- Opening Bell

- October 23, 2024

- 3 min read

BoC Rate Cut Anticipation and Earnings Breakdown

BoC Interest Rate Cut Decision

The market is currently pricing in a 45 basis point (bp) rate cut by the Bank of Canada (BoC) as inflation has slowed below target. However, there’s a strong debate between a 25bp and 50bp move. A 25bp cut remains more likely as core inflation measures did not slow further in September, and recent labor market data showed robust gains with the unemployment rate ticking lower. Furthermore, the BoC Business Outlook survey indicates improved future sales expectations. With the Federal Reserve’s hawkish stance raising U.S. rate expectations, the BoC may be cautious about widening the rate gap between Canada and the U.S., making an outsized cut less desirable. If the BoC does opt for a 50bp cut, it could simply be to align with market expectations, though a more moderate easing seems more prudent to maintain economic stability without weakening the Canadian dollar excessively.

Quarterly Earnings Breakdown with Technical Analysis

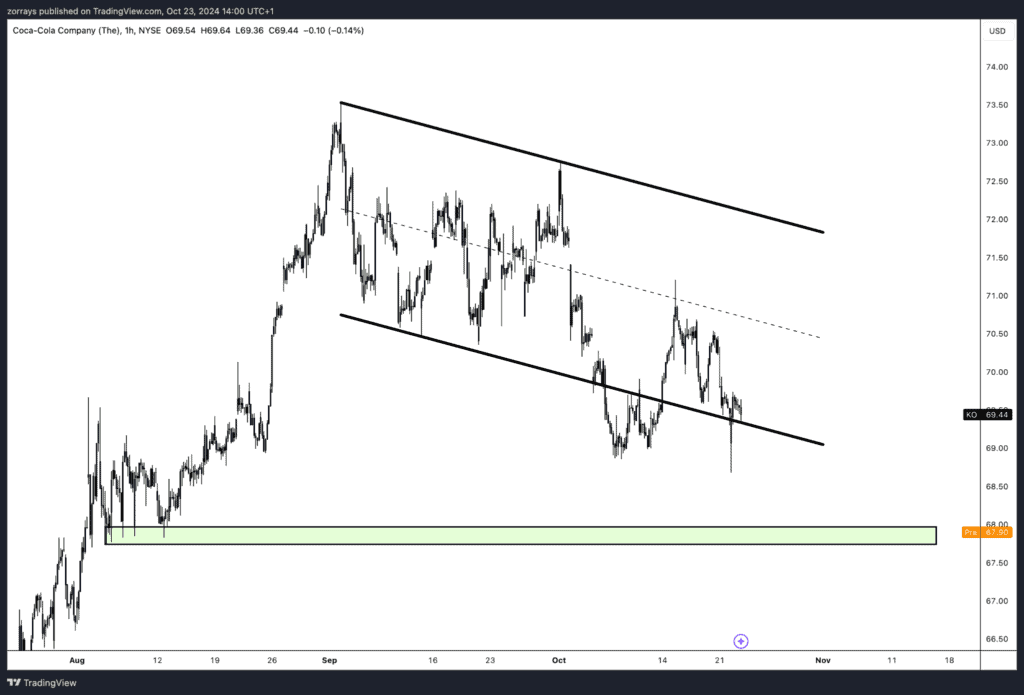

1. Coca-Cola (KO)

Revenue Forecast: $11.63 billion | Actual: $11.9 billion

- Summary: Coca-Cola exceeded expectations, reporting $11.9 billion in revenue. Organic revenues grew by 9%, driven by a strong price mix despite a 1% decline in unit case volume. However, the company faced currency headwinds and challenges in certain segments, like water and sports drinks, which saw a decline in sales. Despite the robust revenue figures, net income fell by 8% due to increased operating costs and other charges.

- Technical Insight: KO opened in a negative gap near a critical support zone around $67.90. The stock appears to be nearing the lower end of a descending channel, and given the mixed earnings performance, this zone could act as a crucial area for buyers to step in. If this support is breached, further downside corrections could follow.

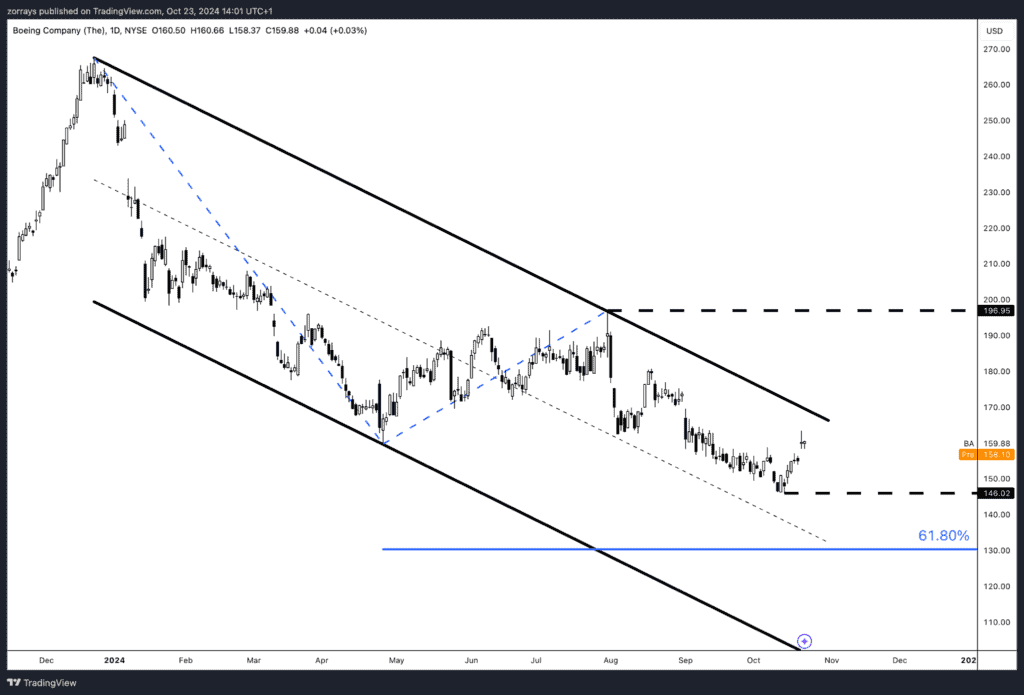

2. Boeing (BA)

Revenue Forecast: $18.23 billion | Actual: $17.8 billion

- Summary: Boeing fell short of its revenue expectations, posting $17.8 billion compared to the forecast of $18.23 billion. The company cited the impact of labour stoppages and previously announced program charges as reasons for the miss. However, Boeing remains optimistic about its future with a backlog of over 5,400 airplanes and plans to ramp up production of its 787 model by year-end.

- Technical Insight: Boeing’s stock didn’t open with much of a gap, reflecting market indecision. The stock remains inside a broad descending channel, with the market still undecided on whether the long-term outlook is bullish or bearish. The lack of a clear directional gap suggests investors are waiting for more clarity, either through stronger earnings or a strategic breakthrough.

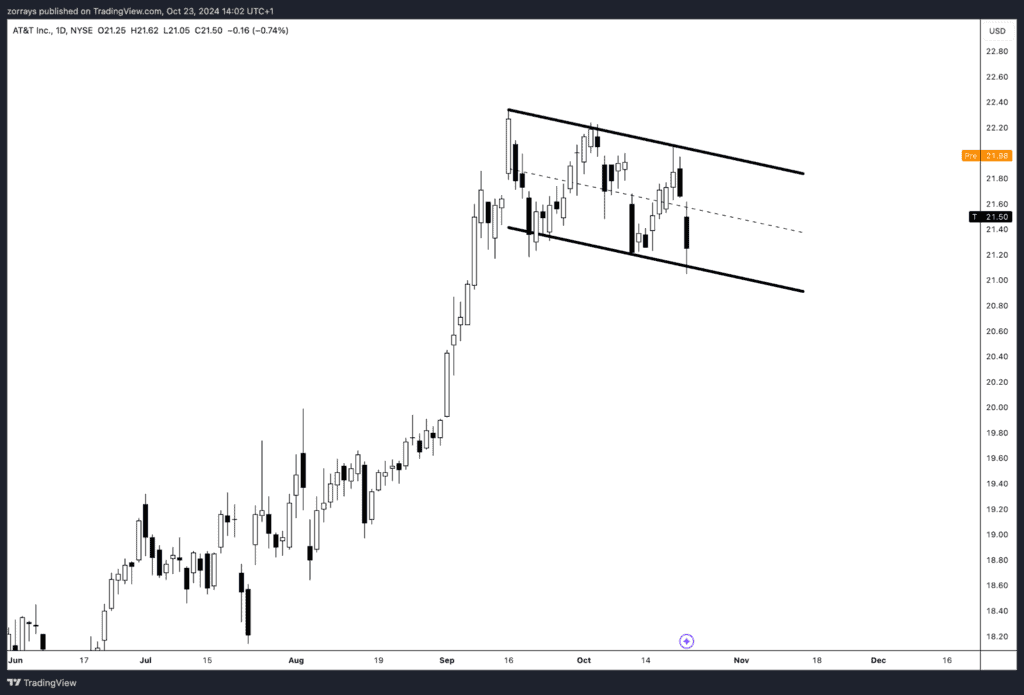

3. AT&T (T)

Revenue Forecast: $30.45 billion | Actual: $30.21 billion

- Summary: AT&T slightly missed its revenue forecast, reporting $30.21 billion versus the expected $30.45 billion. The company’s mobility segment showed strength with 4% growth in service revenue, while broadband revenues also grew by 6.4%. Despite these positives, AT&T faces headwinds from declining equipment sales and ongoing legacy service transitions.

- Technical Insight: AT&T is currently inside a bull flag formation, gapping slightly higher in pre-market trading. The bullish momentum, supported by strong growth in key segments like mobility and broadband, suggests a potential breakout to the upside. If this pattern plays out, the stock could see further gains in the coming sessions.

Conclusion

The day ahead sees continued focus on macroeconomic developments, particularly with the BoC’s rate decision on the horizon. Meanwhile, mixed earnings reports from major corporations like Coca-Cola, Boeing, and AT&T reflect the broader challenges of navigating inflationary pressures and operational disruptions. While KO and AT&T show potential for support and bullish breakouts, Boeing’s performance leaves the market on edge, awaiting clearer signals.