The markets are currently showing mixed signals since the Nvidia Q1 FY25 report, which has shown an 18% increase in revenue compared to the previous quarter.

Here’s what the general markets are looking like:

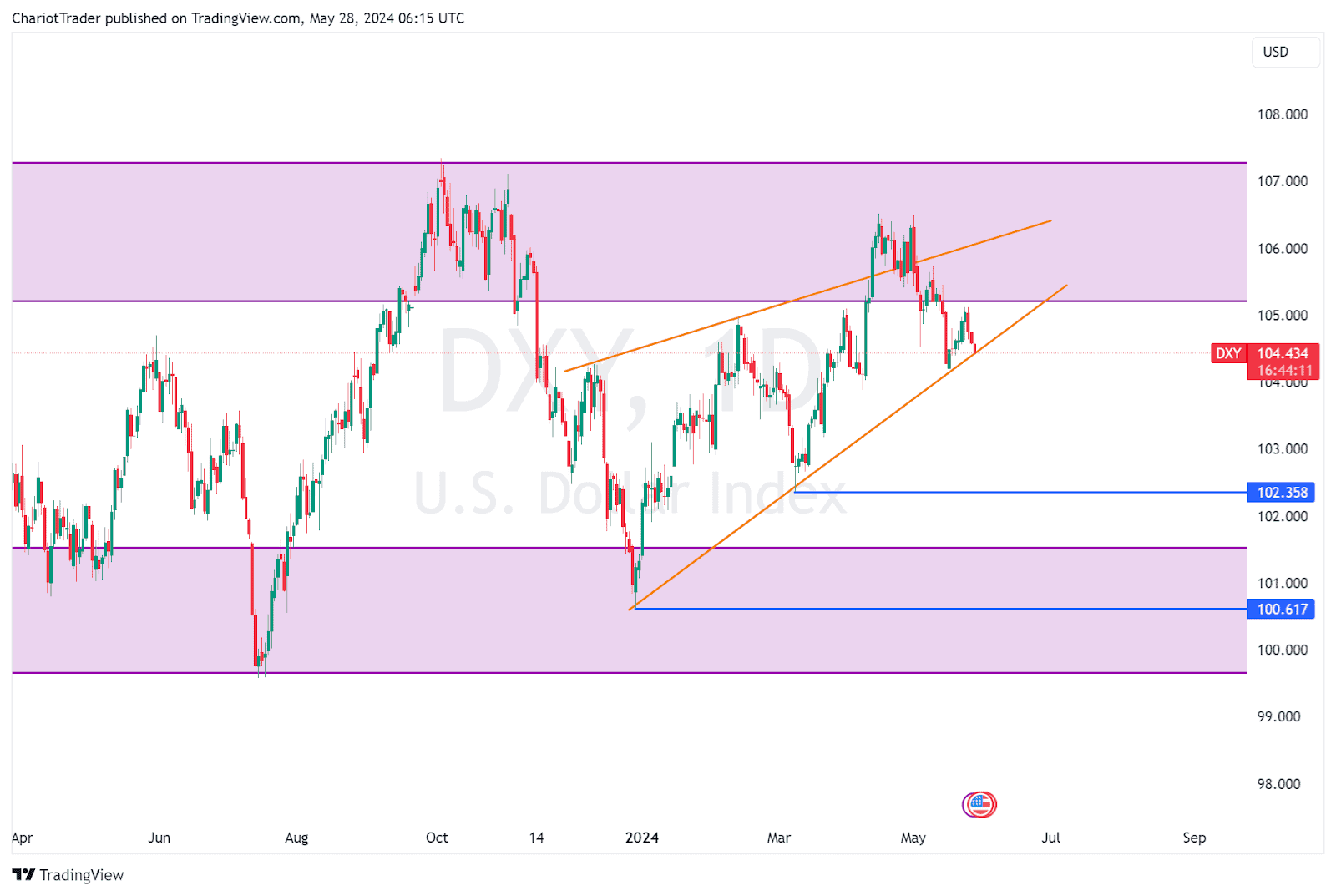

- U.S Dollar Index (DXY) has dropped onto a weekly trendline formed since the start of 2024.

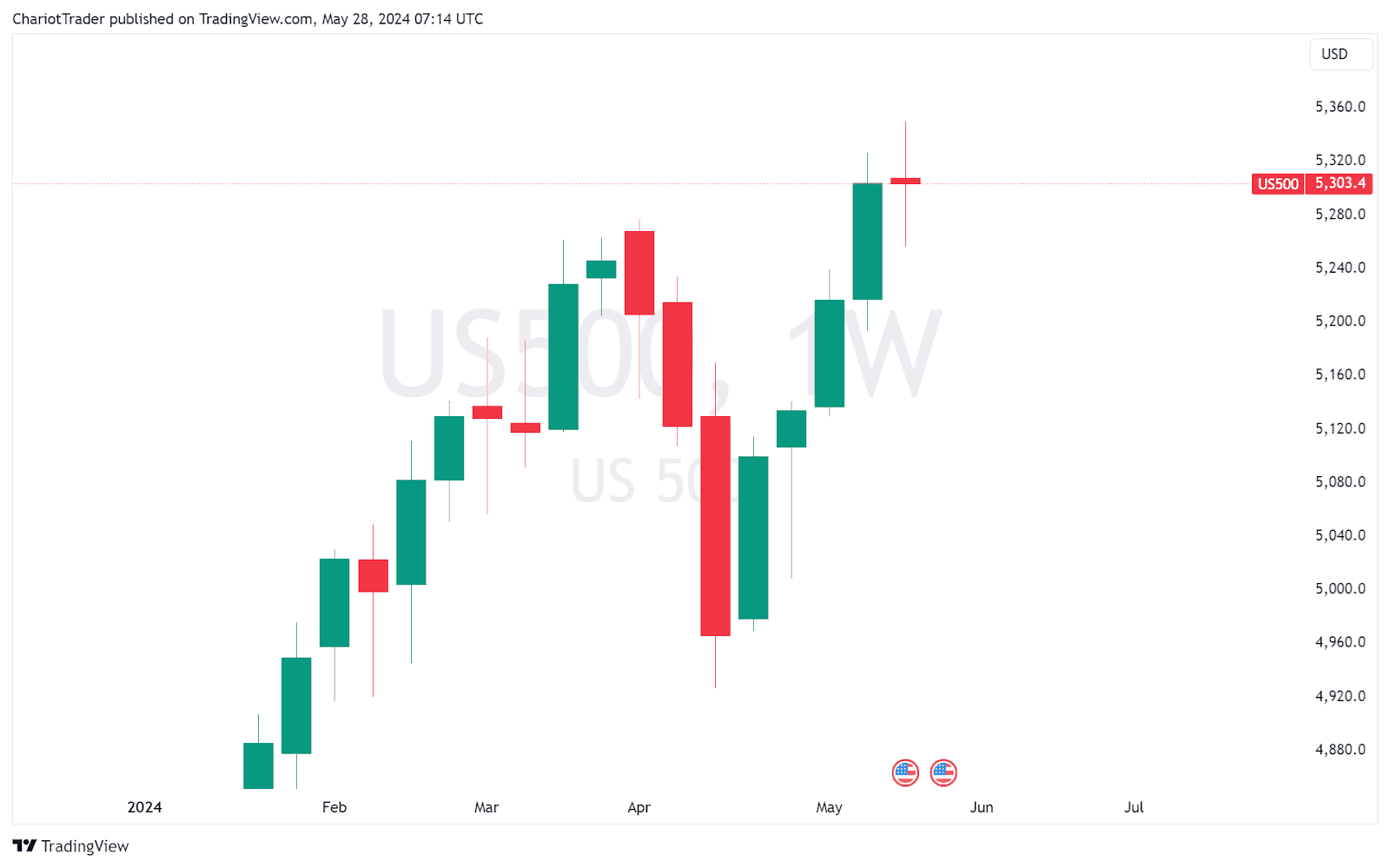

- S&P 500 has rallied and dropped, forming a weekly Doji candle.

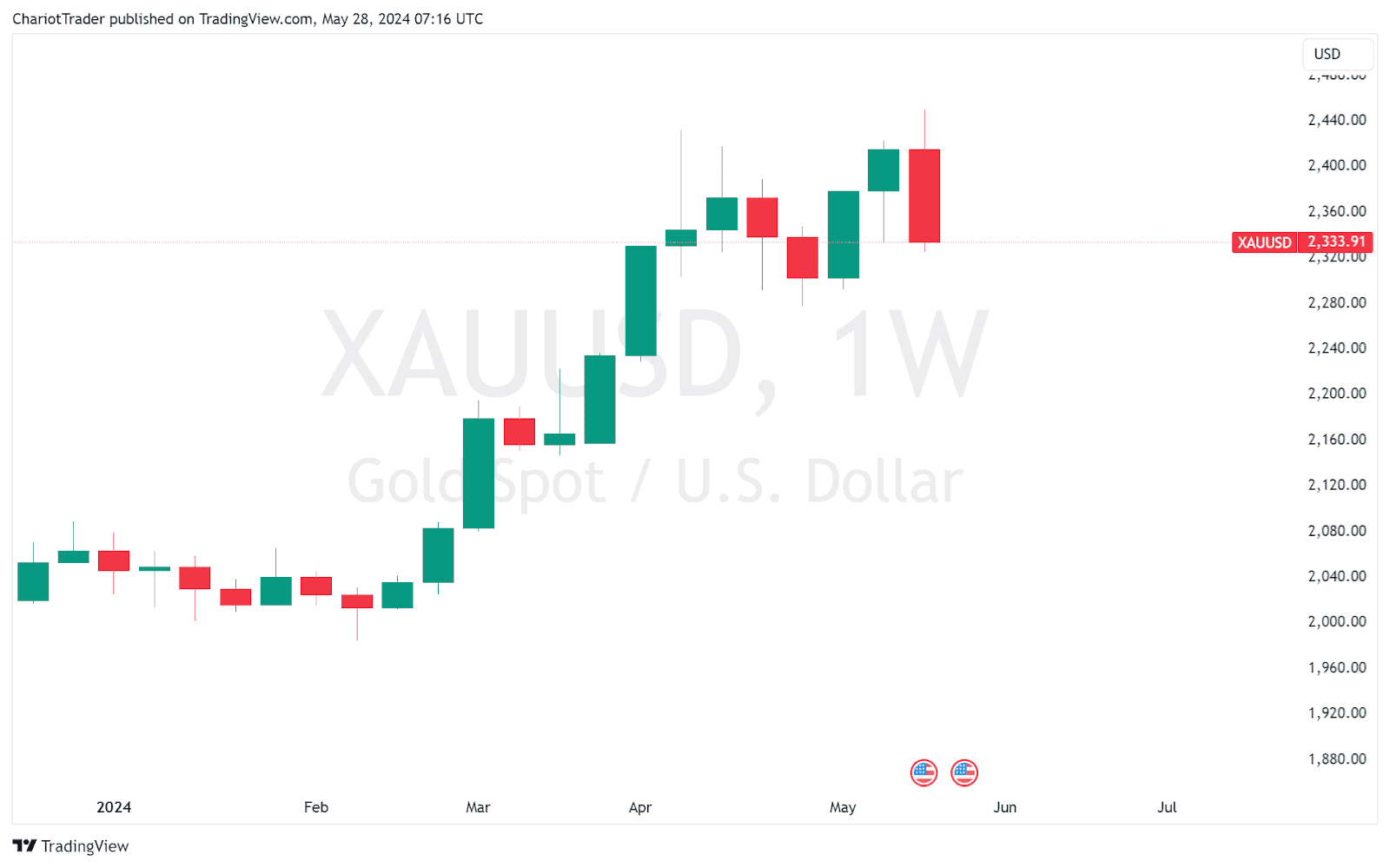

- Gold has created a large weekly bearish engulfing candle.

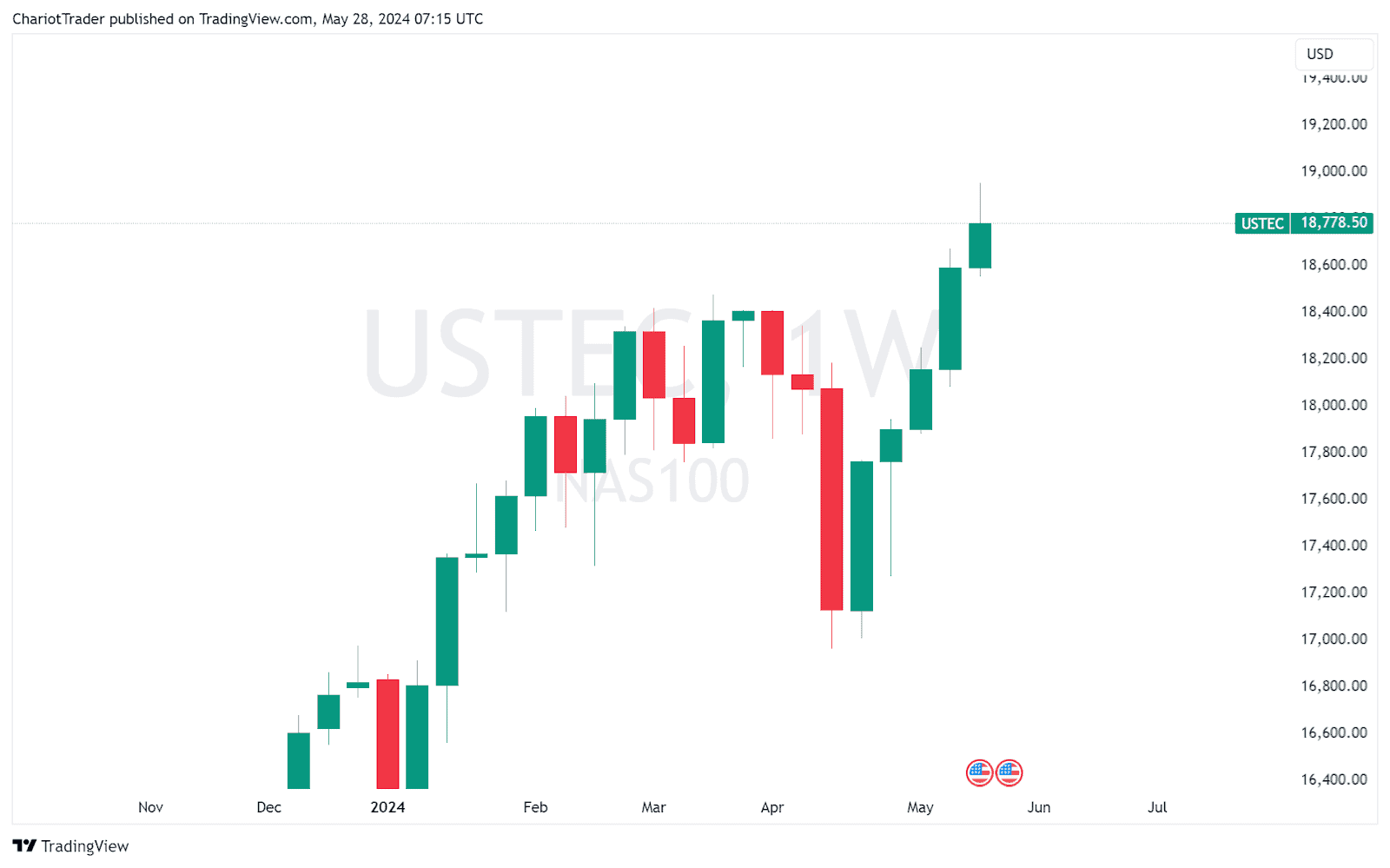

- Nasdaq 100 has rallied to new highs, closing with a green weekly candle.

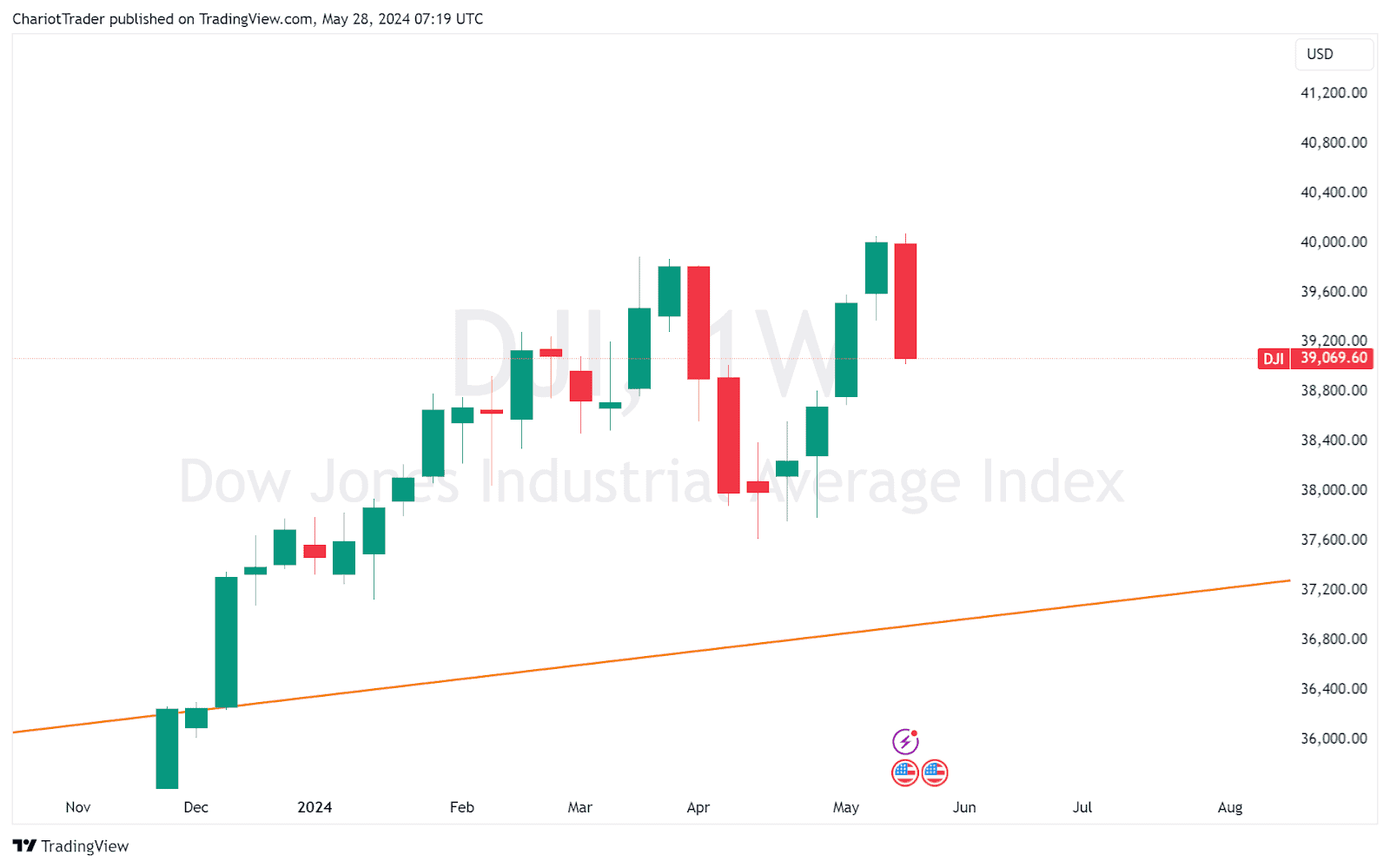

- Dow Jones has formed a large weekly bearish engulfing candle.

The DXY has fallen to a weekly/daily trendline support. The U.S Dollar could hold at this region until the Core U.S PCE Data is released on May 31st, 2024.

With a news announcement being so near and the DXY being on a weekly trendline, we may see Dollar hold out here or even creep up before Friday’s news kicks in.

The Core PCE m/m data is forecasted to be 0.2%, which is 0.1% lower than the previous month’s reading. If these targets are met, then it is going to be bullish for the markets, and DXY would likely break down from its weekly rising wedge.

On the flipside, if the data is higher than 0.2%, we may see a continued pause or small correction before the markets rally again.

Keep in mind that despite the support level on DXY, mixed messages in the market, and news announcement. Many indices and assets such as Nasdaq 100, Bitcoin, and Gold forming cup-and-handles on the weekly time frame.

You can check our charts here for their macro bullish targets.