighten energy supply expectations — a factor that can fuel inflation and harden the Fed’s stance.

So while the Fed is expected to hold steady today, don’t underestimate the impact of Powell’s guidance. If he hints at a hopeful committee over the economy/conflicts, it could shift market sentiments fast.

| Key takeaway: No cut expected today, but the language used may shape the path forward. Stay ready for potential high volatility. |

Technical Breakdown of OIL, DXY, NASDAQ, BTC

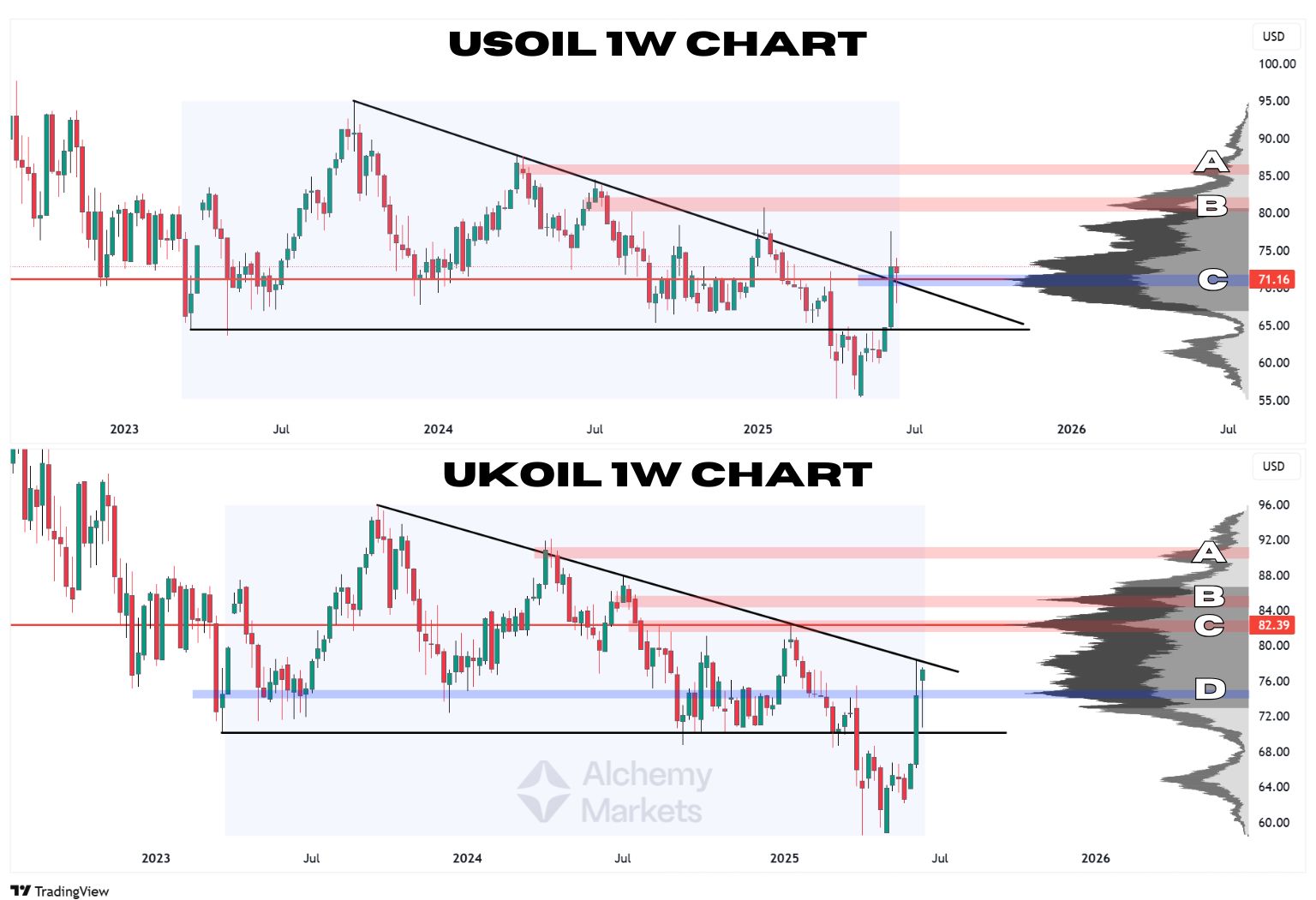

OIL CHARTS are looking good, with USOIL looking more bullish than UKOIL.

Although a daily hidden bearish divergence on USOIL threatens a retracement, it’s technically broken out of a descending triangle. Meanwhile UKOIL still sits below its triangle’s trendline.

| USOIL Levels to Watch | |

|---|---|

| A | April 2024 Highs — Around $85 to $87 |

| B | Value Area High and July 2024 Highs — Around $80 to $81 |

| C | Point of Control support — Around $71.16 |

| UKOIL Levels to Watch | |

|---|---|

| A | March 2024 Highs — Around $89.5 to $90.5 |

| B | July 2024 Highs — Around $84.7 to $85.7 |

| C | Point of Control resistance — Around $82.39 |

| D | High Volume Node support — Around $74 to $75 |

DXY CHART is printing a weekly bullish divergence, but faces geopolitical and FOMC risks. If the FOMC is dovish (rate cuts likely in September with hopeful tone about the economy), then DXY would fall lower.

For now, the bullish case is a recovery towards 100, and the bearish case is a rollover down as low as 96 — but these scenarios could take weeks to play out. An extremely bullish case for USD would be a reclaim of its range lows in 2023, from around 100 to 101.019.

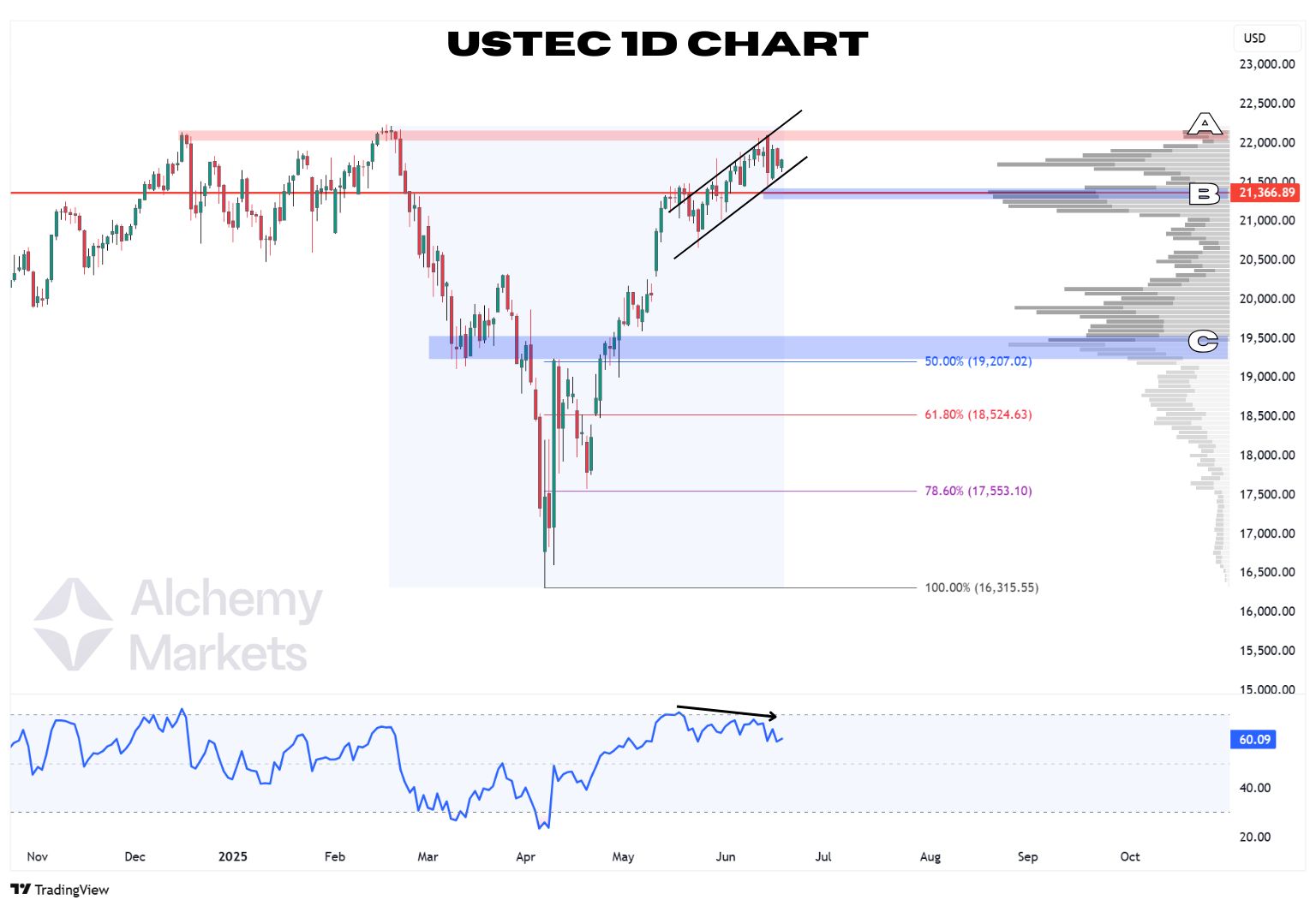

NASDAQ 100 (USTEC CHART) is showing signs of exhaustion as price trades within a tight rising channel, just beneath key resistance from its March highs. The RSI has begun diverging bearishly, a classic warning sign of fading bullish momentum.

Nasdaq’s back near the $22,000 mark for the third time — brushing up against its all-time highs but still no daily close above. With that kind of hesitation, a dip toward the Point of Control at $21,366.89, or even the Value Area Low around $19,500, becomes a possibility.

| USTEC Levels to Watch | |

|---|---|

| A | All-Time-Highs — Around $22,000 |

| B | Point of Control support — Around $21,366.89 |

| C | Value Area Low near 50% Fib Level — Around $19,160 to $19,500 |

BTC/USDT CHART is caught in a tug-of-war between fading bearish pressure and reluctant buyers.

The price is squeezing inside a symmetrical triangle, trading just below key resistance between $105,650 and $106,000 — a zone aligned with the anchored VWAP from the recent top.

But if price fails to reclaim the VWAP and stalls, Bitcoin could slip back toward ~$105,000 or lower, where the volume profile shows the last significant support zone. With volatility tightening, a breakout (or fakeout) is likely on the horizon.

A break of the triangle and the Value Area Low at $103,500, however, could see Bitcoin fall through a thin volume profile down to $100,000 or even lower.

| BITCOIN Levels to Watch | |

|---|---|

| A | Point of Control & Anchored vWAP resistance — Around $105,458 to 105,650 |

| B | High Volume Node resistance — Around $107,530 to $107,750 |

| C | Value Area Low near 50% Fib Level — Around $19,160 to $19,500 |

| D | High Volume Node support — Around $104,775 to $104,970 |

Closing Statement:

As the FOMC prepares to announce its decision, remember — it’s not just about the rate, but the rhetoric. With markets on edge and geopolitical tensions running high, even a single word from Powell could jolt sentiment across oil, equities, and crypto. Stay sharp, stay nimble.

You may also be interested: