- Elliott Wave

- October 6, 2025

- 2 min read

AUD/USD Elliott Wave: 4-Year Trend Line Holding It Down

Executive Summary

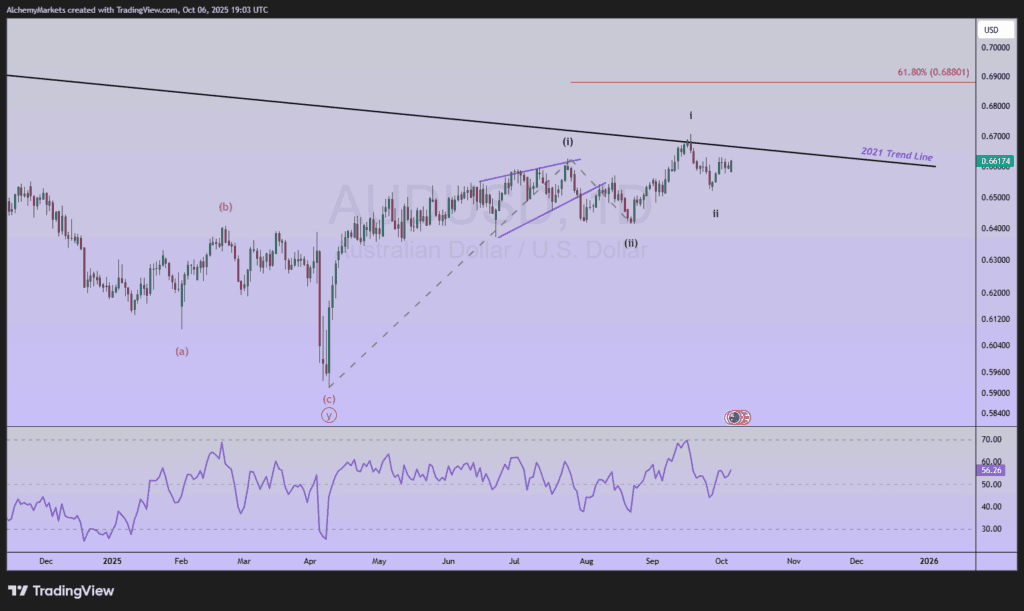

- Trend Bias: The AUD/USD pair is rallying within a larger uptrend.

- Initial Rally Target: Near 0.72 where wave (iii) would be equal to the length of wave (i).

- Resistance to Watch: A trendline shaped from the 2021 high is holding Aussie down.

The kangaroos are bouncing a little higher these days. Since April, AUDUSD has been grinding higher in a motive wave.

Current Elliott Wave Analysis

It appears that AUD/USD is currently rallying in wave (iii). We are unsure if the current wave is iii of (iii) or if the current wave is ii of (iii).

Regardless, we anticipate the declines to remain muted and the next trend is higher.

Wave (i) was a leading diagonal followed by a quick zigzag in wave (ii). Aussie appears to have begun its rally again in wave (iii).

The key level to follow is a resistance trend line near the previous high of .67. This 4-year trend line has been in place since 2021

A break above this trend line will likely coincide with wave three rally at multiple degrees of trend. On a break higher, the near-term target is .72 where wave (iii) would equal wave (i) [100% Fibonacci extension]. Even higher levels are possible.

Bottom Line

If AUD/USD is successful in punching above the 4-year resistance trend line, then we anticipate an acceleration of the rally in a third wave at multiple degrees of trend.

We anticipate declines would be mild and rallies to grow stronger. If the Aussie prints below .59, then we’ll reconsider the wave count.