- Opening Bell

- February 6, 2025

- 4 min read

Earnings Recap & Outlook: Alphabet (GOOG), Ford (F), and AMD (AMD) – What’s Next?

As the current earnings season progresses, several major companies have reported their financial results, with more anticipated in the coming days. Here’s a concise overview focusing on prominent household names.

Recent Earnings Reports:

- Alphabet Inc. (GOOG): On February 4, 2025, Alphabet reported its fourth-quarter earnings, highlighting a 12% increase in revenue compared to the previous year. The company’s performance was bolstered by robust advertising revenue and growth in its cloud services division. However, the announcement of a substantial $75 billion capital expenditure plan for 2025, primarily aimed at advancing AI infrastructure, raised concerns among investors. This led to a significant decline in Alphabet’s stock price, reflecting scepticism about the company’s future growth prospects.

- Advanced Micro Devices (AMD): AMD also released its earnings on February 4, showcasing strong financial results driven by increased demand for its processors and graphics cards. The company continues to benefit from the expanding gaming and data centre markets.

- Walt Disney Company (DIS): On February 5, Disney announced its earnings, reporting significant growth in its streaming services, particularly Disney+. The company’s theme parks and resorts also contributed positively, reflecting a rebound in consumer activity.

- Ford Motor Company (F): On February 5, 2025, Ford reported a fourth-quarter net income of $1.8 billion, or 45 cents per share, compared to a net loss of $526 million the previous year. However, the company provided a cautious outlook for 2025, forecasting adjusted earnings before interest and taxes (EBIT) between $7 billion and $8.5 billion, down from $10.2 billion in 2024. This guidance led to a 4.5% decline in Ford’s stock during after-hours trading.

Upcoming Earnings Releases:

- Amazon.com Inc. (AMZN): Scheduled to report its fourth-quarter earnings today, February 6, 2025, after the market closes. Analysts are focusing on Amazon Web Services (AWS), expecting it to generate $28.8 billion in revenue, up from $24.2 billion the previous year. Overall, Amazon is anticipated to post earnings of $1.49 per share and total revenue of $187.3 billion.

- Apple Inc. (AAPL): Set to announce earnings today, February 6, 2025, post-market. Investors will be closely monitoring iPhone sales, services revenue, and demand trends in China.

- Meta Platforms Inc. (formerly Facebook, FB): Expected to release results on February 7, 2025, with a focus on advertising revenue growth and advancements in AI-driven ad targeting.

- PayPal Holdings Inc. (PYPL): Also reporting on February 7, 2025, where attention will be on payment volumes and profit margins amid increased fintech competition.

As the week concludes, market participants will analyse these earnings reports to assess corporate performance and inform investment decisions.

Technical Analysis:

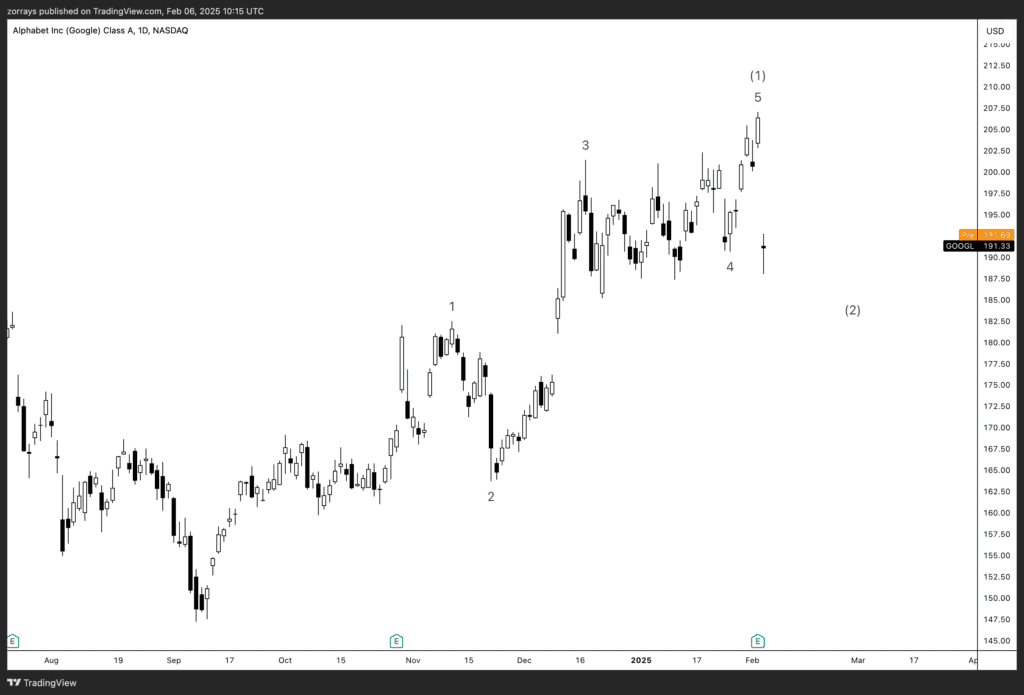

Alphabet Inc. (GOOG):

Alphabet’s stock is currently undergoing a corrective phase, identified as wave (2) in Elliott Wave theory. This phase appears to be forming a zigzag pattern, suggesting potential for further downside movement before a reversal. The recent earnings report, which included a substantial $75 billion capital expenditure plan for 2025 aimed at advancing AI infrastructure, has raised concerns among investors. This has contributed to the stock’s decline, reflecting skepticism about the company’s future growth prospects.

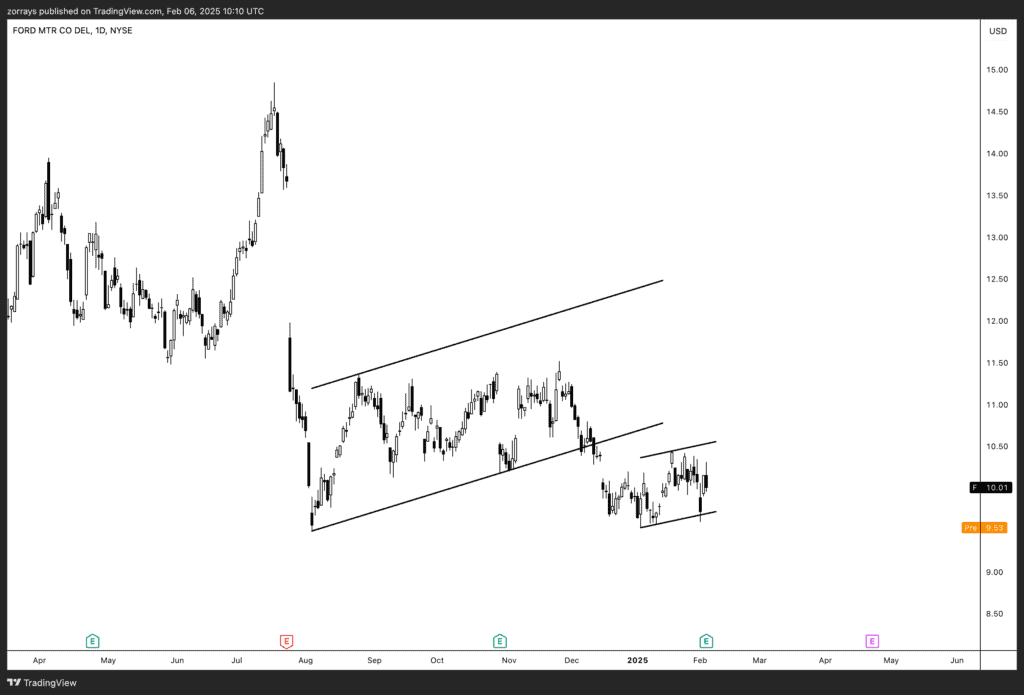

Ford Motor Company (F):

Ford’s stock has broken below a flag pattern, indicating a bearish continuation. This movement is attributed to the company’s muted 2025 guidance, which forecasts adjusted earnings before interest and taxes (EBIT) between $7 billion and $8.5 billion, down from $10.2 billion in 2024. Additionally, Ford projects its electric vehicle (EV) division will incur losses of up to $5.5 billion in 2025, similar to the $5.1 billion loss reported in 2024. These factors have contributed to the downward pressure on the stock.

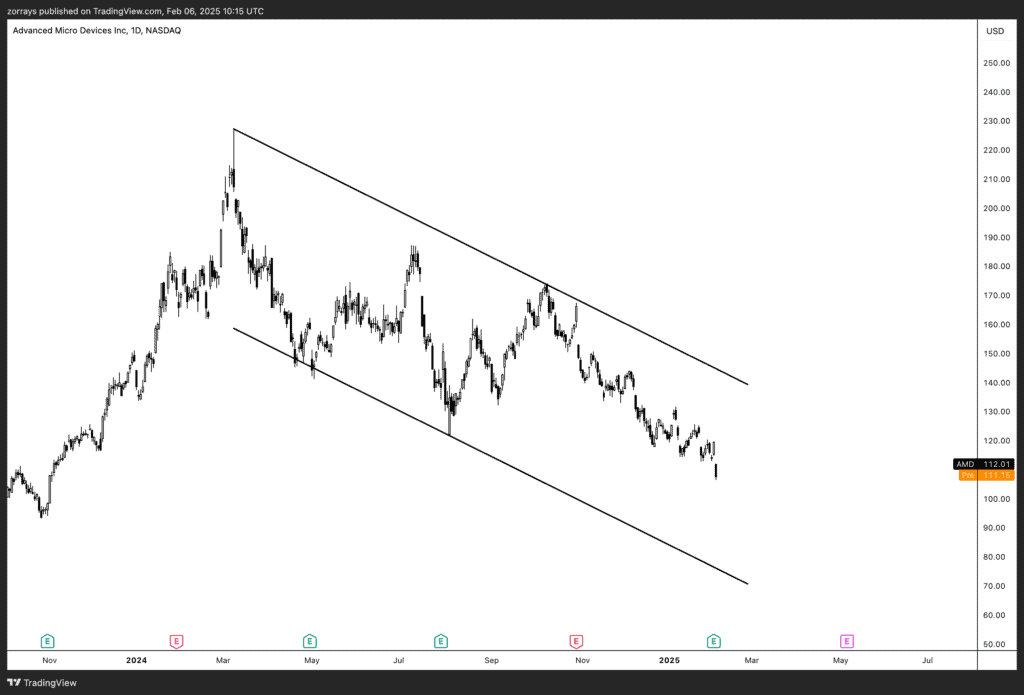

Advanced Micro Devices (AMD):

AMD’s stock continues to trade within a descending channel, reflecting a prevailing downtrend. The recent earnings report revealed a 24% increase in fourth-quarter revenue to $7.66 billion; however, data center revenue of $3.86 billion fell short of the expected $4.14 billion. Concerns have also been raised about the company’s AI GPU business, with expectations of flat revenue growth in the first half of 2025 compared to the second half of 2024. These factors have contributed to the stock’s decline, with shares dropping approximately 9% following the earnings announcement.