- Chart of the Day

- July 17, 2025

- 2min read

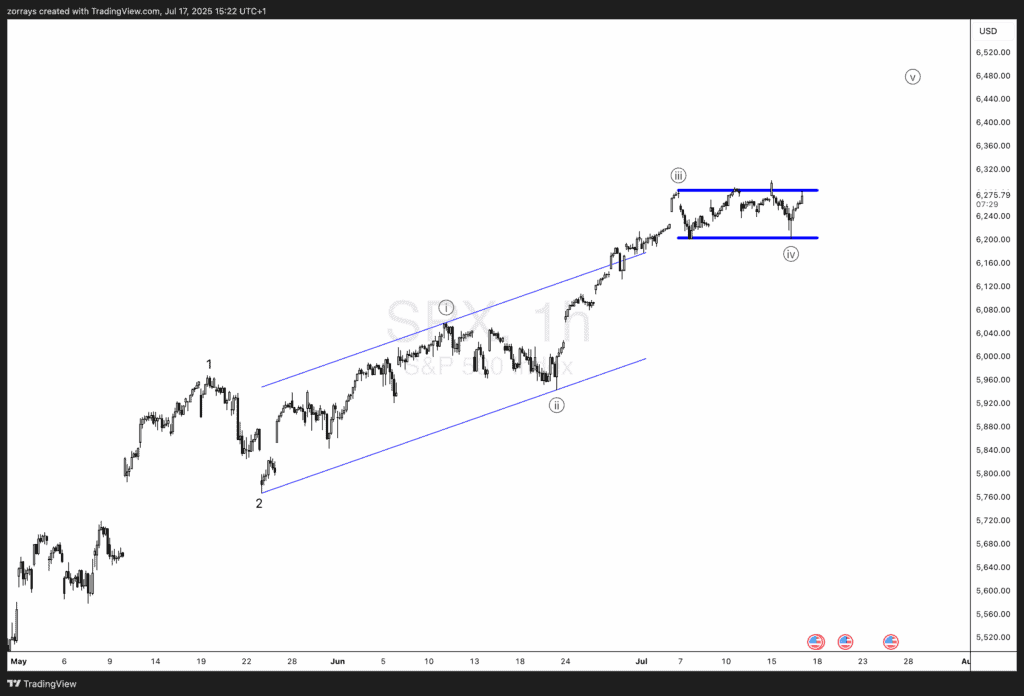

S&P 500 Elliott Wave Update: Flat Correction in ((iv)) Potentially Completed – Wave ((v)) May Be Underway

Wave Count Status: Intermediate Degree

The current wave structure on the hourly chart continues to unfold impulsively from the June low, likely forming an ongoing intermediate (1) or (3) wave, depending on higher degree framing.

Focus: Wave ((iv)) as an Expanded Flat

Wave ((iv)) appears to have resolved as a textbook expanded flat (3-3-5):

- Wave A – Three-wave decline

- Wave B – Pushes marginally above the end of ((iii)) to invalidate a triangle scenario

- Wave C – Sharp five-wave drop terminating near the 6,200 level

Key technical validations:

- Time duration of ((iv)) balanced relative to ((ii)) – supports alternation principle

- Contained within a horizontal range box between 6,200 and 6,320 – compression phase

This pattern supports a complete corrective sequence, setting the stage for ((v)).

Wave ((v)) Outlook and Targets

With the break off the 6,200 pivot low and reclaim of the mid-range (now near 6,275), bullish momentum is returning.

Expectations for ((v)):

- Minimum target: Equality with ((i)) → projects ~6,400

- Ideal target: 0.618 × ((i))-((iii)) distance added to ((iv)) low → 6,460–6,500 zone

- Wave ((v)) might truncate if momentum fades (watch for divergence on RSI/volume)

Invalidation: A sustained break below 6,200 reopens the door to an ongoing ((iv)) or potential WXY combination.

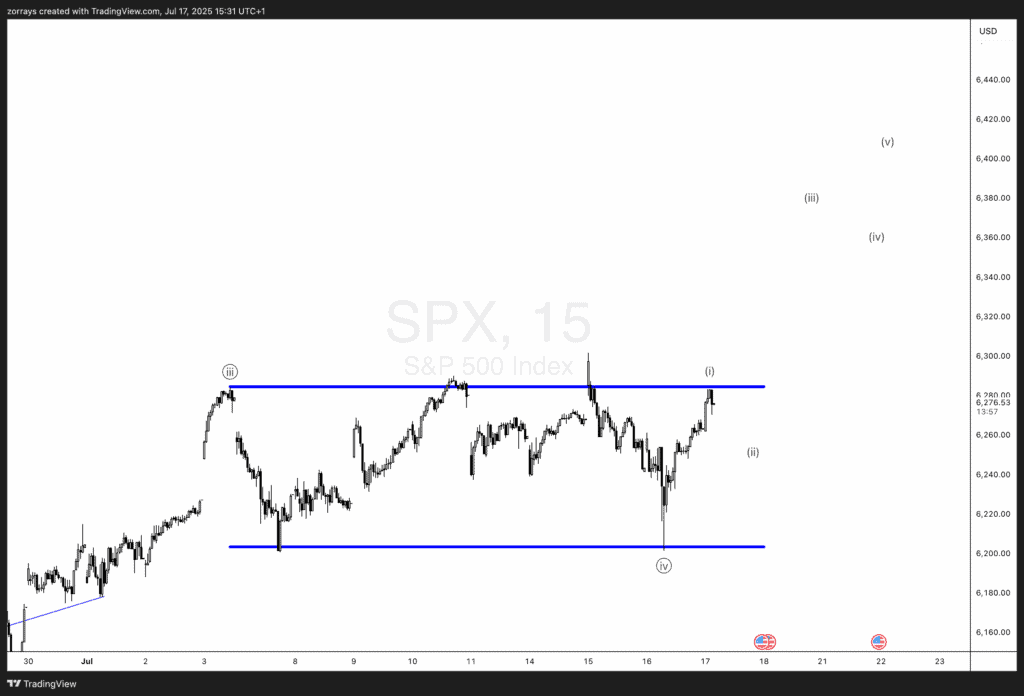

Micro Structure Check: Early Stages of ((v))?

Zooming in, the post-((iv)) advance appears impulsive on the 15m chart:

- Initial 5-wave thrust forming micro (i)

- Minor pullback or sideways consolidation expected for (ii)

- Confirmation comes on break of 6,320 resistance with volume thrust

Stay alert for overlaps or lack of follow-through — if ((v)) is weak, it could imply diagonal characteristics or truncation.

Alternate Count Consideration

While the flat scenario looks mature, alternate structures must be acknowledged:

- Running flat variant if Wave C of ((iv)) undershoots (low probability here)

- Triangle in progress – invalidated by B wave exceeding ((iii))

- WXY complex correction – still viable if price stalls below 6,320 and revisits the 6,200 low

That said, price action currently favors the primary flat count completion.

Strategic Positioning:

- Aggressive longs already triggered off the 6,200 C-wave low

- Conservative longs to engage post 6,320 breakout confirmation

- Protective stops just under 6,200

- Watch for divergence signs on hourly RSI/MACD as ((v)) progresses

Conclusion: Flat Resolved, Rally Brewing

The S&P 500 appears to have completed an expanded flat in wave ((iv)), and all signs suggest a nascent wave ((v)) is emerging. If momentum sustains above the 6,320 resistance zone, the next leg toward 6,460–6,500 becomes probable.