- Elliott Wave

- February 20, 2025

- 2 min read

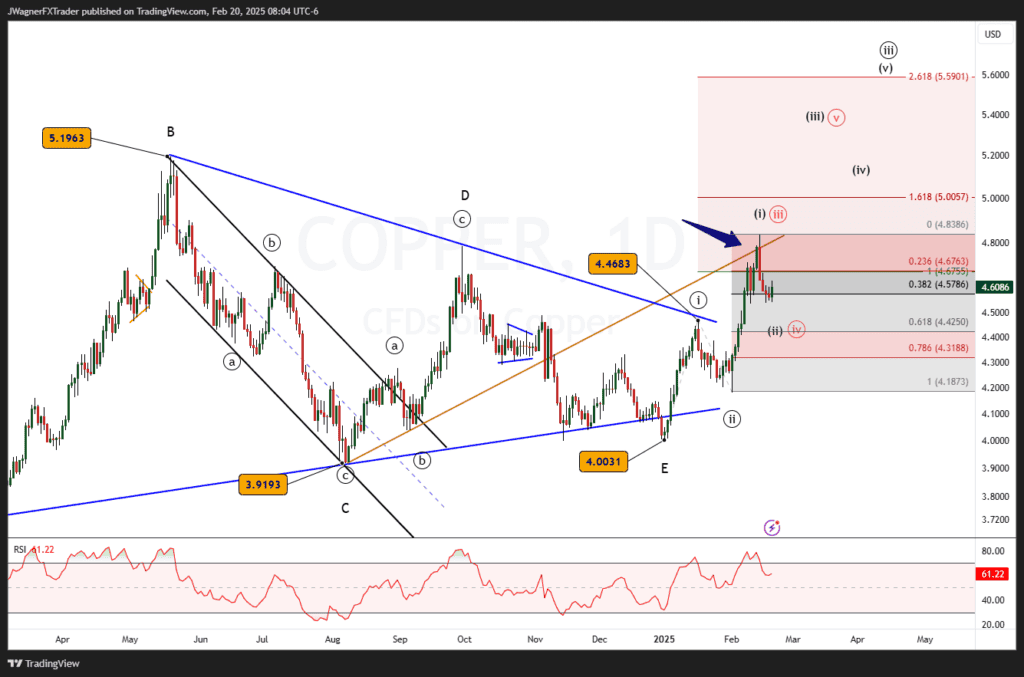

Copper Elliott Wave Forecast: Bullish Breakout Targets $5+

Executive Summary

- Trend Bias: Copper has broken out of a contracting triangle and is in a bullish impulsive phase.

- Key Resistance Levels: The next major target is $5.00, with a potential extension to $5.59.

- Support Levels: Key support at $4.47; below $4.00 would invalidate the bullish count.

Current Elliott Wave Analysis

Copper’s Elliott wave price structure suggests a completed contracting symmetrical triangle (ABCDE) correction, followed by the start of a five-wave impulse. The chart shows:

- Primary Degree Count: The rally from the $4.00 low (Wave E) marks the start of a five-wave impulse pattern.

- Intermediate Degree Count:

- Wave (i) of ((iii)) topped at $4.8346.

- Wave (ii) of ((iii)) is in progress, likely finding support above $4.42-4.54.

- Wave (iii) of ((iii)) is expected to extend toward the 1.618 Fibonacci extension level (~$5.00).

- Wave (v) of ((iii)) could reach the 2.618 Fibonacci extension (~$5.59).

The Relative Strength Index (RSI) shows overbought conditions, suggesting a short-term correction before the next rally.

Copper’s Alternate Count

There is an alternate count we are keeping an eye on (labeled in red).

The alternate count would suggest that the February 14 high was wave ((iii)) and a sideways grind is unfolding in wave ((iv)). This sideways grind would need to hold above $4.46 to remain valid.

The alternate count would imply a more mature advance with less upside potential.

Bottom Line

Copper’s Elliott Wave count suggests an impulsive rally targeting $5.00+. A corrective pullback toward $4.42-4.54 offers potential buying opportunities. Bulls remain in control unless price drops below $4.18.

You might be interested in: