- Chart of the Day

- May 27, 2024

- 1 min read

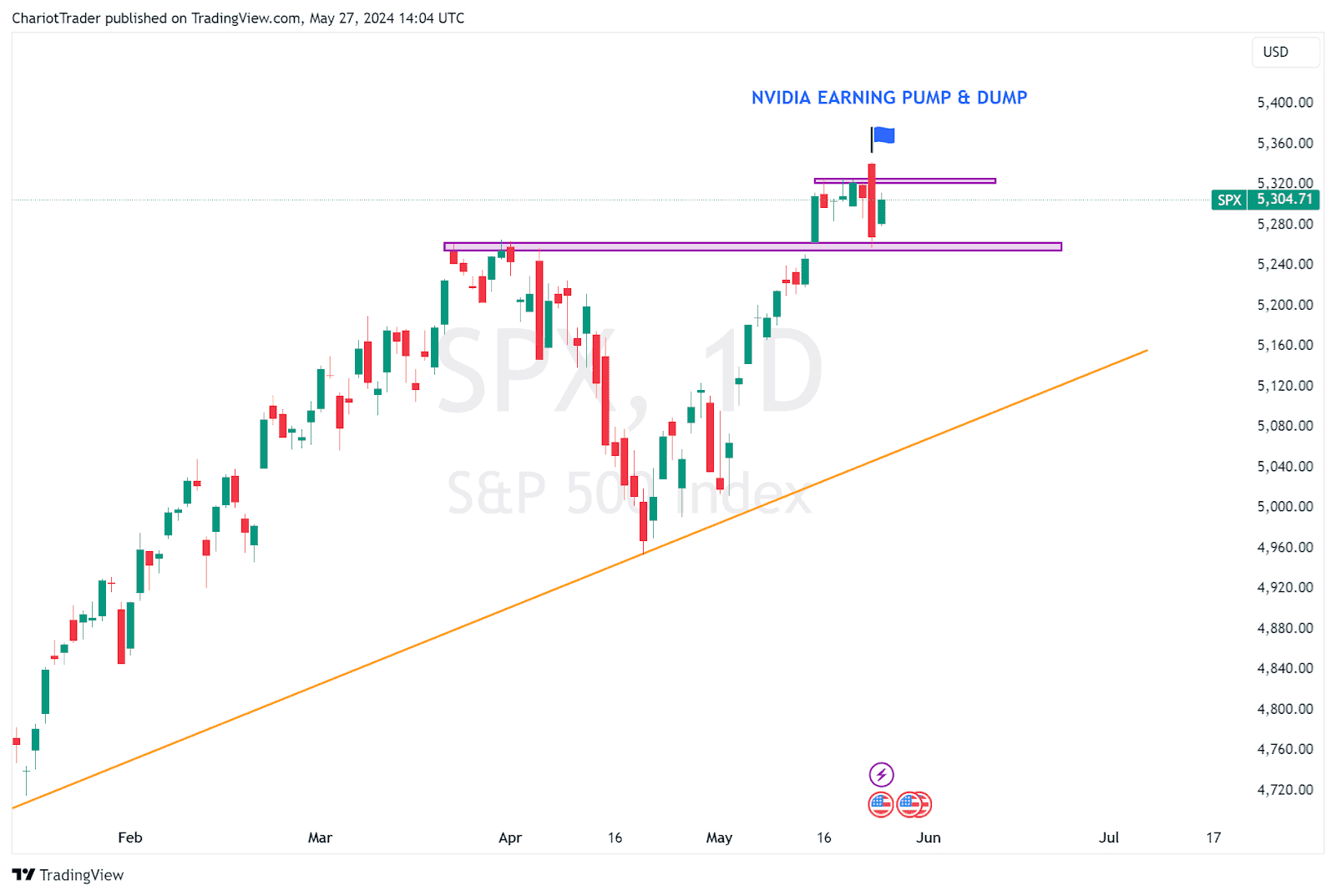

S&P Pumped to New Highs With Nvidia Earnings Report. What’s Next?

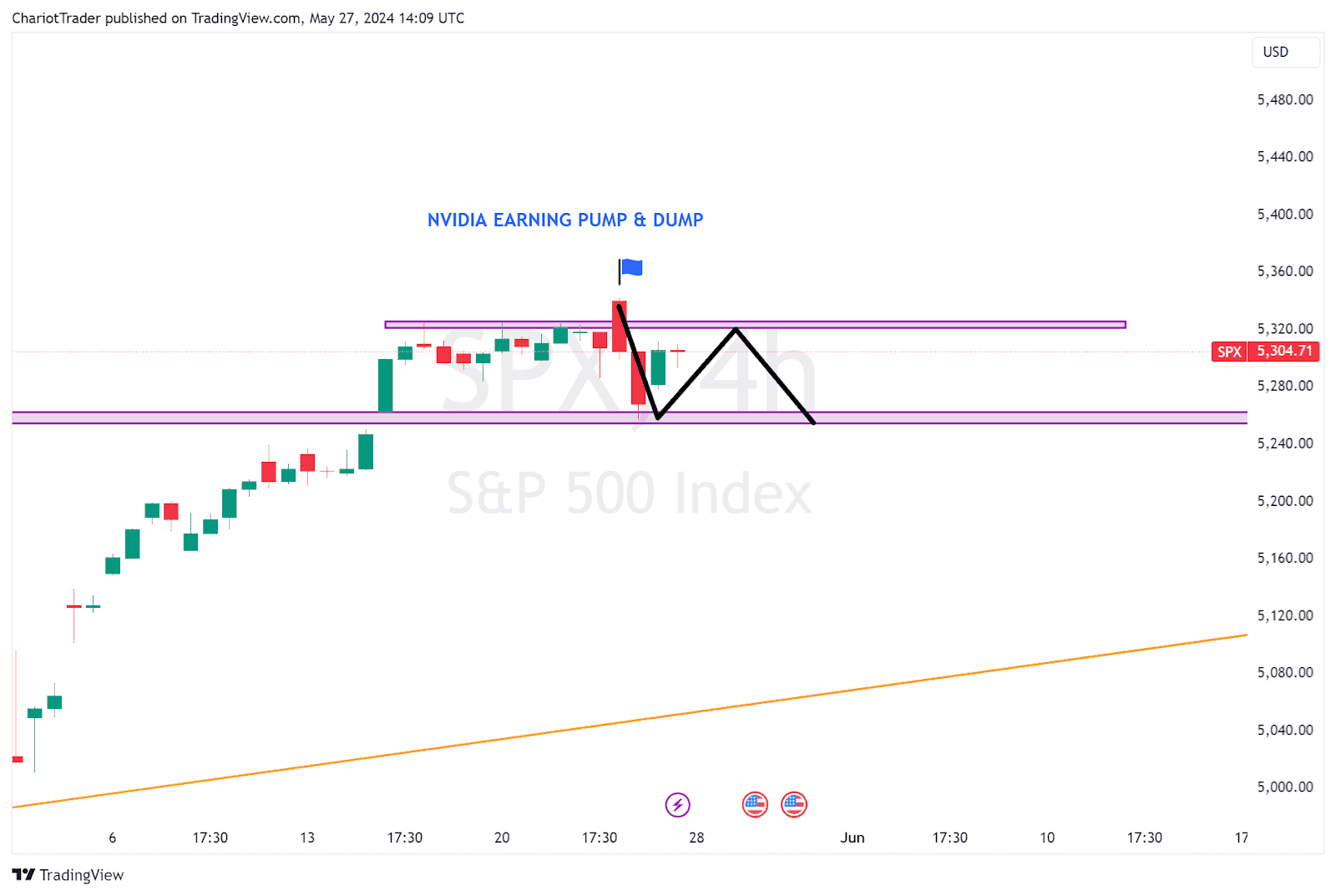

So as expected, a pump and dump happened to the S&P 500 with the Nvidia 2025 Q1 Earnings Report that came in on May 22nd (Wednesday) Midnight.

The entire market is looking bullish, the CPI data isn’t too bad, but this also means it’s the best time for a correction to take place. So what’s next?

Since today is memorial day, we can take a short step back from the markets and analyze the situation. I would watch the levels at approximately $5,325 for signs of resistance, and $5,250 for signs of support – creating a range.

It would not be surprising to me if the S&P 500 formed an ABC flat correction here, especially on the backs of bullish investors upon hearing the Nvidia Y25 Q1 news.

However, if we push past $5,325, we could very easily go up to $5,400 – forming a new high at a psychological level.