- Chart of the Day

- November 18, 2024

- 3 min read

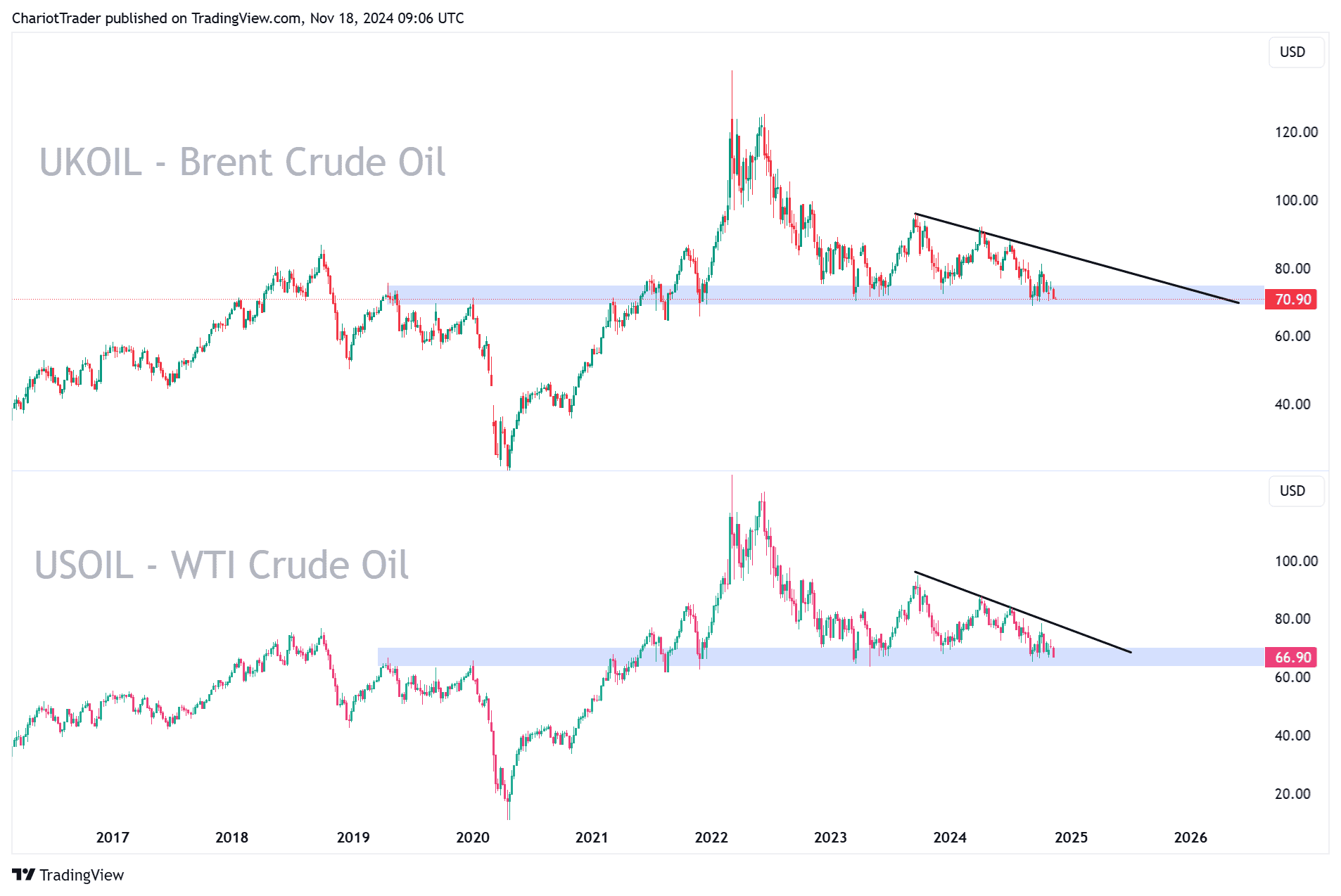

Global Oil Demand Down: Brent and WTI Dump in Q4?

Recent price developments have led Brent Crude Oil and WTI Sweet Crude prices to revisit a visible neckline of a Descending Triangle Pattern on the weekly timeframe. With recent news of the IEA (International Energy Agency) expecting a surplus of 1 million barrels produced per day in 2025, the markets could be selling off in anticipation of this outlook.

Currently, UKOIL and USOIL are testing critical support levels from between $69.10 to $75, and $63 to $70.40 respectively. If broken, and closed below with a red candle, a larger price decline is expected on oil CFDs.

Note: the patterns being developed could be a descending parallel channel as well, which would be bullish, but the overall fundamentals suggest bearishness for oil prices in Q4 and perhaps even leading into Q1 2025.

Weakened Chinese Demands, and Surplus Estimations

As of November 14th, 2024, the International Energy Agency has estimated that oil supply will exceed demand by 1 million barrels per day by 2025. This divergence seems to be fueled by Iraq and the U.A.E producing oil above their quotas, creating the conditions for a price war to emerge (Bearish for oil).

Additionally, China, the world’s largest importer of Crude Oil, appears to be experiencing a lowering demand for oil. This is indicated by China’s oil refinery outputs being lower by 4.6% compared to one year ago (Bearish).

Russia-Ukraine War Escalates Over the Weekend

The Russian-Ukraine Conflict has experienced an escalation over the weekend, with Russia launching the most extensive airstrike on Ukraine in nearly three months. In response, the U.S. administration has permitted Ukraine to use American-made weapons for deep strikes into Russia, marking a notable policy shift.

This escalation brings up speculation of the success rate of Trump’s Peace Plan to bring an end to the conflict, and also the possibility of Ukraine forces striking Russian oil infrastructure – which would lower the supply and potentially raise UKOIL prices.

Though this escalation has bullish implications for the price of oil, the effects appear to be minimal for now.

Trump’s Sanctions Could Push Oil Prices Either Way

As we know, Trump is currently proposing a peace plan to end the Russian-Ukrainian Conflict, which the president of Russia, Vladimir Putin has suggested to be open to: only if Russian demands are met.

This opens up the possibility of easing of American sanctions on Russian oil production – injecting supply into the market and lowering oil prices (Bearish).

Alternatively, Trump could also tighten sanctions on Iranian oil, potentially taking off 1 million barrels of oil per day in the market (according to Michael Lynch, Strategic Energy & Economic Research) – which would offset the surplus estimations made by IEA.

Closing Thoughts

- UKOIL and USOIL could be in a descending triangle pattern (Bearish).

- More bearish news for oil prices on a Macroeconomic Scale (Bearish).

- A break of critical support zones, paired with bearish fundamentals would signal a bearish Q4 for Oil.

- A bullish shift could happen, but would depend on key news such as war developments, or sanctions.

You may also be interested in: