- Chart of the Day

- October 2, 2025

- 3 min read

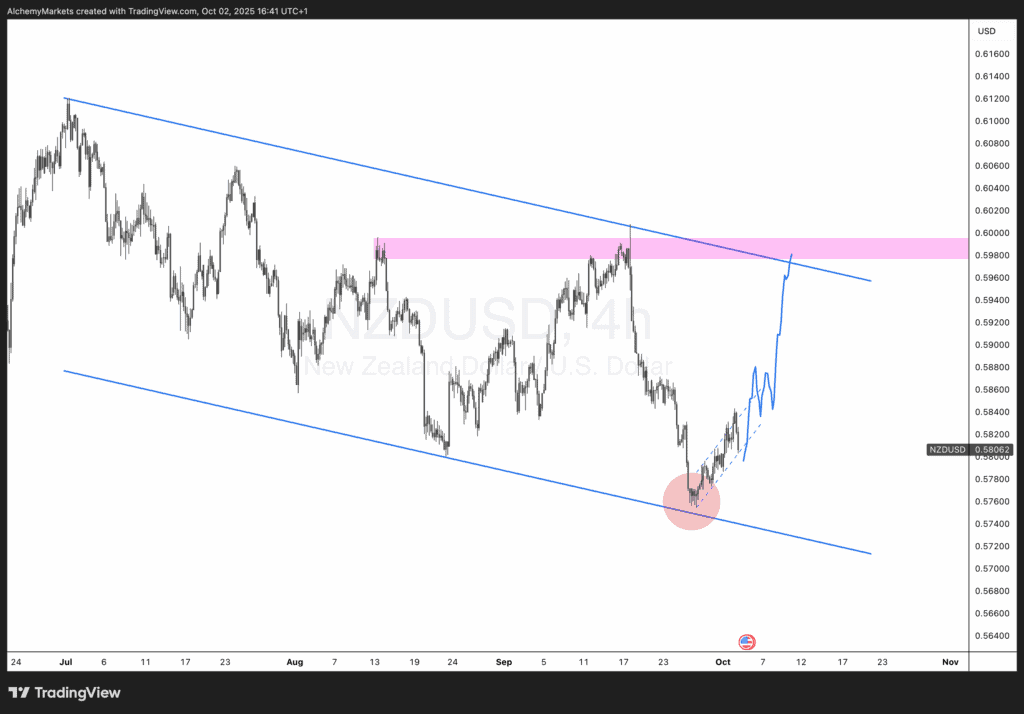

NZD/USD: Bullish Bounce from Channel Support – Eyes on 0.60

The New Zealand Dollar (NZD) has been under pressure for months, weighed down by a weakening domestic economy and growing expectations of rate cuts by the Reserve Bank of New Zealand (RBNZ). However, the technical picture on NZD/USD is beginning to show signs of a potential recovery.

After finding support at the lower bound of a well-defined descending channel, the pair is staging a bounce. While I remain bullish on the medium-term outlook, I’m waiting for a tactical pullback before entering long positions, with an eye on a potential move toward 0.6000.

Technical Outlook: A Bounce from the Bottom

Looking at the 4-hour chart, NZD/USD has been locked inside a descending channel since July, reflecting the broader downtrend. Recently, price touched the channel’s lower bound near 0.5750, where it found strong buying interest.

- The pair is now climbing in a small rising channel, suggesting momentum is shifting to the upside.

- A short-term pullback is likely before bulls can build enough momentum for a sustained rally.

- If this bullish structure holds, the next significant target sits around 0.6000, where the upper channel resistance aligns with a prior supply zone.

This technical alignment strengthens the case for a reversal rally—but timing the entry will be crucial.

Why the Downside Looks Limited

While the charts point to a rebound, the fundamentals also suggest that NZD downside risks may be overstated. Here’s why:

1. RBNZ Rate Cuts Expected, But Markets Too Dovish

The RBNZ meets on 8 October, where a 25bp rate cut to 2.75% is expected. Market pricing currently leans more dovish, suggesting:

- A potential 32bp cut priced in (hinting at speculation for 50bp).

- Two more cuts expected after October, including one in early 2026.

This looks premature, given that crucial Q3 CPI (19 Oct) and employment data (4 Nov) have not yet been released. Without these data points, it’s hard to justify aggressive dovish bets.

2. Weak GDP Data Already Priced In

The bearish outlook stems largely from the -0.9% contraction in Q2 GDP, a shock that far exceeded forecasts (-0.2% consensus, -0.3% RBNZ forecast). The downturn was broad-based:

- Manufacturing contracted -3.5%

- Construction fell -1.8%

- Exports dropped -1.2%

While this confirmed economic weakness, markets may have overreacted by extrapolating further cuts without fresh evidence from Q3 data.

3. Dovish Bets May Be Overextended

In August, two RBNZ members pushed for a 50bp cut, fueling speculation of deeper easing. However, we believe:

- Rates will likely bottom at 2.50% by November.

- Additional cuts in February look unlikely without weaker CPI or jobs data.

- Incoming governor Anna Breman (starting December) may lean dovish, but policy credibility still hinges on actual data.

For now, the overly dovish market stance means the NZD has limited downside into year-end, leaving room for a corrective rally.

Trading Implications

The technical and fundamental narrative suggests a buy-the-dip opportunity in NZD/USD.

- Short-term strategy: Wait for a corrective pullback before potentially climbing to around 0.5780–0.5800.

- Medium-term outlook: Upside potential toward 0.6000, aligning with technical resistance and overdone dovish expectations.

- Risk factors: A weaker-than-expected Q3 CPI on 19 October or deteriorating labor market data in November could validate additional cuts, capping gains.