- Opening Bell

- July 1, 2024

- 2 min read

ISM Manufacturing PMI: July 2024 Expectations and Implications for the U.S. Economy and EUR/USD

ISM Manufacturing PMI for June 2024

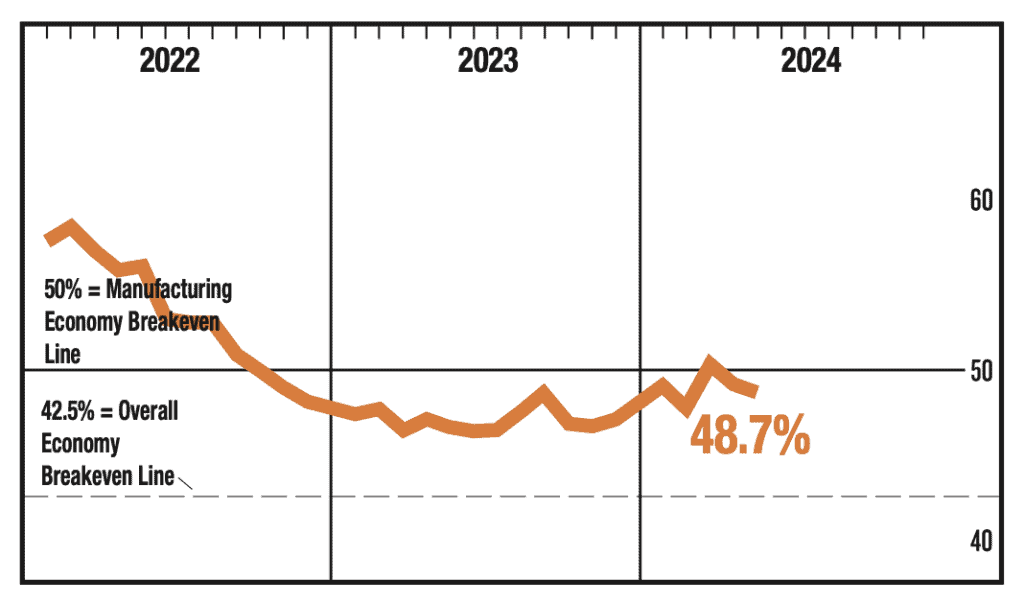

The ISM Manufacturing PMI for June 2024 was reported at 48.7, indicating a contraction in the manufacturing sector as it remained below the 50 mark for the eighth consecutive month. As we await the July 2024 data, market forecasts predict a slight increase to 49.2. However, given the recent trend of declining PMI figures, the outlook remains cautious.

Impact on the U.S. Economy

The PMI reading of 48.7 for June signifies continued contraction in the manufacturing sector, though the forecasted increase to 49.2 for July suggests a potential, albeit modest, improvement. The sub-50 readings indicate that the sector has been struggling, but a move closer to 50 could imply that the contraction is easing.

Economists are watching closely to see if the July data can break the trend of decline. A PMI above 50 would indicate expansion, while a figure below 50 continues to suggest contraction. If the PMI meets or exceeds the forecasted 49.2, it could signal stabilisation in the sector, offering a glimmer of hope for a rebound in the latter half of the year.

Implications for EUR/USD

The ISM data can have significant effects on the EUR/USD exchange rate:

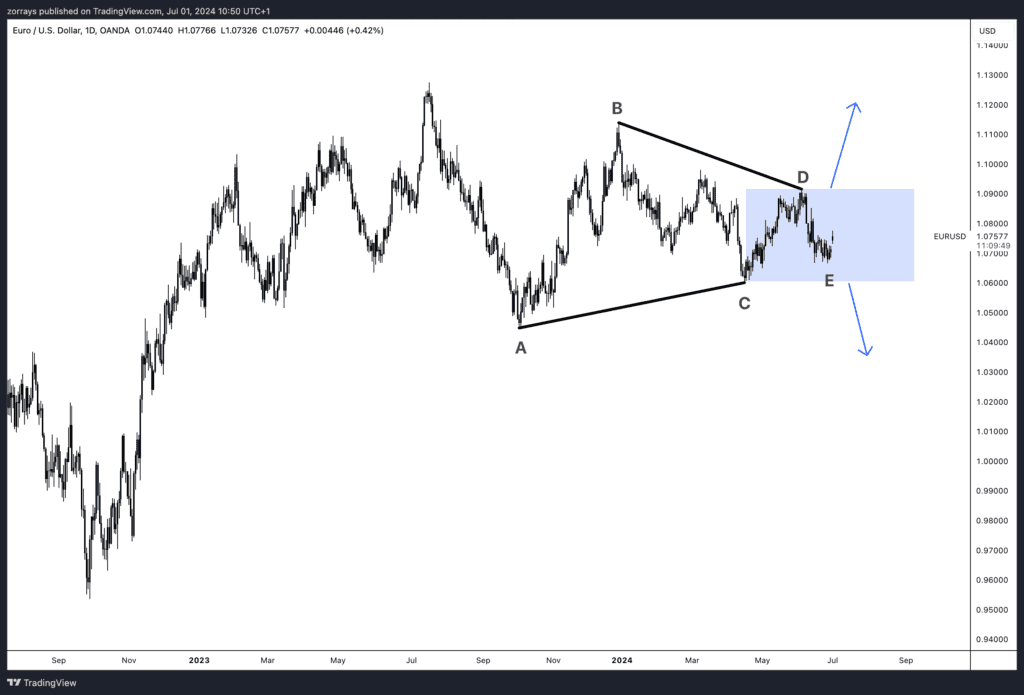

- Better Than Expected ISM Data: Should the PMI exceed the forecast and edge closer to or surpass 50, it would indicate economic improvement. This positive outlook could strengthen the U.S. dollar as investors anticipate a stronger economy and potentially tighter monetary policy. Consequently, the EUR/USD rate would likely decrease, as the euro weakens relative to the dollar.

- Worse Than Expected ISM Data: Conversely, if the PMI falls short of expectations or continues to decline, it would suggest ongoing economic challenges. This could weaken the U.S. dollar, as investors might expect a more dovish stance from the Federal Reserve. In this scenario, the EUR/USD rate would likely increase, as the euro strengthens relative to the dollar.

Conclusion

As we await the release of the July 2024 ISM Manufacturing PMI data, the market remains focused on whether the sector can reverse its contraction trend. The expected slight improvement to 49.2, if realised, could signal stabilisation. However, the continued sub-50 readings emphasize the challenges still facing the manufacturing sector. Monitoring the PMI data will be crucial for gauging the future direction of the U.S. economy and its impact on the EUR/USD exchange rate.