- Chart of the Day

- July 18, 2024

- 2 min read

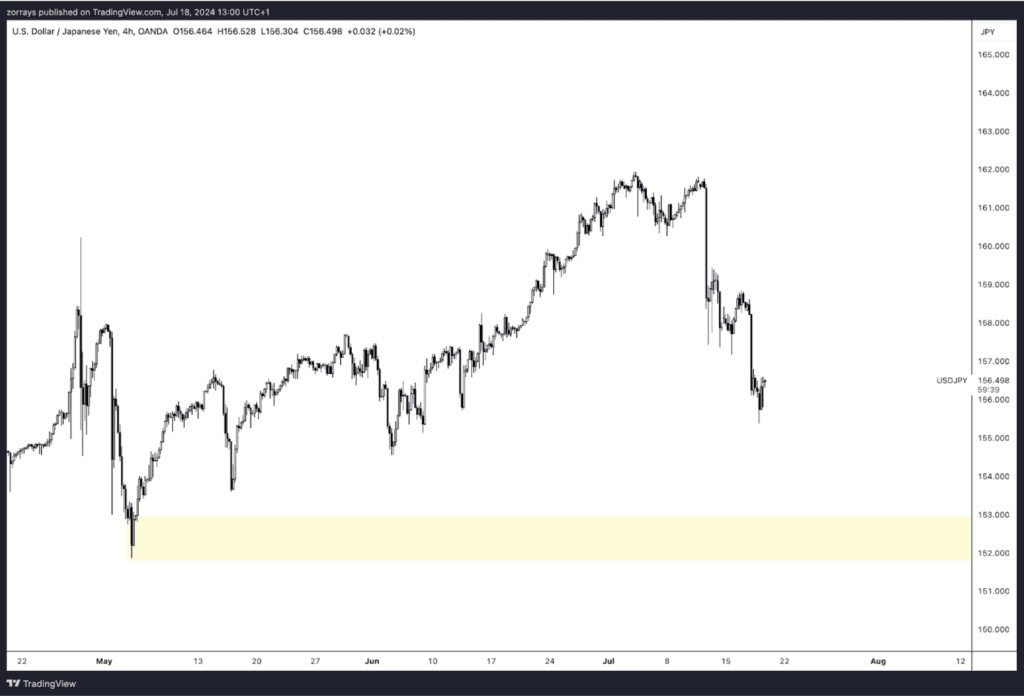

USD/JPY: The Summit Reached, Time for the Descent?

The USD/JPY pair has experienced a notable decline this month, with the price dropping by approximately 4%. This movement is depicted in the attached chart, showing a retracement to the 155/156 area, a level last seen in early June. The decline is influenced by several factors, including lower short-dated US rates and increasing political pressure both in the US and Japan regarding the undervalued yen.

From a technical perspective, the recent price action suggests a downward trajectory for USD/JPY. The market is currently pricing in a potential Federal Reserve rate cut in September, while the Bank of Japan (BOJ) is taking measures to stabilise its currency. This dual action from central banks could further influence the pair’s movement.

As the chart shows, USD/JPY has found some temporary support around the 156 level. However, the next significant support area lies at 153. The key question for traders and investors is whether the pair will retrace upwards before testing this support or continue its decline without significant pullbacks.

Given the current macroeconomic backdrop, it is plausible that the pair will trend lower. Political developments, such as comments from former President Donald Trump about the yen’s impact on US manufacturing, and growing calls in Tokyo for a stronger yen, add to the complexity. Additionally, the potential for Japanese FX intervention may also play a role in the coming weeks.

In conclusion, while the long-term outlook for USD/JPY appears bearish, with a year-end forecast of 153, short-term movements may see some volatility. Traders should watch for any retracements as potential selling opportunities, with the 153 support level as a critical target. The interplay between Fed and BOJ policies will continue to be a significant driver of the pair’s performance.