- Elliott Wave

- January 27, 2025

- 2 min read

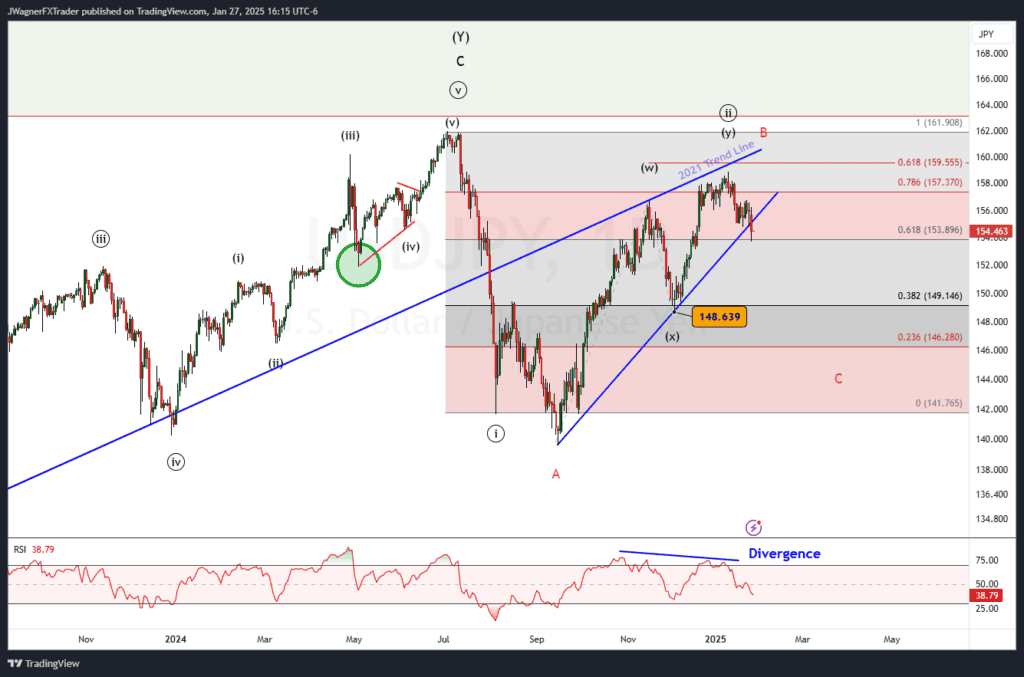

USD/JPY Elliott Wave Forecast: Divergence Sets the Stage

Executive Summary

- USD/JPY exhibits signs of a potential decline following a bearish RSI divergence.

- A breakdown below the trendline signals a downtrend that tests 148 and possibly lower levels

- The bearish trend is anticipated to hold below 158.87.

Current Elliott Wave Analysis

USD/JPY has broken below a support trend line signalling a larger top may be in place. Last Friday, January 24, the Bank of Japan announced a 25 basis point interest rate increase. This news, plus the Fed’s potential rate cut in 2025 closes the interest rate differential between the two countries. As a result, the carry trade that aggressively drove the USDJPY exchange rate higher may be experiencing a trend change.

There are two Elliott wave counts we are following.

The first wave count has black labeling. It suggests that wave ((ii)) just finalized at 158.87 and wave ((iii)) is beginning to the downside. This wave ((iii)) would break below 142 and possibly reach significantly lower levels like 134 & 127.

An alternate count we are following is bearish in the near-term but would not drop as far. The red labels on the chart above suggest the 158.87 top was wave ‘B’ of a symmetrical triangle pattern. This implies a decline in wave ‘C’ of a triangle that retests 148 and possibly reaches 146.

The structure of the decline will signal which of the patterns is higher probability. Either way, we are anticipating continued decline to below 148.

Back on November 8, we forecasted a major top, which came one week later on November 15. However, that top was simply wave (w) of a double three rally.

Bottom Line

The divergence on RSI suggests waning momentum to the upside. USD/JPY’s break below the support trend line signals the mood of the market has changed from up to down. We are anticipating a retest of the 148 low while prices hold below 158.87. Around 148, our models diverge as a wave ((iii)) decline would carry below 142 whereas wave ‘C’ of a triangle holds above 142.

You might be interested in: