- Opening Bell

- December 2, 2024

- 4 min read

Altcoin Season is Here: XRP Takes Flight, BTC Dominance Down

Apparently, gravity has stopped functioning on XRP. The asset broke past its previous All-Time High (ATH) at $1.9669 last week, and went on to close the week out with a new ATH candle. This weekly “God Candle”, as some may call it, reflects a growth of 60%, leading many to wonder if it’s time for a reversal, or will the bull train continue?

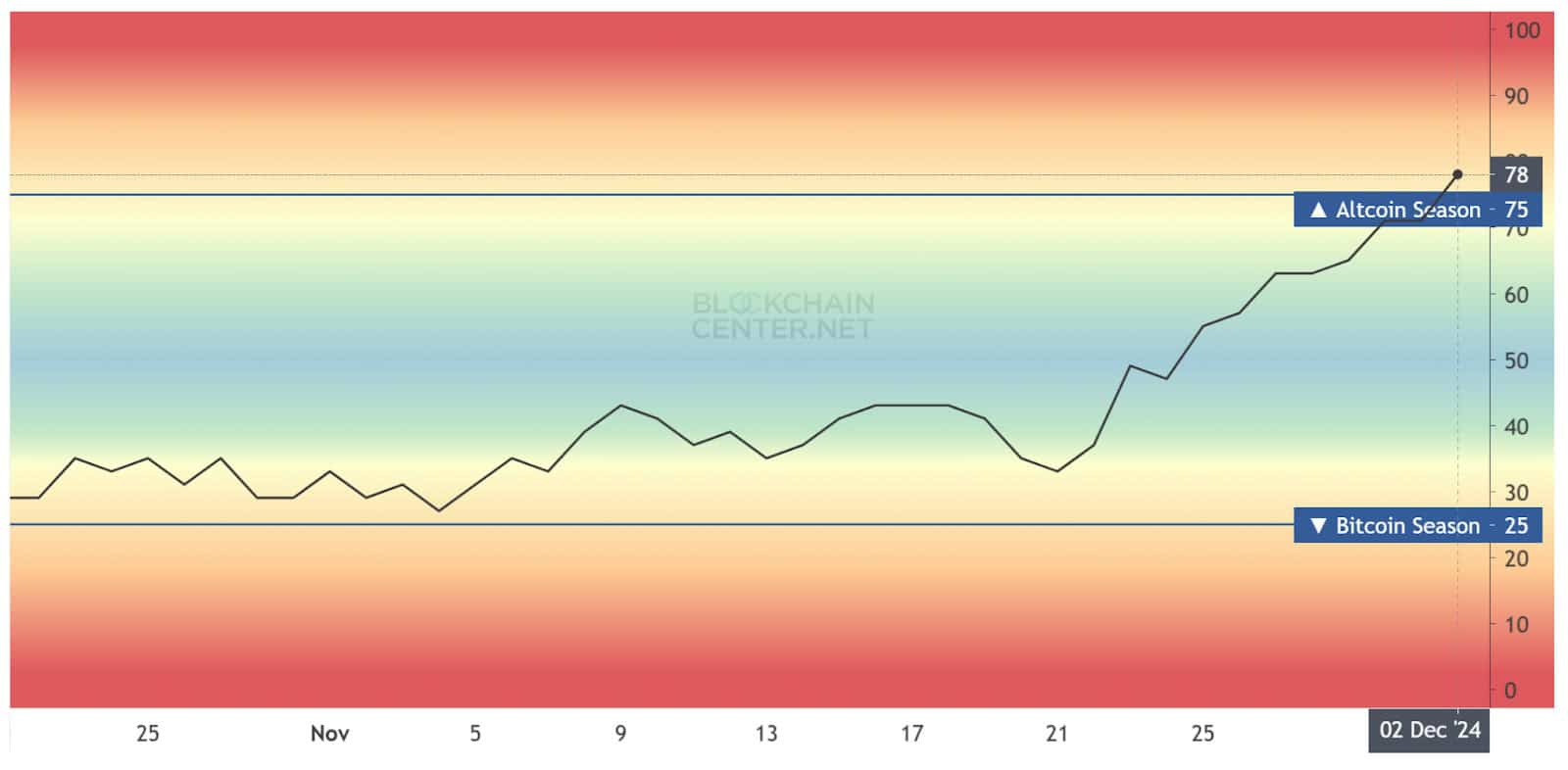

Additionally, the markets have officially entered the Altcoin Season, according to an indicator created by Blockchain Center. This marks a period of time where non-Bitcoin cryptocurrencies will typically outperform Bitcoin in overall gains.

With Bitcoin narrowly missing $100,000 and temporarily falling from $99,690, Altcoins may be getting their time to shine in the sun while Bitcoin consolidates. Altcoins, like XRP, tend to have quick yet powerful explosions to the upside due to their smaller market caps. Overall, several indications point to altcoins outperforming Bitcoin in the coming days or weeks.

Alt Season Index Analysis

According to the Altcoin Season Index indicator from Blockchain Center, we have officially entered the Altcoin Season as of December 2nd, 2024.

Whenever this indicator is over 75, that means Altcoin Season is in play. The previous reading was 71, and recorded on November 30th. The most recent reading is 78, which marks today as the official day we’re in an Alt season.

Bitcoin Dominance Chart Analysis

The Bitcoin Dominance Chart (BTC.D) is also showing promising signs for an Altcoin Bull Run to occur, as a major supporting trendline dating back to June 2023 is on the verge of breaking down.

If this week confirms a close below the support trendline, we could see a cascade on BTC.D down to the 48.50% region, where a major resistance from 2021 to 2023 has flipped into a major support level. A breakdown from here would also imply that Bitcoin is consolidating, while Altcoins begin to experience impulsive rallies.

On the flip side, if BTC.D begins to creep up again, then it would effectively cancel Alt Season, putting the spotlight back on Bitcoin. This would imply two scenarios, both non-ideal for the positive momentum of altcoins:

- Bitcoin is driving impulsively higher, and therefore capturing the majority of the market cap/media attention.

- Bitcoin is dropping rigorously, but altcoins are dropping even harder.

XRP Chart Analysis (4H Timeframe)

XRP (Ripple) has broken out into new all-time highs, which puts the asset officially into “Blue Sky Breakout” territory. There are no real resistances above, making it difficult to predict where XRP’s rally would stop. A great tool for assessing the health of XRP’s uptrend is the Bollinger Bands® EMA-20 with 1 Standard Deviation on the 4H timeframe.

The standard deviation helps capture any deviating moves, and as long as XRP does not close below the standard deviation bands, we can assume that the uptrend will continue. We saw this in late November, when the price of XRP broke below the EMA-20 but failed to close below the standard deviation bands. Following this, XRP climbed higher into new highs.

The basic gist: As long as XRP does not close below the standard deviation band of this Bollinger Band, we should assume that the uptrend will continue.

| Support Levels to Watch on XRP: 1. 4H EMA-20: Currently at $1.9732 2. Previous All-Time High: $1.9669 3. Consolidation Area from approximately $1.3019 – $1.5463 4. Consolidation Area from approximately $1 – $1.1863 |

Additionally, if you squint hard enough, a bearish RSI divergence can be spotted on XRP/USDT, starting from the $1 region to the all-time-highs. However, since this 4H-divergence is pretty far apart, it may be an unreliable signal.

Closing Thoughts

- Altcoin Season Index has officially signalled ‘Altcoin Season’, with 78% of the Top 50 Alts outperforming Bitcoin.

- BTC.D is about to break a major support trendline on the weekly timeframe, pushing Alts even higher.

- If Bitcoin takes a drastic plummet to the downside (20% or more), Altcoins will slump even harder – cancelling Alt Season.

You May Also Be Interested In: