- Elliott Wave

- January 23, 2025

- 2 min read

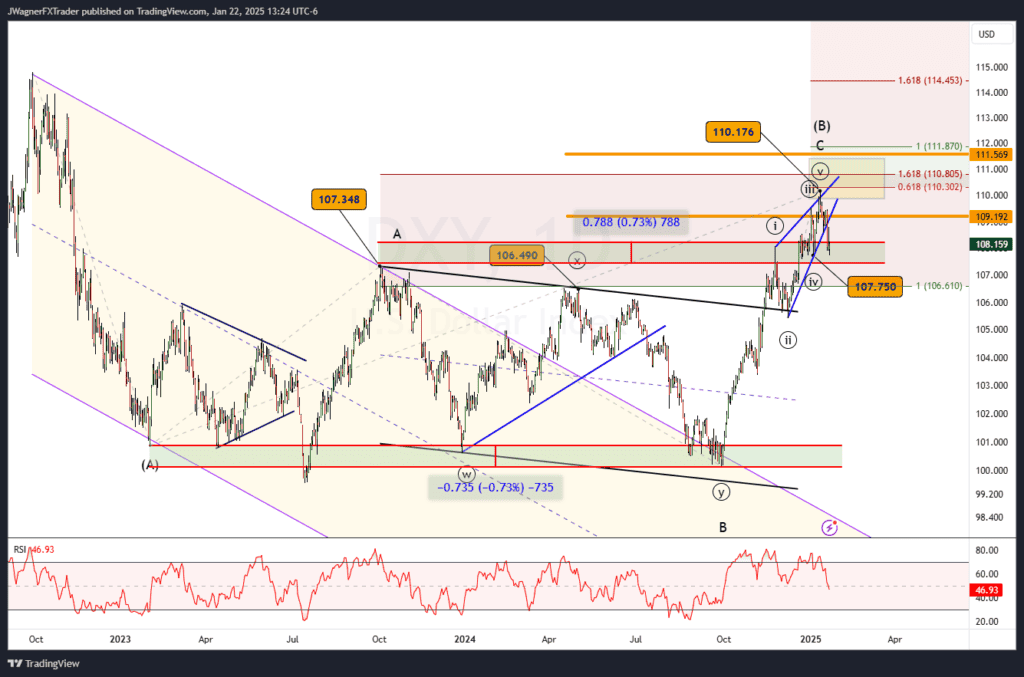

US Dollar Elliott Wave: The Wave That Could Change the Game

Executive Summary

- Trend Bias: A major top may have formed at the 110.18 high and a bearish reversal shifts the trend to down.

- Key Resistance: Bearish below the area near 110.176.

- Downside Targets: 96-97 and possibly 89-90 are downside targets over the next several months.

Current Elliott Wave Analysis

The DXY Elliott wave analysis displays a potential Primary Wave (B) structure at or near a completion, with subwaves visible at two degrees of trend:

- Intermediate Degree:

- Wave (A): Completed decline to 100.80.

- Wave (B): Ongoing upward correction, subdividing into an A-B-C structure.

- Minor Degree:

- Wave (B)’s subwave (C): Carved an ending diagonal pattern that has the minimum subwaves in place at 110.18 to count it complete.

The RSI divergence near resistance at 110.176 signals potential weakness. This suggests Wave (B) may complete near the 1.618 Fibonacci extension at 110.805, marking a turning point.

Forecast

The chart implies a bearish reversal, initiating a larger Primary Wave (C) decline. Probable targets for this decline are between 96-97 and possibly 89-90 over the next several years.

If DXY rallies above 109.42, the alarm bells will start ringing again that something else is brewing.

Bottom Line

Bearish bias while below 110.18. Below 109.42 we can be comfortably bearish. Above 109.42 and it’s an early warning dashboard signal that something’s not right. Huge downside targets so give this room to breathe.

Downside targets include 96-97 and possibly 89-90 over the next several months and perhaps years.

You might be interested in…