- Opening Bell

- July 22, 2025

- 4 min read

Coca-Cola Q2 2025 Earnings: Margin Beat Overshadows Weak Demand, but Can the $69 Support Hold?

Coca-Cola (KO) posted its Q2 2025 results with a headline EPS beat, but the quality of that beat warrants a closer look. Below is a breakdown of the key financial metrics and what truly drove the performance, followed by an analysis of the current technical setup in KO’s stock price.

Headline Numbers (Non-GAAP Focus)

| Metric | Actual (Q2 2025) | Consensus | Y/Y Growth |

|---|---|---|---|

| EPS (Non-GAAP) | $0.87 | $0.83 | +4% |

| Revenue | $12.5B | $12.5B | +1% |

| Organic Revenue | +5% | — | +5% |

| Operating Margin (Adj) | 34.7% | 32.8% | +190 bps |

What Drove the Beat?

1. Margins, Not Revenue, Powered the EPS Beat

Coca-Cola matched revenue expectations but surpassed EPS estimates by 4 cents. The driver? Margin expansion.

- Adjusted operating margin jumped 190 basis points to 34.7%.

- On a currency-neutral basis, margins were even stronger at 36.0%.

This was primarily due to:

- Tight control over SG&A expenses

- Deferred marketing investments

- Eased input cost pressures

- Effective pricing strategies

Conclusion: The beat was operational, not volume-based. EPS strength came from internal efficiency, not external growth.

2. Weak Volume Points to Soft Demand

The underlying demand picture wasn’t encouraging:

- Global Unit Case Volume: –1%

- Coca-Cola Trademark: –1%

- Juice/Dairy/Plant-Based: –4%

- Asia-Pacific: –3%

- Latin America: –2%

This suggests Coca-Cola’s growth was driven by price/mix rather than more product being sold.

Conclusion: There’s a vulnerability here. If inflation continues cooling or if promotional spend increases, price/mix benefits may erode quickly.

3. FX Was a Drag, but Margins Held Firm

While currency effects shaved 5% off EPS, Coca-Cola still delivered +9% EPS growth on a currency-neutral basis. That reinforces the company’s strong operational execution.

4. Negative Free Cash Flow — But Explained

Free cash flow was –$2.1B, but this included a $6.1B payment for fairlife. Excluding that, adjusted FCF was a healthy +$3.9B.

This isn’t a red flag unless negative cash flow persists into future quarters.

5. Slightly Upbeat Outlook

Coca-Cola guided full-year comparable EPS growth to +3%, reaffirming 5–6% organic revenue growth. The modest upgrade reflects confidence in margin control, though not necessarily volume growth.

Second-Order View: How Strong Was the Beat, Really?

- Quality of Earnings Beat: High. It wasn’t propped up by lower taxes or buybacks—this was real operational discipline.

- Risks: Negative global volume is a red flag. If price/mix stops working, growth could flatline.

- Investor Perception: Depends on positioning. Those expecting a demand rebound may be disappointed. However, those valuing margin control and cost discipline may stay bullish.

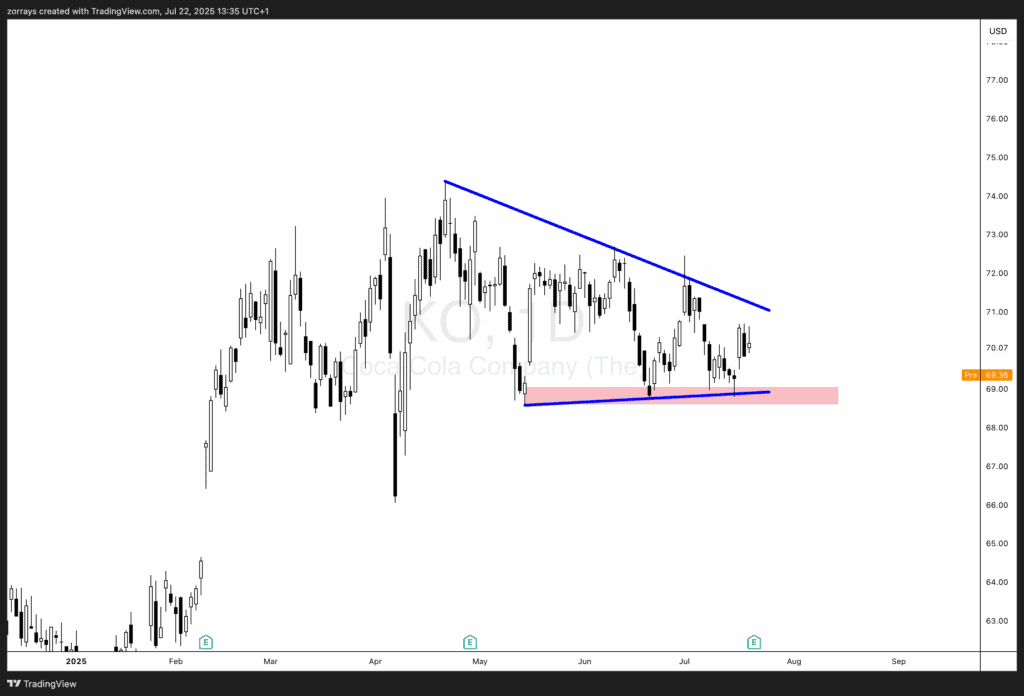

Technical Analysis: Compression Near a Critical Level

Coca-Cola’s stock is currently consolidating inside a symmetrical triangle, with descending highs and a flat support zone around $69, highlighted in red.

What to Watch Technically:

- The $69 level has held multiple times, acting as a firm support.

- This zone aligns with previous demand accumulation and could represent buyer interest.

- However, the stock is nearing the apex of the triangle, and compression usually precedes a breakout or breakdown.

Scenarios Ahead:

- Bullish Case: If KO continues to respect $69 and breaks above the descending trendline (~$71), it could trigger a move toward $73–$75, driven by renewed optimism in margin control and potential Q3 marketing reinvestment.

- Bearish Case: A confirmed breakdown below $69 opens the door to a drop toward $66, a prior area of consolidation from early 2025.

Catalyst Needed?

Fundamentally, Coca-Cola will need either:

- A turnaround in unit volume growth

- Clear marketing spend deployment plans to drive future demand

- A shift in sentiment where investors reward margin protection over volume growth

Until then, $69 remains a make-or-break level. A close below that support—especially on volume—would raise caution.

Final Thoughts

Coca-Cola’s Q2 2025 performance was a masterclass in cost and margin management, but it did little to ease concerns about consumer demand. The market’s response may hinge on how much slack investors are willing to cut a high-margin, slow-growth business in a soft macro environment. Meanwhile, from a technical standpoint, all eyes should remain on the $69 level—if that breaks, KO may have further downside to explore.

You may also be interested in: