- Chart of the Day

- December 10, 2024

- 2 min read

RBA Holds Rates Steady at 4.35%, Signals Easing Inflation Pressures

The Reserve Bank of Australia’s (RBA) decision to keep rates steady at 4.35% and its slightly dovish tone suggest that while inflation pressures are moderating, the central bank remains vigilant. This dovish tilt is juxtaposed with market expectations of a more accommodative Federal Reserve policy in the coming months. If the Fed adopts a dovish stance and the RBA remains cautious but steadfast, the narrowing interest rate differential could provide medium-term support for the Australian dollar (AUD).

Technical Perspective

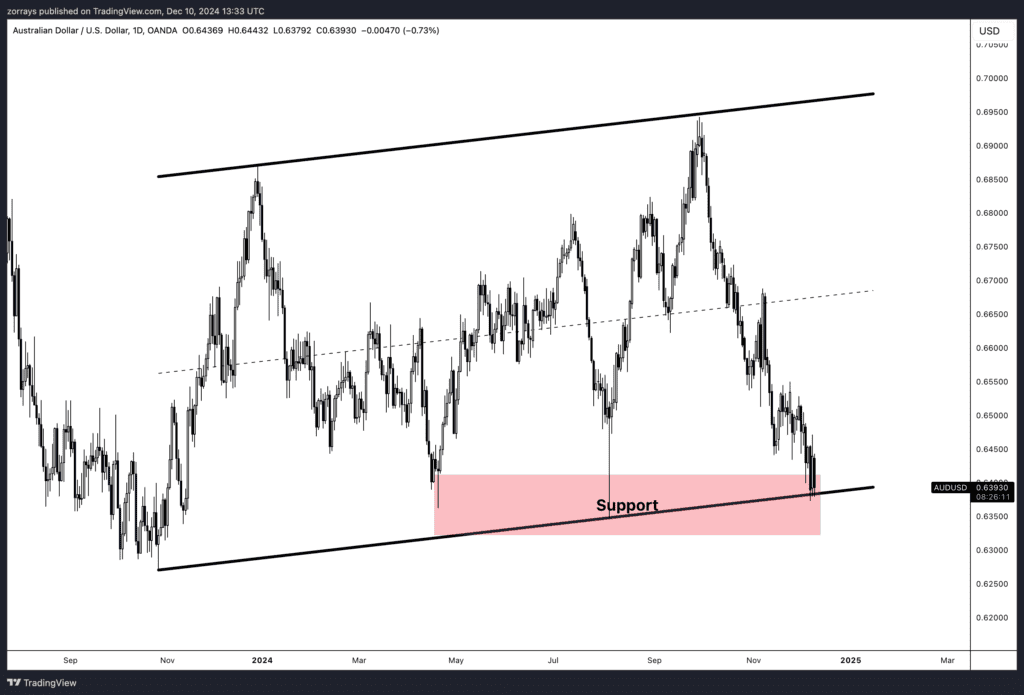

The daily chart of AUD/USD shows the pair currently testing a critical support zone marked in the red region, just above 0.6350. This zone aligns with the rising trendline extending back to late 2023, acting as a significant level where buyers have consistently stepped in over the past year. While the pair remains in a broader descending channel, the support zone indicates a potential inflection point where technical buyers might emerge, providing short-term relief to the AUD.

If this support level holds, AUD/USD could rebound toward the mid-channel range near 0.6650–0.6700. However, a decisive break below this support could open the door to further declines, potentially toward the 0.6200 psychological level.

Blending Technical and Fundamental Views

The combination of technical support and shifting fundamentals paints a mixed picture for AUD/USD:

- Bullish Case:

If the support zone near 0.6350 holds, the pair could benefit from narrowing monetary policy divergence. A dovish Fed, paired with the RBA’s cautious inflation outlook, may boost AUD sentiment, leading to a recovery toward the channel’s upper resistance levels. Any improvement in Australian consumption or Chinese economic data would add further fuel to this rally. - Bearish Case:

On the flip side, if the support breaks, it could signal further weakness for AUD/USD. This would be exacerbated by weaker Australian consumption data or a prolonged hawkish stance from the Federal Reserve, which would strengthen the USD.

Key Levels to Watch

- Support: 0.6350 (trendline and major demand zone), 0.6200 (psychological level).

- Resistance: 0.6500 (near-term barrier), 0.6650–0.6700 (mid-channel range).

Conclusion: While fundamentals lean cautiously optimistic for AUD/USD in the medium term, the immediate price action hinges on the ability of the current support zone to hold. Traders should closely monitor upcoming economic data and central bank commentary to validate directional bias.