- Opening Bell

- May 21, 2024

- 3min read

Markets Surge in Anticipation of NVDA Earnings

As we approach the earning reports of Nvidia’s Q1 FY25 on May 22nd, the markets have rallied to new highs or towards their all time highs.

This is in spite of the usual negative correlation between the DXY and the general markets, creating a divergence. This suggests that large players are currently loading or unloading their positions to prepare for a larger move.

Gold, Nasdaq, Bitcoin steal the show

XAUUSD

Gold has broken past $2,400 and is well on its trajectory to the measured move target of its inverse head and shoulders at $2,536.

USTEC

Nasdaq 100 is potentially in a cup and handle breakout, with measured move targets being projected at $21,291.92. There is also a lower support trendline on the weekly timeframe to keep the uptrend sustained, which is coinciding with the Weekly 50 EMA.

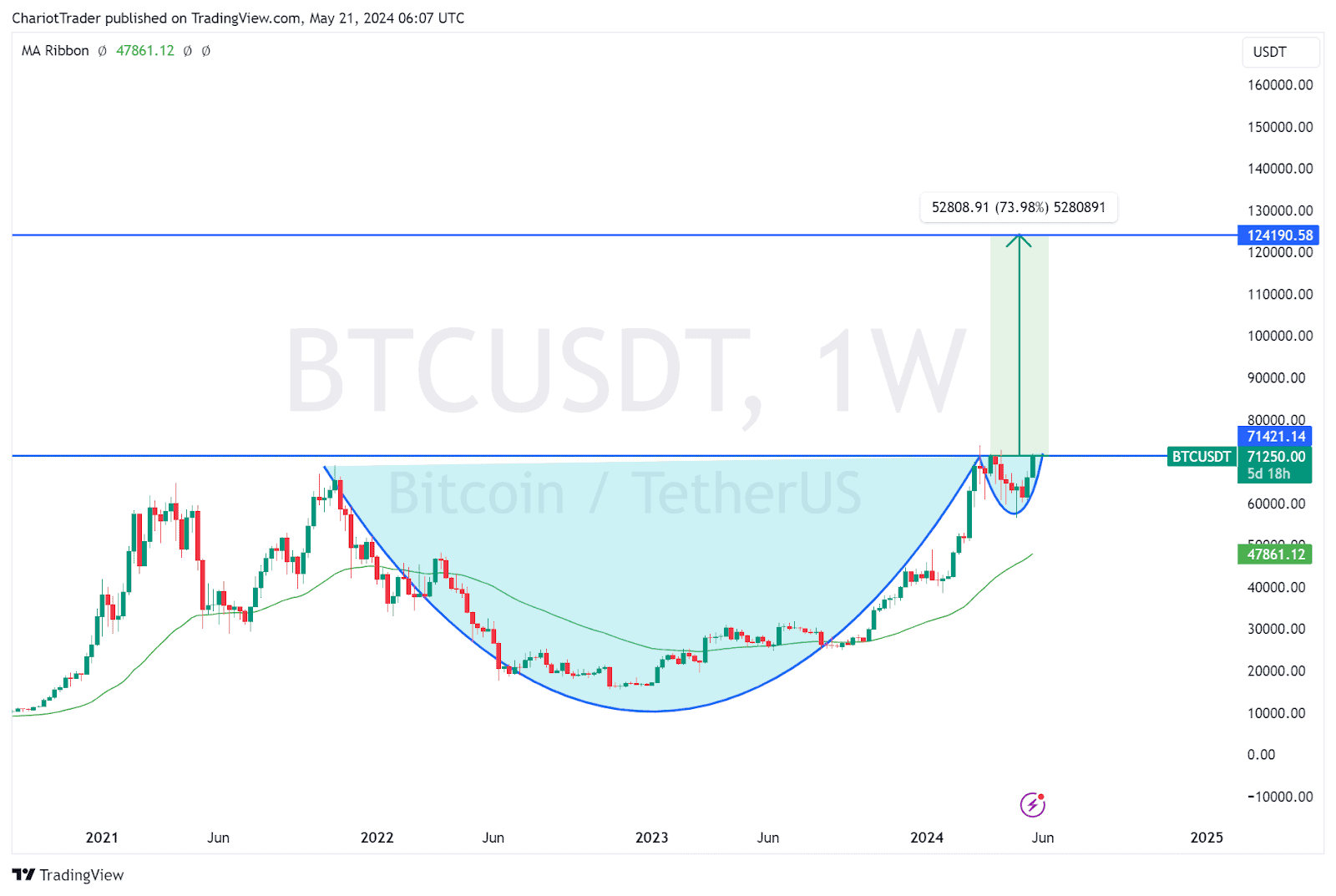

BTCUSDT

Bitcoin has recovered its losses from April, and is now back at $71,000 – carrying the rest of the crypto market up with it. There is also a potential for a massive cup and handle formation that can be found on the weekly timeframe, which would project its price target to roughly $124,000 per coin.

Impact of Nvidia Quarter Earnings Report

On the S&P 500 and Nasdaq 100

With approximately 5% market share for the Nasdaq 100 and S&P 500, Nvidia plays a significant role in affecting the price of these indices. Investors are keeping an eye on Nvidia’s earnings as it represents the growing opportunities for AI in the tech sector, which will lend itself to creating more economic growth.

On the Cryptocurrency Market

Meanwhile, increased earnings for Nvidia could also imply an expected price increase for Bitcoin. This is because Bitcoin is typically mined digitally using Nvidia GPUs.

If Nvidia is earning more, it’s possible that more GPUs are being sold, and miners will be more active, potentially driving up Bitcoin prices due to increased demand for mining power. Thus, Nvidia’s performance is closely watched by investors not only for its direct impact on stock indices but also for its implications in the cryptocurrency market.

Expectations for Nvidia Q1 FY25 EPS

- The previous report had an EPS of $5.16 per share.

- As for the Q1 FY25 forecast, it’s sitting at $5.52 per share.

If the report is able to meet expectations or even surpass it, the markets should react favorably in the mid to long term. However, traders should remain cautious and expect volatility in the short term.

Data Implications for Nvidia

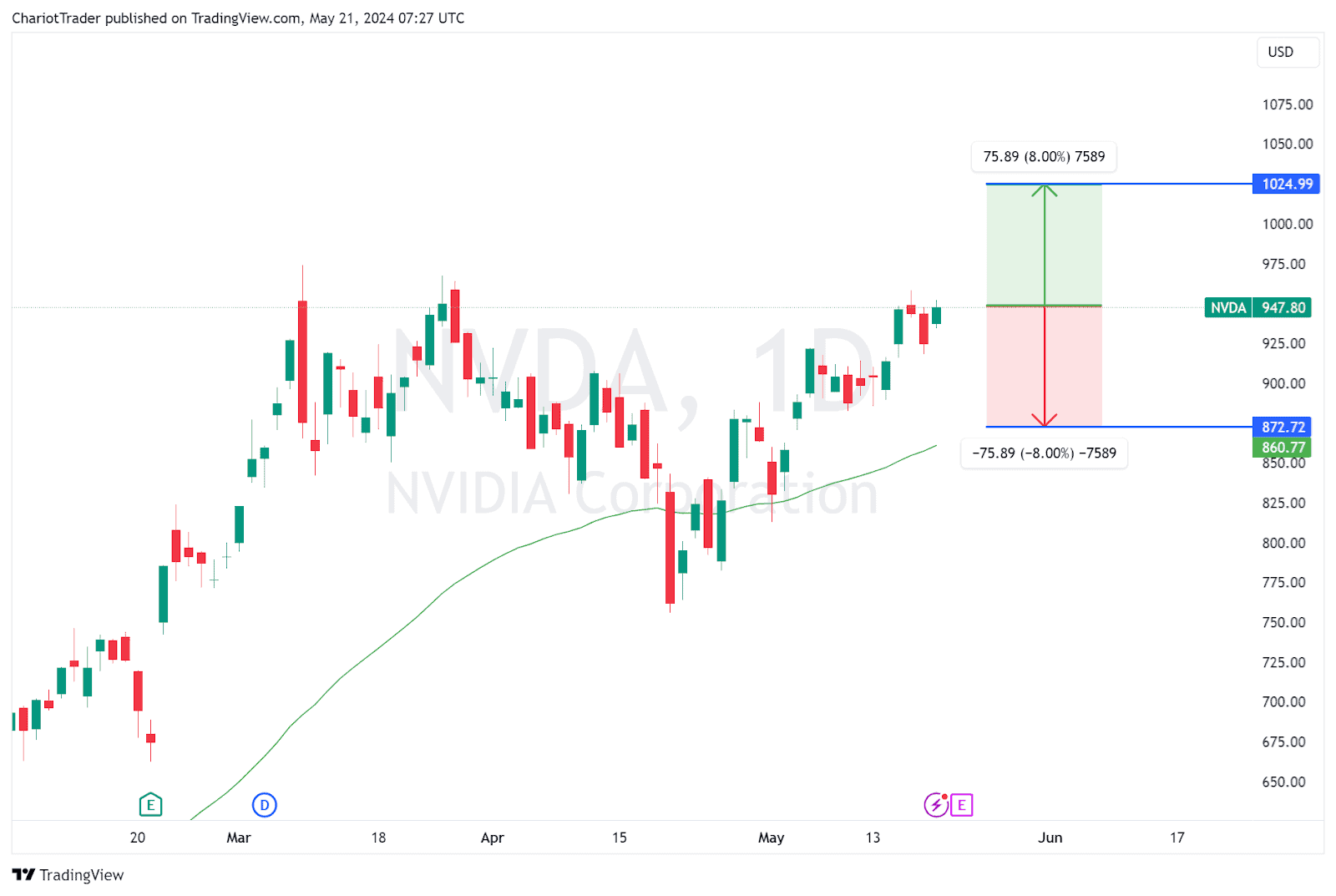

Depending on the earnings report data, Nvidia’s stock is expected to move 8% either to the upside or downside – according to experts from Nasdaq.