- Opening Bell

- October 22, 2024

- 3 min read

Dollar Macro Trends and Today’s Earnings Overview

The U.S. dollar is gaining strength early this week, driven by a surge in U.S. Treasury yields. This momentum is further bolstered by hawkish rhetoric from the Federal Reserve. However, we also suspect that broader market positioning, possibly linked to risk management ahead of the upcoming U.S. elections, is playing a significant role. This environment seems to be setting the stage for continued dollar strength across the board as investors brace for potential volatility.

Dollar:

At the start of the week, the U.S. dollar finds renewed support as U.S. Treasury yields rise sharply. While hawkish comments from Federal Reserve officials have influenced this upward move, a broader factor appears to be the preparation for possible market volatility ahead of the U.S. elections. As risk managers deleverage their positions, the dollar gains traction, reinforcing its strength across major currencies.

Quarterly Earnings Breakdown with Technical Analysis

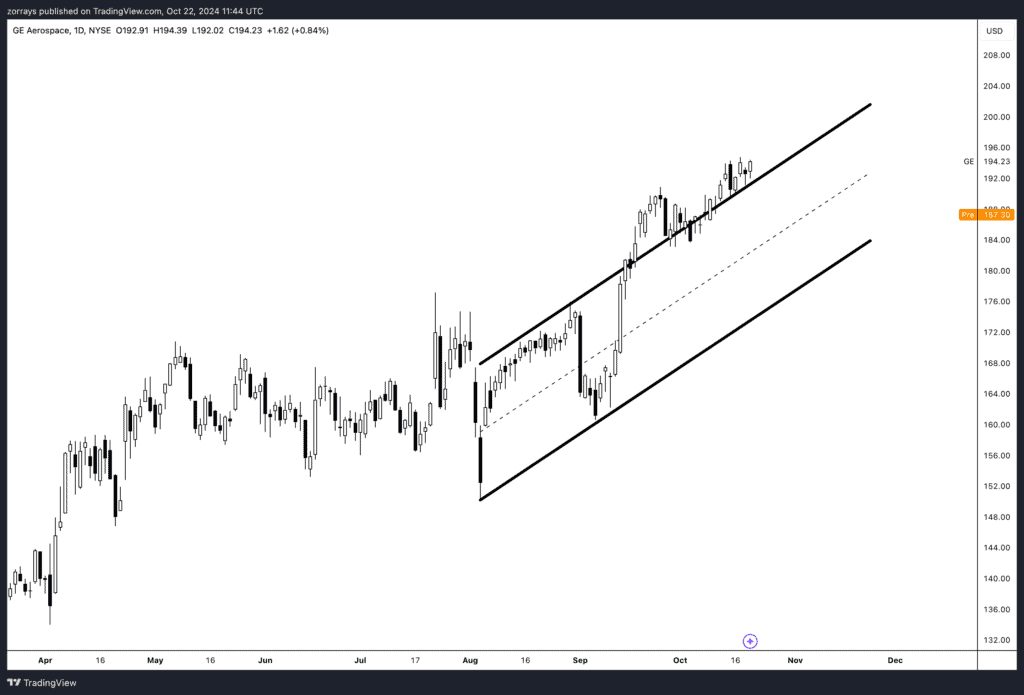

1. General Electric (GE)

Revenue Forecast: $9.05 billion | Actual: $8.94 billion

- Summary: General Electric slightly missed its revenue forecast, reporting $8.94 billion, falling short of the expected $9.05 billion. Despite this, the company maintains an optimistic outlook, thanks to strong demand in aerospace services. The company raised its full-year guidance, reflecting confidence in operational improvements and growth in orders.

- Technical Insight: Price initially broke out of its ascending channel but pre-market activity shows that it may be re-entering the channel. This could signal a potential correction as the stock appears to be losing upward momentum.

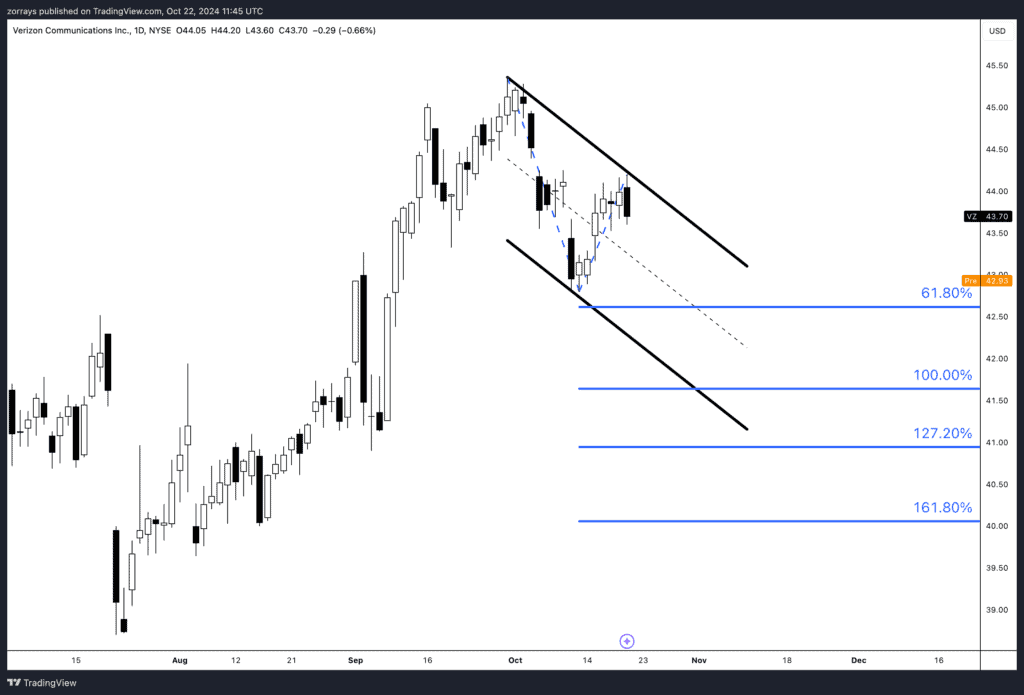

2. Verizon (VZ)

Revenue Forecast: $1.18 billion | Actual: $1.19 billion

- Summary: Verizon beat expectations, reporting $1.19 billion in revenue, slightly above the forecast of $1.18 billion. However, the stock is opening in a negative gap, likely due to concerns about growth and profitability in the future. The company continues to focus on 5G expansion and broadband investments, reiterating its commitment to delivering on its strategic priorities.

- Technical Insight: Verizon’s price action suggests it could be unfolding a continuation of its current downtrend, entering a broader correction phase that began after its September highs. A further downside move looks possible if the correction extends.

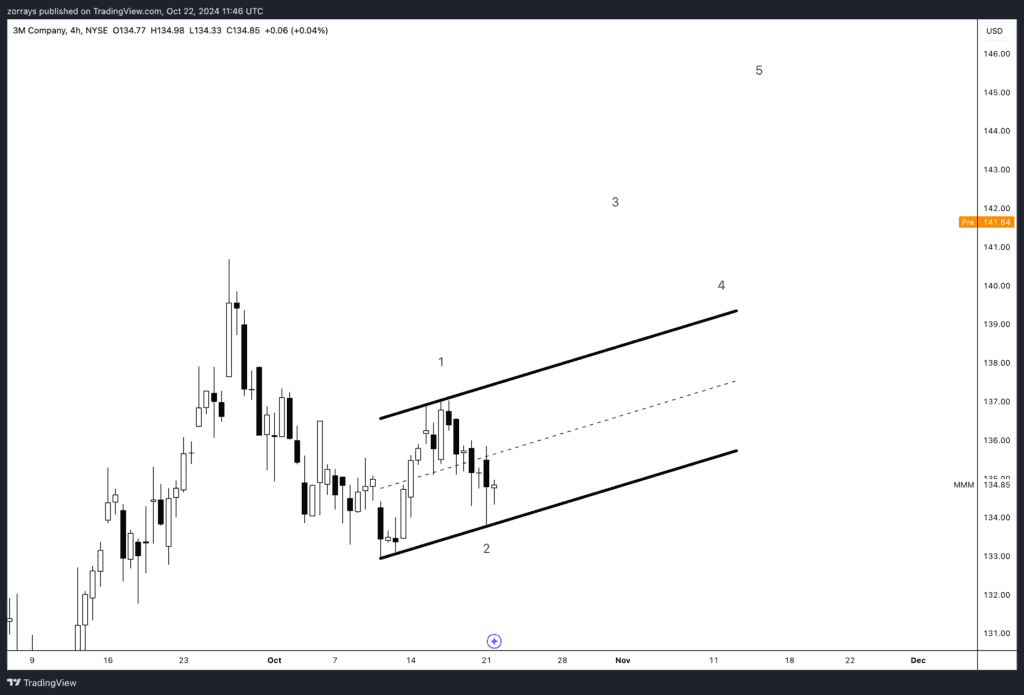

3. 3M (MMM)

Revenue Forecast: $6.0 billion | Actual: $6.1 billion

- Summary: 3M exceeded expectations, reporting $6.1 billion in revenue versus the $6.0 billion forecast. The company’s positive revenue gap and strong Q3 performance have prompted an upward revision to its full-year earnings guidance. Operational improvements and strategic capital deployment continue to drive growth.

- Technical Insight: 3M opened in a significant gap, which appears to be part of a possible wave 3 impulse wave in an Elliott Wave structure. This gap could indicate the start of a strong upward movement, especially if momentum sustains.

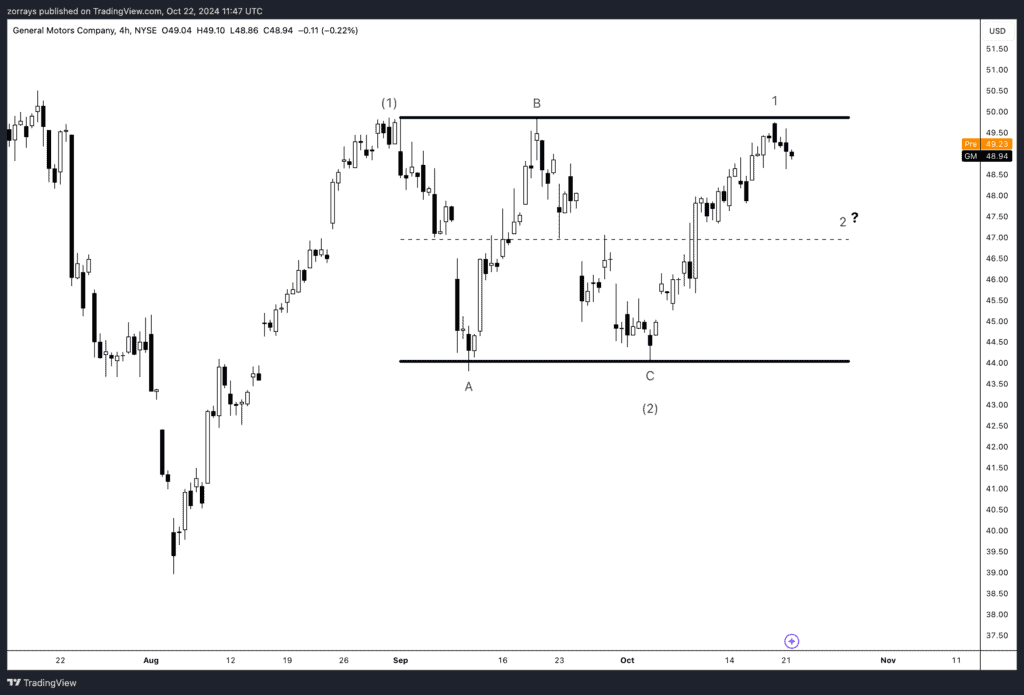

4. General Motors (GM)

Revenue Forecast: $44.74 billion | Actual: $48.76 billion

- Summary: General Motors significantly outperformed, posting $48.76 billion in revenue, well above the forecast of $44.74 billion. Strong vehicle sales and improved operating efficiency are behind this performance. GM also raised its full-year guidance, expecting sustained growth in earnings and cash flow.

- Technical Insight: GM remains trapped in a consolidation pattern, which aligns with a flat pattern in Elliott Wave theory. This suggests a potential correction might occur before the stock can break out of its current range.

Conclusion

As the U.S. dollar gains strength on the back of rising Treasury yields, earnings results from major corporations highlight both opportunities and challenges. While some companies have exceeded expectations, others remain cautious about forward growth, with technical indicators suggesting potential corrective phases.