- Opening Bell

- June 12, 2024

- 3 min read

Federal Reserve’s June Meeting, All Eyes on Rate Cut Forecast

As S&P 500 soars ahead of the FOMC June Meeting, many economists are speculating that interest rates are likely to be held this month.

The CPI m/m and y/y forecast, according to ForexFactory, are 0.1% and 3.4% respectively. This marks a 0.2% improvement for the CPI m/m data, and no effective change on the CPI y/y data.

With great jobs report numbers on paper, and the stock market doing well, the Federal Reserve does not have any pressing reasons to issue a rate cut anytime soon.

This puts investors in an odd predicament, as good economic news now may represent a failure of the Federal Reserve to live up to the expectations of three rate cuts this year. As we approach the fourth of eight FOMC meetings this year, investors will be closely monitoring for any indications or forecasts regarding the number of rate cuts expected in 2024.

Interest Rates Likely To Be Held

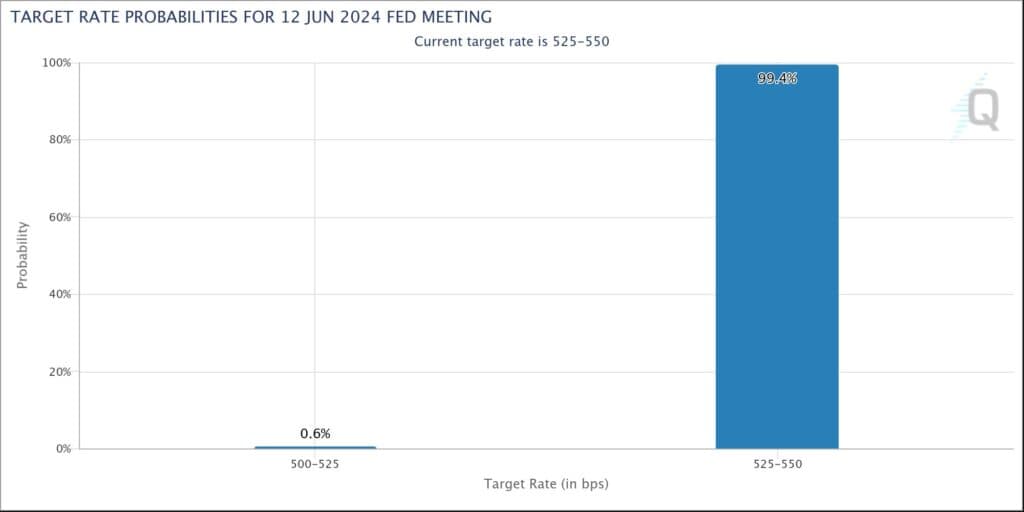

The Fedwatch Tool forecasts a 99.4% of interest rates being held, with a surprising 0.6% prediction of a 25 basis point rate cut in June.

It is worth noting that if CPI m/m data comes low as expected, the idea of a soft landing could be achieved. However, we have to keep in mind that as of December 2023, the CPI y/y reading was 3.1%. It’s already midyear of 2024, and the CPI y/y reading still sits at 3.4% – the same as it was in January.

What does this mean?

Well, inflation in the U.S. hasn’t budged since January.

With the Federal Reserve’s commitment to reaching the 2% inflation target, we should expect the rates to continue to be held.

Closing Thoughts

The Federal Reserve would be cutting it close by backloading the rate cuts towards the end of 2024, which could imply less than three rate cuts this year.

I would also consider the possibility that the Federal Reserve may shift their goal post from 2% to 3%, as inflation is currently sticky.

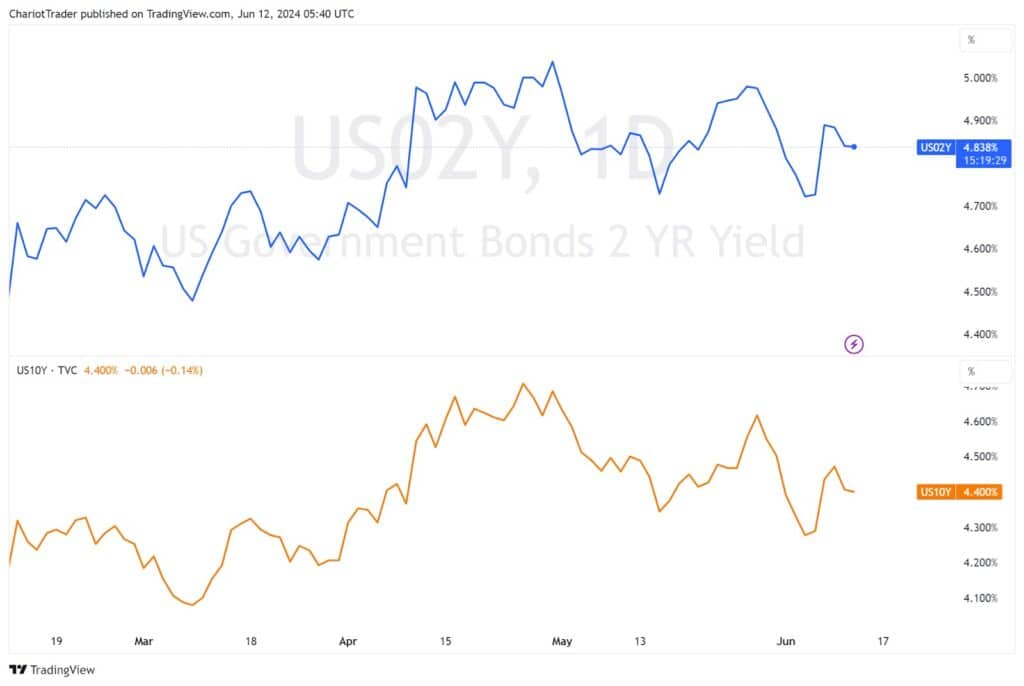

Taking a look at the U.S. 2 Year Yields (4.83%) and the U.S. 10 Year Yields (4.40%), we can see an inverted yield curve with a 43 basis point difference. This is a significant sign that recession is looming, and that investors should proceed cautiously.

Currently, although the S&P 500 chart has creeped up, we can also see that the Dollar is regaining strength – crawling back to its parallel channel after initially breaking it.

Personally, I believe the FOMC meeting will clarify that more economic data is required for them to make a judgment on how many rate cuts will happen this year.

My current bias for the short term, however, is bearish for most assets outside of S&P 500. The DXY is back within its weekly channel, and the S&P 500’s bullish behavior is largely due to Nvidia’s performance.

I would expect this bearish USOIL (WTI) trade idea to play out, which we are very close to triggering.