- Elliott Wave

- March 25, 2025

- 2 min read

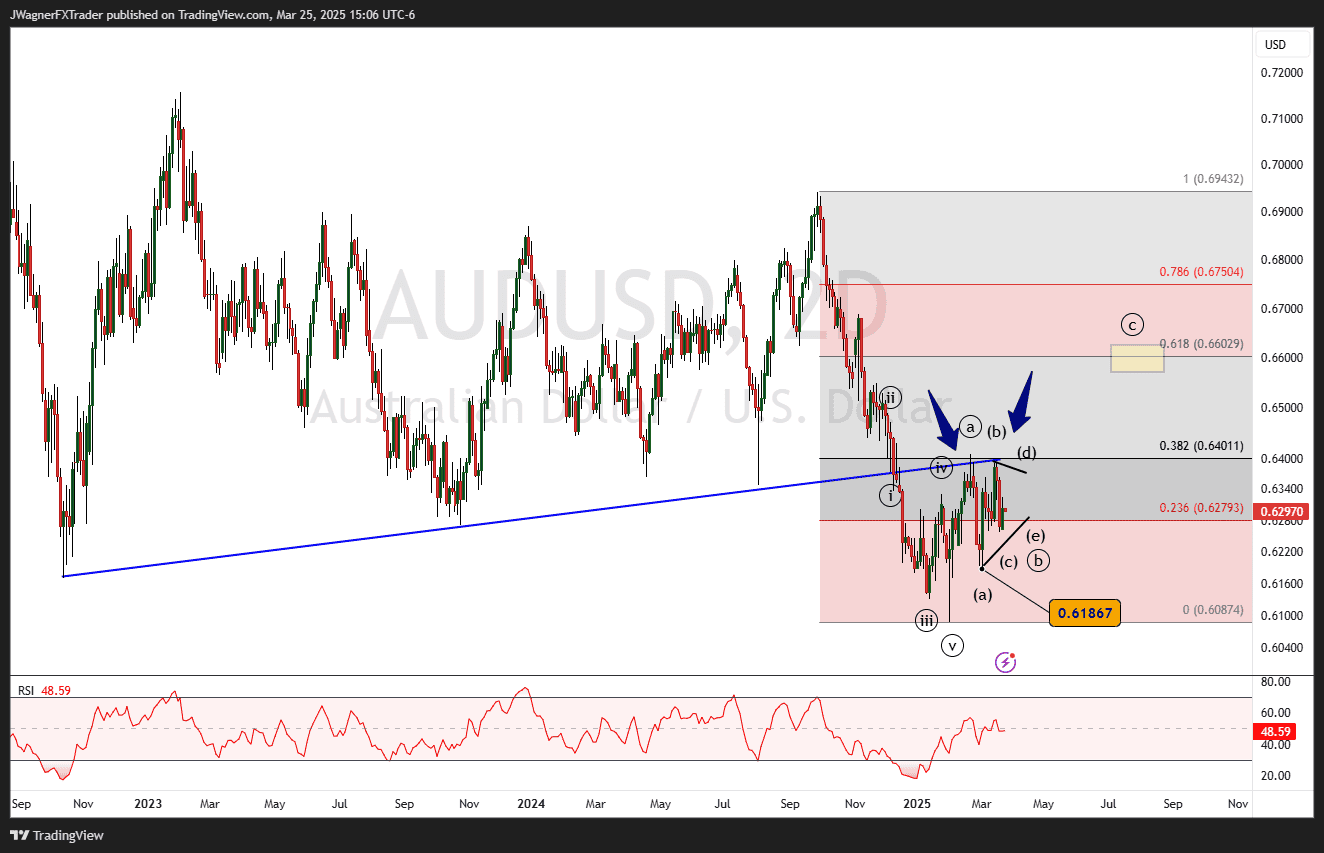

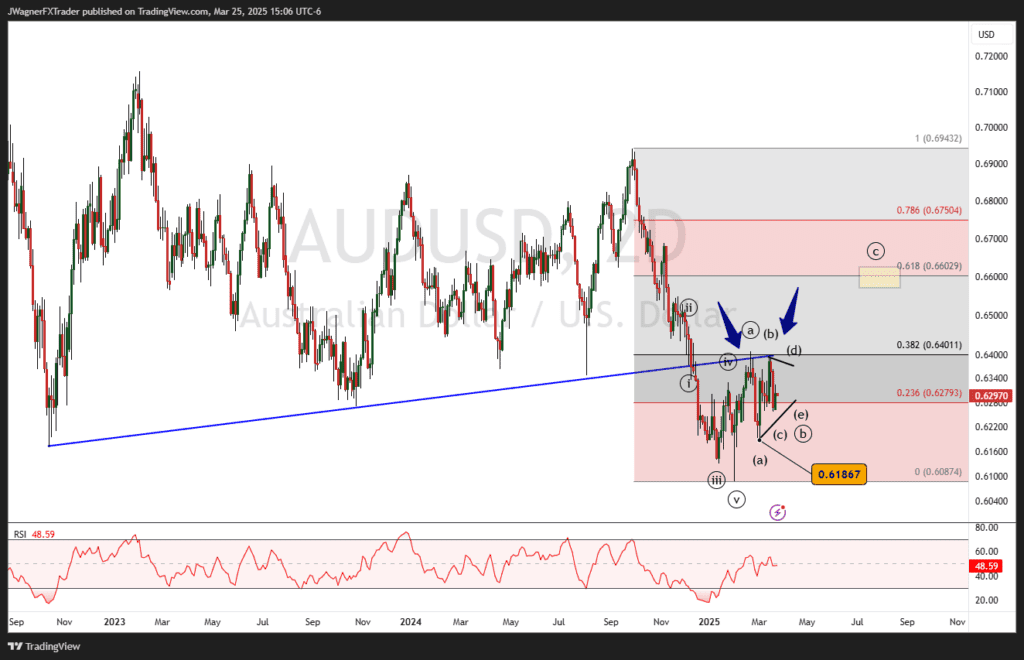

AUD/USD Elliott Wave: Stuck in Triangle

Executive Summary

- Trend Bias: The AUD/USD pair is rallying within a larger downtrend.

- Initial Rally Target: The 0.618 Fibonacci retracement of the H2 2024 decline near .66.

- Resistance to Watch: A trendline shaped from the 2022 low is holding Aussie down.

Current Elliott Wave Analysis

The two-day AUD/USD price chart indicates the current Elliott wave count is wave ((b)) [triangle] of an ((a))-((b))-((c)) zigzag rally.

Aussie appears to be stuck in the middle of the triangle pattern for wave ((b)). After a couple of more ups and downs, the bullish triangle would terminate and lead to a rally in wave ((c)) of the zigzag.

We anticipate wave ((c)) of the zigzag may rally up to the 61.8% Fibonacci retracement level of the downtrend from H2 2024. This Fib level target is near .6600.

However, there is some resistance holding Aussie down.

First, if you pan back to 2022, there is an old support trend line that was broken in Q4 2024. When broken, support can act like new resistance. This is exactly what’s been happening here in the early stages of 2025 (see the blue arrows).

That double top high represents the wave ((a)) high of the bullish zigzag. Once Aussie is finished consolidating in this triangle pattern, we suspect it will have gathered enough energy to make a run and break above that new resistance trend line.

Bottom Line

AUD/USD is consolidating in a sideways triangle pattern representing the middle wave of a bullish zigzag. Once the consolidation is over, we are anticipating a rally to break resistance and possibly trend to the 61.8% Fibonacci retracement near .66.

We’ll know another pattern is at play in the expected event that prices don’t break higher and decline below .6186

You might also be interested in…