- Elliott Wave

- August 11, 2025

- 1min read

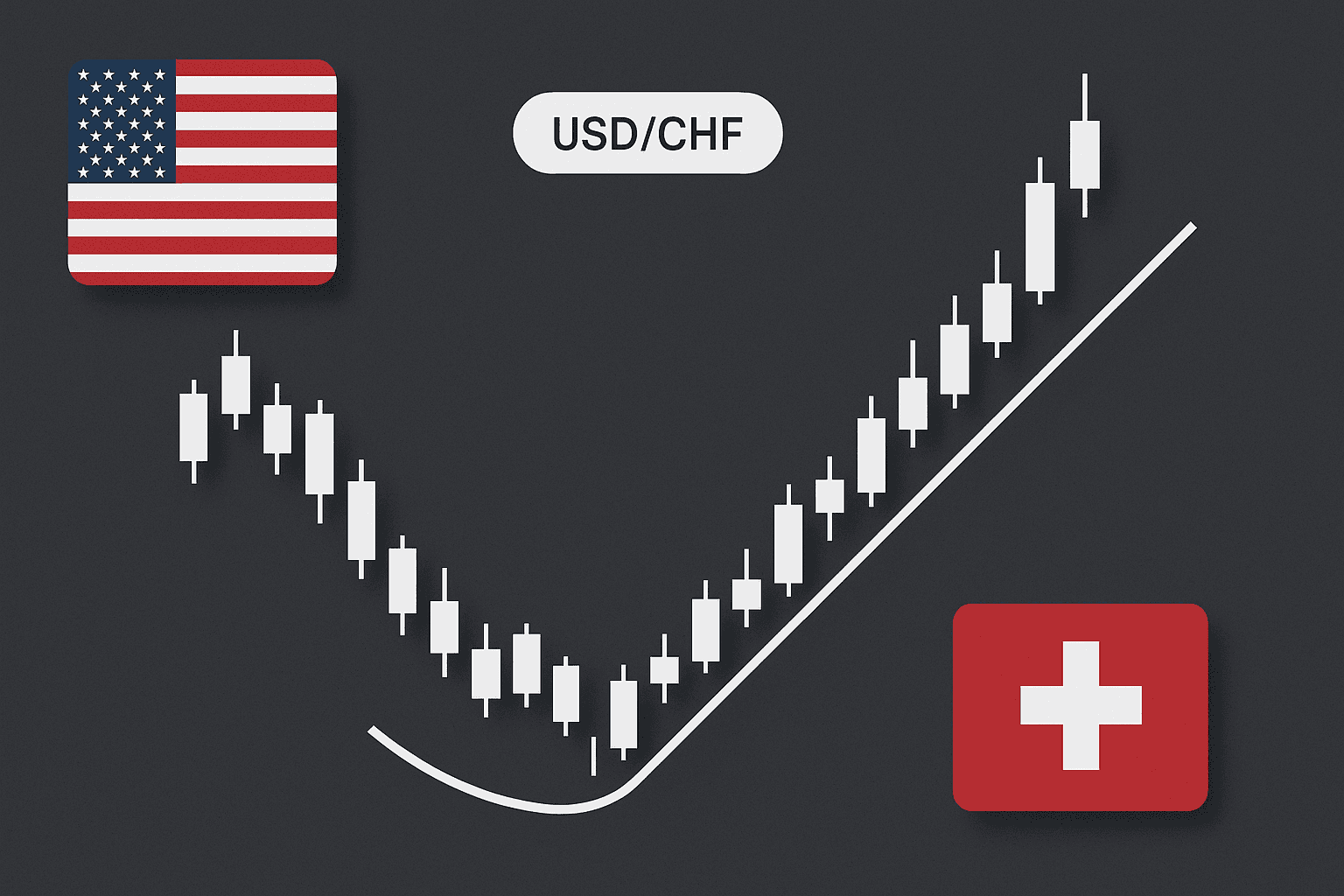

USD/CHF Elliott Wave Forecast: Medium Term Bottom Found

Executive Summary

- Trend Bias: USD/CHF appears to have bottomed at .7872 and beginning a bullish rally.

- Key Levels: Bullish above .7872.

- Target Zone: Upside target lies near the 0.83 region and possibly .86.

Current Elliott Wave Analysis

The Elliott wave analysis for the USD/CHF daily chart illustrates a completed A-B-C structure at the July 1 low of .7872. This means the downtrend pattern from November 2022 is complete and a large rally may be underway.

Back in January 2025, we saw symptoms of a top in price and forecasted a decline to .83 and possibly .77. The low on July 1 at .7872 fulfilled that forecast.

Now, a large rally is beginning that likely carries up to .83, where the 38% Fibonacci retracement level sits and where broken horizontal support is located. Higher levels are possibly like .86 where the 61% retracement level rests and the January 2025 high near .92.

Depending on how the structure of the rally develops will determine which larger degree pattern is unfolding.

Bottom Line

USD/CHF likely bottomed on July 1 at .7872. A rally to .83 and possibly .86 appears to be the higher probability trend.

In the unexpected event of a decline below .7872, then we’ll consider wave ‘C’ is extending further down.