- Chart of the Day

- October 8, 2024

- 2 min read

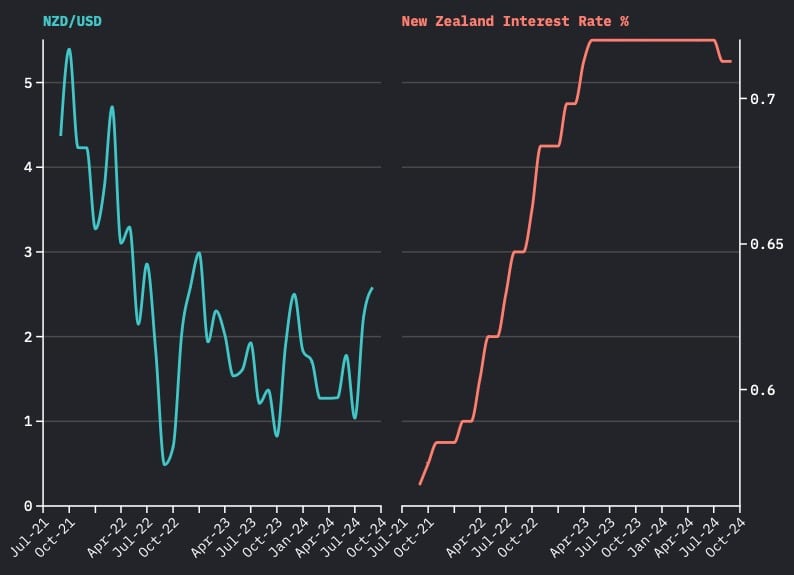

RBNZ Rate Cut Showdown

Data Source: Trading Economics and Yahoo Finance

As the Reserve Bank of New Zealand (RBNZ) gears up for its much-anticipated monetary policy decision tomorrow, all eyes are on the likelihood of a 50-basis point (bp) rate cut. With markets leaning heavily toward this outcome, traders are pricing in about 45bp for this meeting and 91bp by year-end.

The RBNZ is operating with limited fresh data, relying mostly on the second-quarter GDP report showing negative growth, which may justify the need for further easing. However, this rate cut would come without third-quarter inflation figures in hand, raising concerns about the RBNZ’s confidence in the disinflationary process.

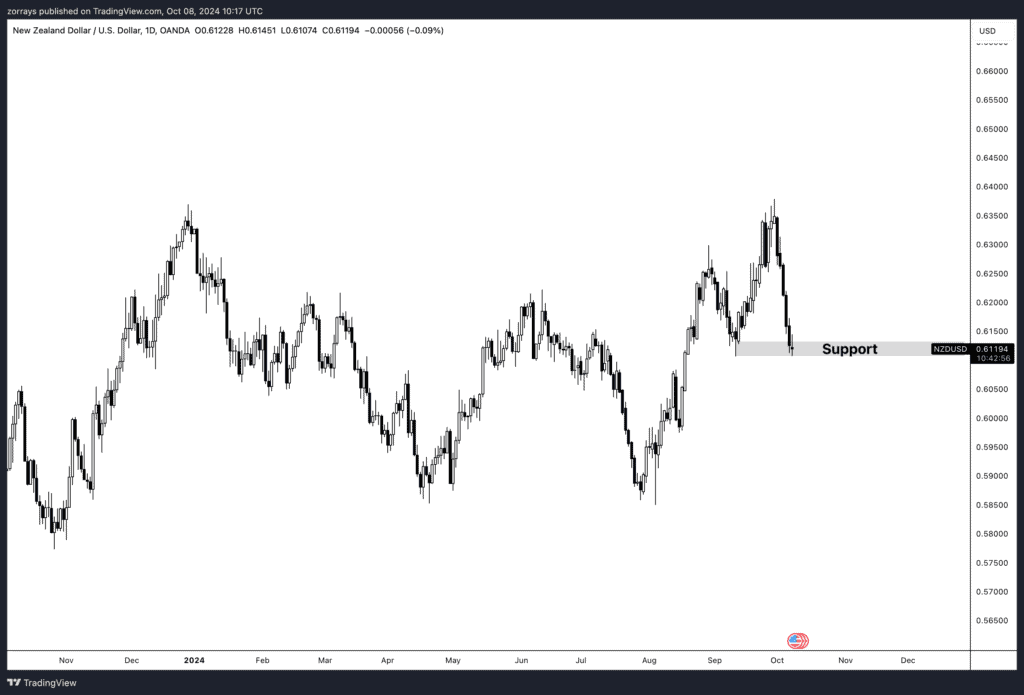

On the technical side, NZD/USD is teetering around the key support level we highlighted earlier, now hovering near 0.6119. Whether the pair bounces off this level or breaks lower may depend more on the US dollar’s strength than the RBNZ’s actions. Last week’s signals from the Fed about their gradual rate-cutting stance have boosted the dollar, adding pressure on NZD.

As we approach the decision, the question remains: will the Kiwi find a floor at support, or will it slide further? Much hinges on how aggressively the RBNZ moves and where the broader USD heads from here.