- Opening Bell

- June 19, 2025

- 2 min read

Fed & BoE Diverge as GBP/USD Tests Key Support in Rising Channel

What the Fed Said

The U.S. Federal Reserve held its policy rate steady at 4.25–4.50%, stating the economy remains solid and the job market robust, yet inflation remains above target. They emphasized that ongoing quantitative tightening (selling bonds) continues to drain liquidity and that rate cuts are not on the immediate horizon—various members expressed caution, noting they need more data confirming inflation is down. Their tone remains data-dependent and flexible: if inflation unexpectedly rebounds, they’re prepared to maintain or even raise rates; if economic data weakens, cuts could come later in 2025.

What the Bank of England Said

The Bank of England also kept its Bank Rate at 4.25%, voting 6–3 to hold, with inflation at 3.4%, still far above their 2% target. They cited sticky core inflation, geopolitical risks (particularly Middle East tensions pushing up oil prices), and weak GDP—April saw a contraction of roughly 0.3%. Governor Bailey and the MPC highlighted a “gradual and careful” approach to any future cuts, reiterating that policy isn’t on a preset path and that they remain alert to energy-price shocks and labor market softness.

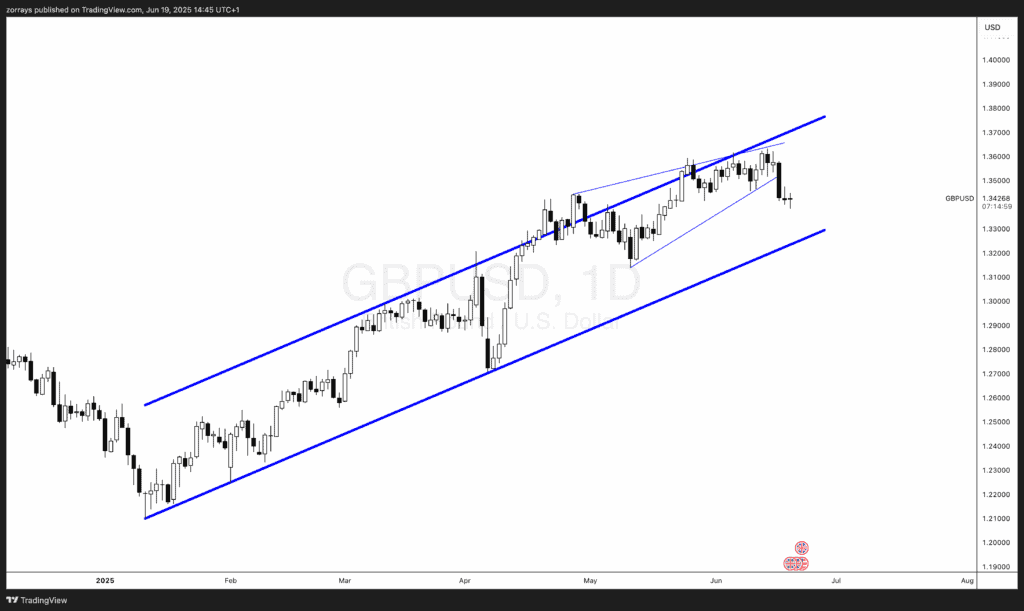

Technical Analysis: GBP/USD Outlook

On the daily chart, GBP/USD is trading within a clearly defined ascending channel (see your chart), currently edging toward the lower trendline. If it breaks below that support—around the lower bound—it could signal a deeper pullback toward the 1.32–1.33 zone. Given the dovish tilt from the BoE relative to the Fed, the pound may remain under pressure, increasing the likelihood of a channel breakdown. Conversely, a stronger-than-expected UK data release before the next meeting could trigger a bounce back up toward the channel midline or upper bound (1.36–1.39). Watch for a close below the lower trendline for confirmation of a bearish extension.