- Elliott Wave

- March 5, 2025

- 2 min read

GBP/USD Elliott Wave: Rally Accelerates

Executive Summary

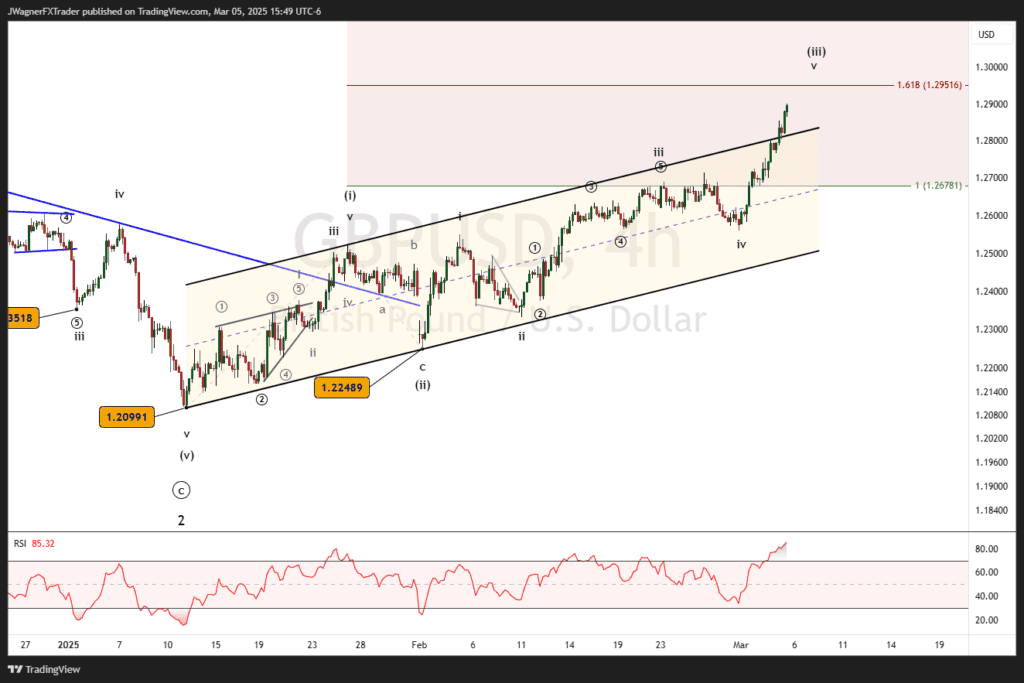

- GBPUSD continues its 3rd wave advance

- Current wave is (iii) of ((i)) of 3.

- 2014 resistance trend line passes near 1.28-1.29.

Current GBPUSD Elliott Wave Count

The current Elliott wave count for GBPUSD on the 4 hour chart is that prices are in a 3rd wave rally at multiple degrees of trend. Therefore, we are showing the current rally in GBPUSD as wave (iii) of ((i)) of 3.

We previously alerted readers to this 3rd wave rally on February 5 when Cable was trading near 1.2485 and just beginning the wave (iii).

The difference now is that GBPUSD appears to be late in development on wave (iii). However, there is still plenty of opportunity if this wave count is correct because the higher degrees of trend are wave ((i)) of 3.

Higher Degree of Trend

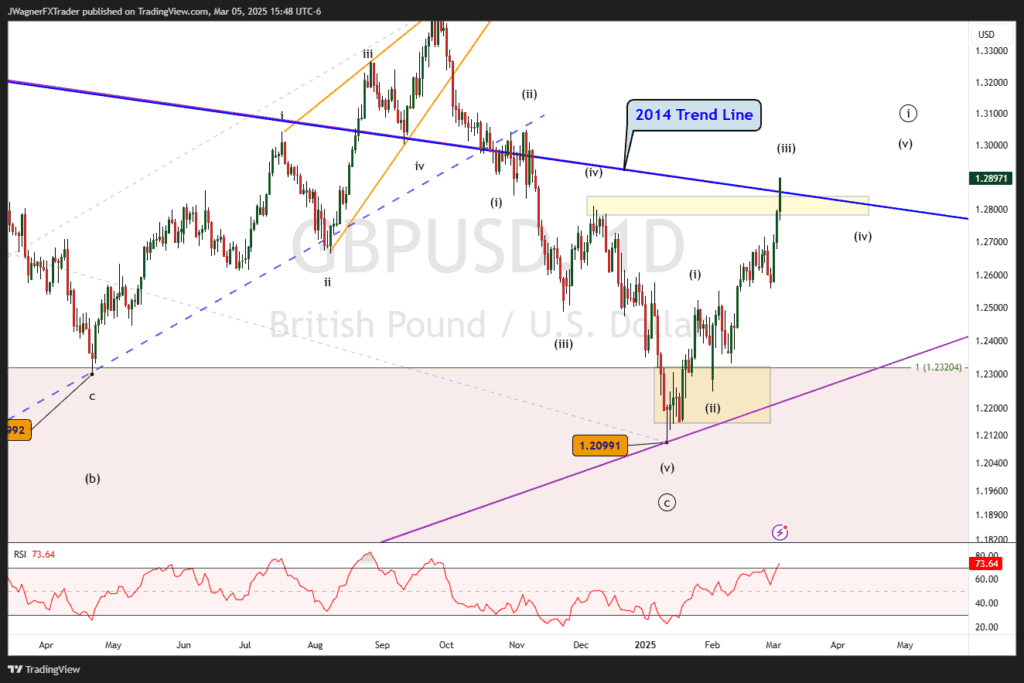

Zooming out to the daily chart, I want to point out a long-term trend line passing through nearby. This trend is shaped from the highs of 2014 and 2021. That blue trend line was the top edges of a very large bearish ending diagonal pattern.

That pattern has completed and GBPUSD is now rallying back to retest this trend line.

I suspect the current wave (iii) and (iv) will play with this trend line, then pull away to the upside as the Elliott wave count is incomplete.

Bottom Line

GBPUSD has accelerated higher in wave 3. Cable is currently testing a trend line that began in 2014. We suspect this trend line will ultimately break. In the meantime, wave (iii) and (iv) may dance around the trend line.

Ultimately, the higher degree wave count points to higher pricing near 1.54 and possibly higher.

You might also be interested in: