- Opening Bell

- June 5, 2025

- 3 min read

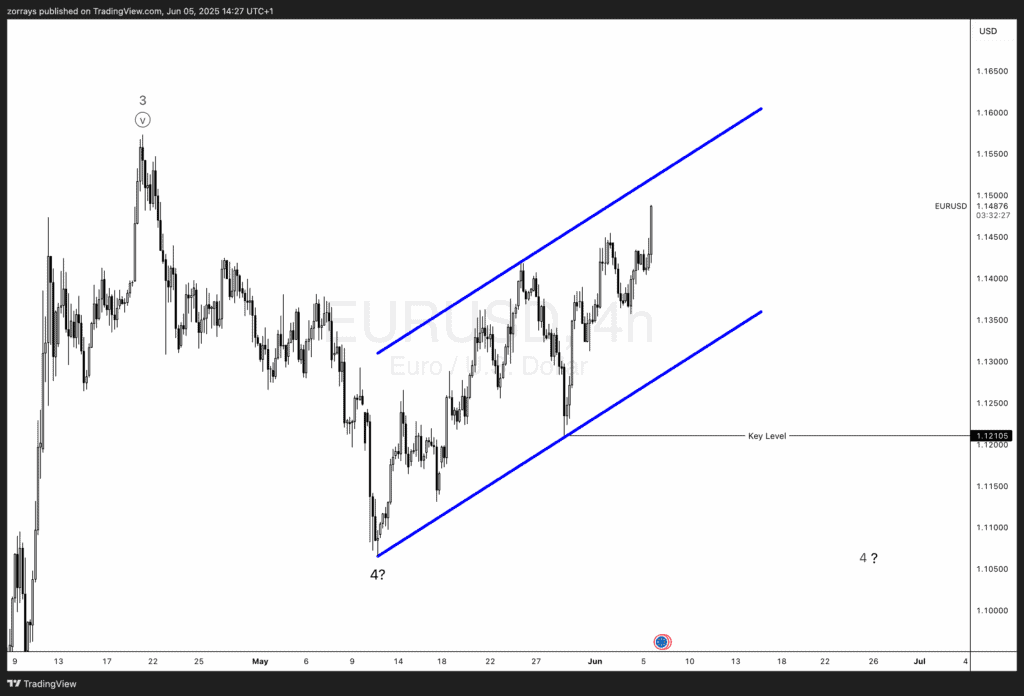

EUR/USD: ECB Cut, Euro Rallies – So… Is Wave 4 Really Done?

The ECB went ahead with the expected 25bps rate cut yesterday, taking the deposit rate down to 2.00%. On paper, that’s dovish – a cut is a cut. But the euro didn’t fall. In fact, it did the opposite. It rallied. And if you’re watching price action as closely as I am, that’s the kind of move that makes you stop and ask: what’s actually driving this?

So, Why Did the Euro Rally?

Let’s break it down. Yes, the ECB cut rates, but the guidance that followed wasn’t exactly screaming “more cuts are coming.” In fact, it was the opposite — data-dependent, cautious, and non-committal. That tone matters. Markets didn’t hear, “we’re staying dovish.” They heard, “we’ve cut, now we wait.”

On top of that:

- The cut was already fully priced in

- The dollar’s under pressure (thanks to U.S. trade tensions and fiscal noise)

- Eurozone fiscal policy is turning up with a big push in defense and infrastructure spending

Put that all together, and you’ve got a market that’s not responding to the cut itself, but to the absence of anything worse. That’s why EUR/USD pushed higher. It’s not really bullish on the euro — it’s just not bearish anymore.

Now, Let’s Talk Charts – Where Are We in the Bigger Picture?

Looking at EUR/USD on the 4H, we’re climbing inside a clean ascending channel. There’s definitely a case to be made that Wave 4 is done — price has pulled back, consolidated, and now we’re seeing higher highs and higher lows.

But here’s the thing: this rally doesn’t feel impulsive. It’s messy. Choppy. A bit too overlapping. That’s not typically what you’d expect from a proper Wave 5 — not at this stage. So I’m stepping back and asking whether this move is really the start of something new, or just another leg in something more complex.

If we apply Elliott’s principle of alternation, Wave 2 was sharp and deep — a classic zigzag. So it would make sense for Wave 4 to be a bit more drawn out, sideways, and maybe even still in play. That fits with the idea that what we’re seeing now might be part of a larger, more complex corrective structure — possibly a flat or a triangle. The structure hasn’t confirmed itself yet, so I’m cautious about getting too committed to either side.

Bottom Line

Yes, the euro’s up. Yes, the ECB just cut. But this isn’t about rates — it’s about expectations. The cut was priced in. The guidance wasn’t as dovish as feared. Combine that with a weaker USD backdrop, and the rally makes more sense.

Technically though, I’m not fully convinced we’re in a clean Wave 5 just yet. The move inside the channel is too unconvincing to call it impulsive. For now, I’m open to the idea that Wave 4 could still be unfolding into something broader — but I’ll need more clarity before I shift bias.