- Chart of the Day

- June 7, 2024

- 2min read

Analysis on USOIL (WTI) For June 7th, FVG Setup Available

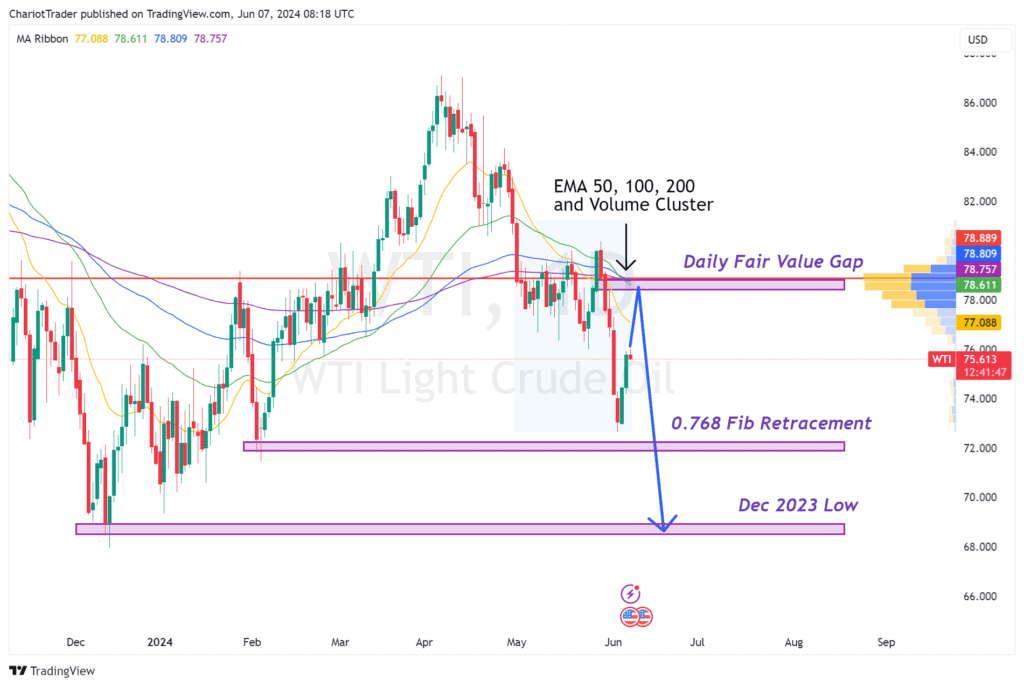

USOIL has been acting choppy for the past few weeks, leading to some difficult scenarios to trade. However, we now may have a clearer, albeit slightly hidden, short trade setup now available on the daily time frame for this asset.

Fair Value Gap Short Setup on USOIL (WTI)

Several bearish confluences indicate a potential decline in USOIL, making this a viable short trade opportunity.

Bearish Daily Fair Value Gap: We have a daily FVG from $78.41 to $78.79 created by the rapid price decline formed last week.

EMA Cluster at FVG: EMA 50, 100, 200 are clumped together between $78.61 – $78.81, which aligns with the daily FVG’s location.

Anchored Volume Profile POC (Red Line): By adding an anchored volume profile on May 1st, gathering volume data over USOIL’s consolidation in May, we get a point of control at $78.8890.

With so many bearish confluences concentrated in one area, I would be keeping a close eye on USOIL if it reaches the $78.6 mark and forms a bearish daily candle. This, to me, would confirm the presence of sellers stepping in to push the price down.

| Potential Short Trade Setup: • Entry Point: $78.6 – $78.8 (if price rejects from this level) • Take Profit Targets: • First Target: $72 (0.768 Fibonacci Retracement) • Second Target: $68.8 (Major Low) |

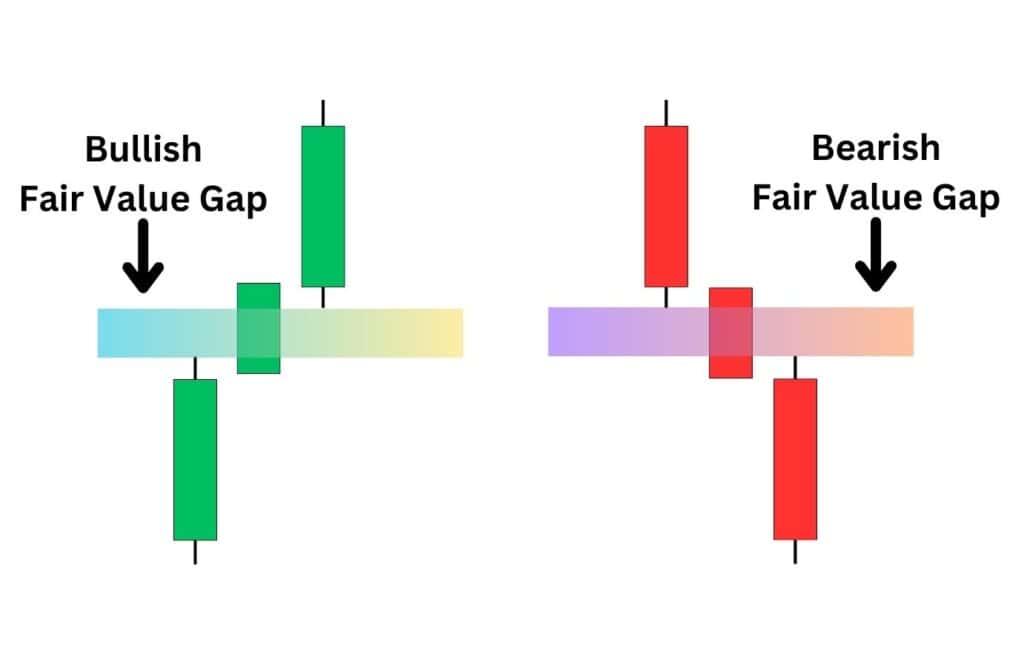

What is a Fair Value Gap?

Fair value gaps are price gaps between three consecutive upwards or downwards candlesticks that typically get filled and act as a point of reversal. The distance between the first candle’s wick and the third candle’s wick make up the fair value gap.