- Elliott Wave

- February 7, 2025

- 2 min read

EUR/USD Elliott Wave: Bearish Dip, Bullish Lift

Executive Summary

- Current Trend Bias: A corrective wave pattern is nearly complete leading to the next major rally.

- Key Levels: Critical support is at 1.0209 for the bullish bias.

- Forecast Implication: A bullish reversal may begin soon and drive EURUSD higher to 1.08 and possibly 1.12 in wave (iii).

Current Elliott Wave Analysis

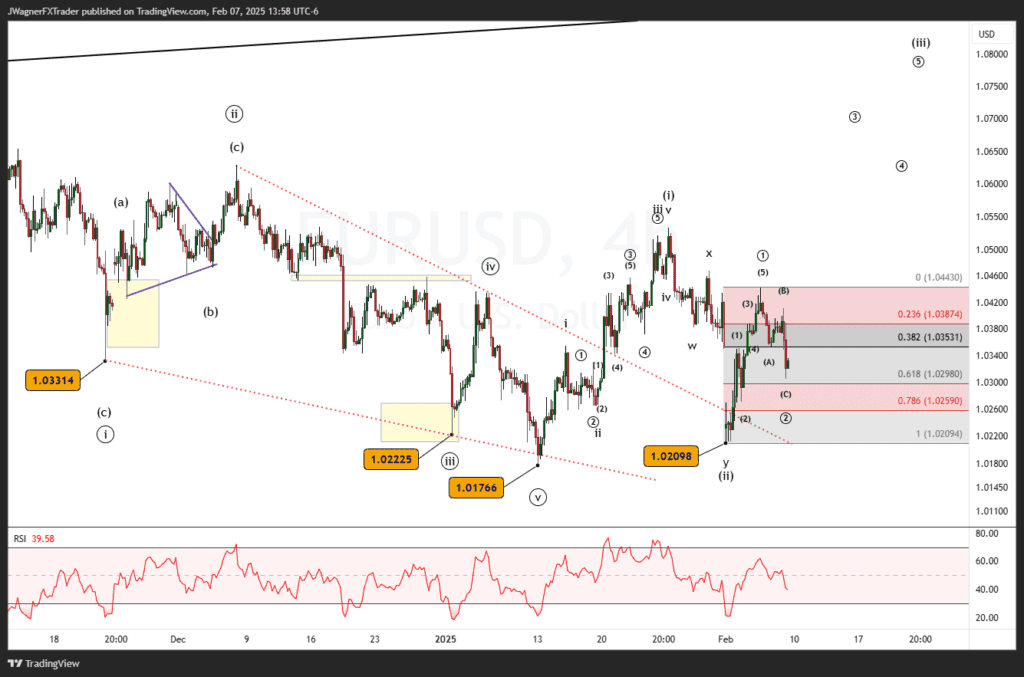

The EUR/USD chart shows a multi-degree Elliott wave bullish structure unfolding. At the higher degree, the chart aligns with a developing Wave (iii), indicating an ongoing bullish trend in the long term. However, the lower degree suggests that EUR/USD is in a corrective phase that is nearing its end of micro wave 2 of (ii).

This corrective structure has retraced into the Fibonacci 61.8% (1.02980) signaling the corrective dip is nearing its terminal point. Such a deep retracement often indicates a potential reversal zone. Moreover, the corrective phase subdivides into smaller waves, consistent with a zigzag pattern (a)-(b)-(c).

Following the completion of micro wave 2, an impulsive pattern is expected to take EUR/USD higher toward the Wave (iii) target near 1.08 and possibly 1.12.

Our previous EURUSD forecast is playing out as anticipated.

Bottom Line

EUR/USD is in the latter stages of a corrective Wave 2. While further downside may test the 1.02590–1.0298 support zone, a significant bullish reversal is anticipated. A break above 1.03874 would confirm the onset of Wave 3 and likely propel prices higher.

Though not expected, a breakdown below 1.0210 would imply a different Elliott wave pattern was unfolding.

You Might Be Interested In: