- Elliott Wave

- August 21, 2025

- 2 min read

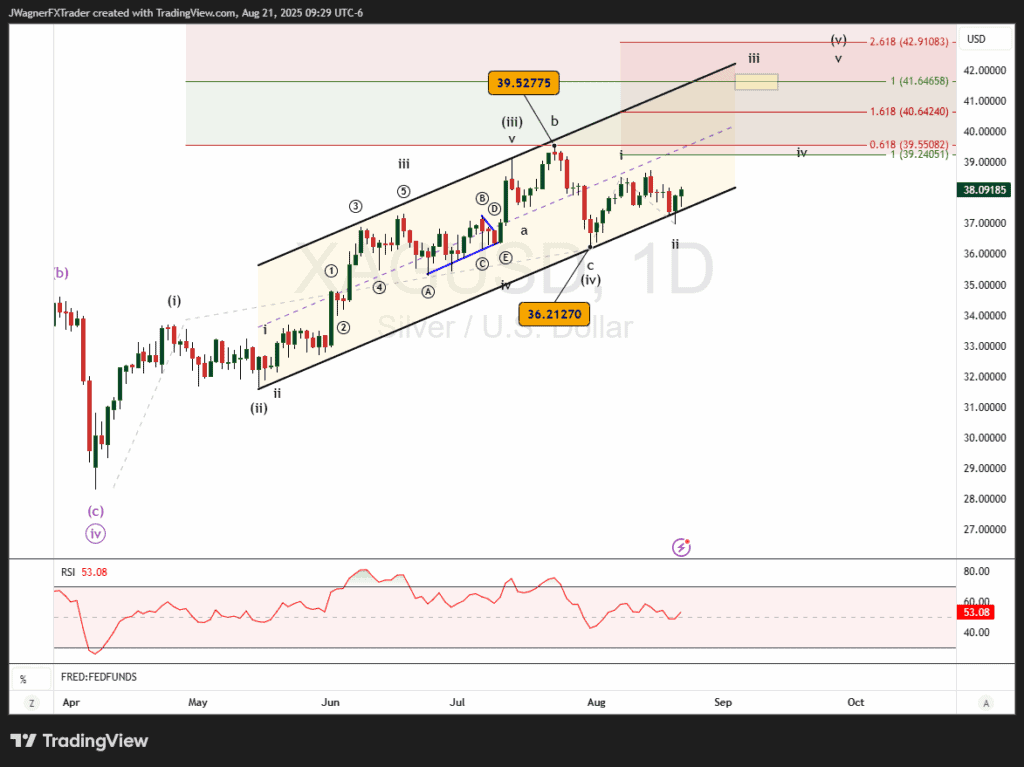

Silver’s Mature Rally Pattern [XAGUSD Elliott Wave]

Executive Summary

- Bullish Bias: Silver (XAGUSD) appears to be rallying in wave (v).

- Key Levels: Bullish invalidation level is $36.21.

- Upside Target: We anticipate wave (v) to reach $41.64 and possibly higher levels.

Current Elliott Wave Analysis

Silver (XAGUSD) appears to be rallying in wave iii of (v). According to Elliott Wave Theory, this rally is forecasted to reach $41.64 with even higher levels available.

Back on July 21, we forecasted:

- The rally at that time was wave b of (iv)

- Wave b of (iv) would likely top below $39.70

- The final touches of wave (iv) decline may reach $36-$38

With the benefit of hindsight, we now know that wave b of (iv) did top 2 days later on July 23 at $39.53, just as forecasted. Additionally, the wave (iv) bottomed at $36.21, right inside the target zone.

Looking ahead, the near-term target for wave iii of (v) is near $40.64. This is where wave iii is the 1.618 Fibonacci extension of wave i. Ultimately, I think Silver reaches up to $41.64 where wave (v) would be equal in length to wave (i), a common wave relationship.

Bottom Line

Silver remains in a mature bullish impulse pattern. The current wave (v) would be an ending wave of the bullish sequence that began in April. Upside targets include $41.64 and possibly higher levels.Any print below support at $36.21 would suggest a larger top is in place.