- Chart of the Day

- July 31, 2024

- 3 min read

McDonald’s Munches on Growth: A Sideways Step Before the Big Leap?

Fundamental Backdrop

Despite a disappointing Q2 earnings report, showing a 12% decline, McDonald’s Corporation (MCD) is forging ahead with a series of promising strategic moves. The fast-food giant plans to open around 2,100 new restaurants next year, resulting in a net increase of approximately 1,600 locations after closures. This expansion aims to boost systemwide sales by nearly 2%, demonstrating the company’s resilience and growth ambitions. McDonald’s also intends to maintain its capital expenditure guidance, underscoring its commitment to achieving around 5% net restaurant growth through 2027.

Technical Analysis

Daily Timeframe

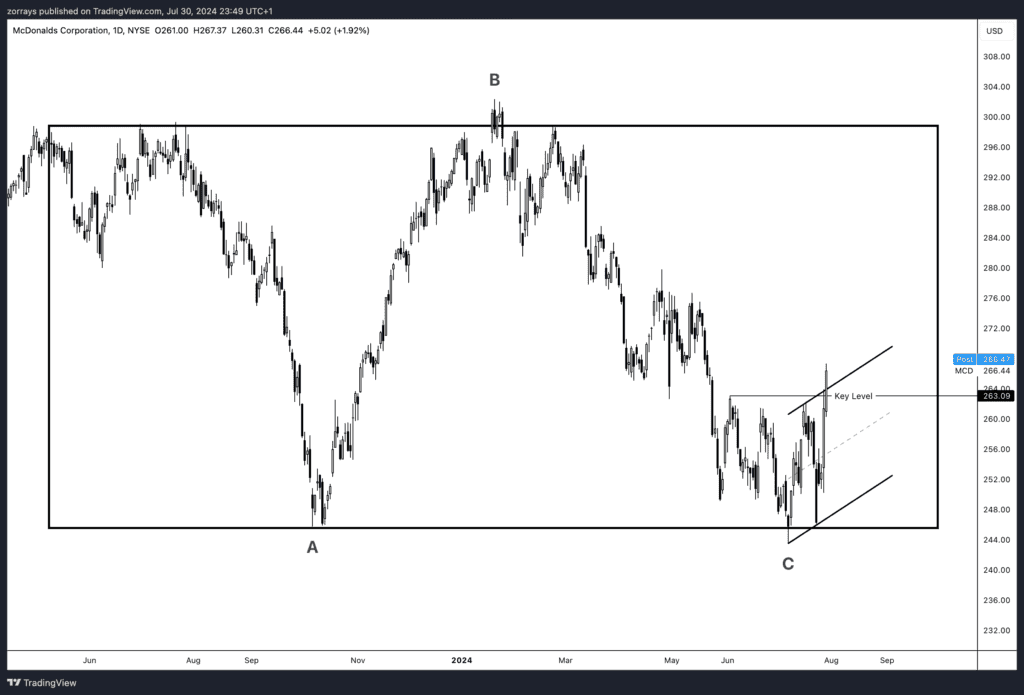

From a technical perspective, McDonald’s stock (MCD) has been exhibiting a sideways trading pattern since May 2023. This consolidation phase appears to be forming an expanded flat correction, a pattern often seen as a continuation signal in technical analysis. The completion of this pattern seems to be aligning with McDonald’s Q2 2024 earnings release on July 29, 2024.

A key level to watch was $263.09, which served as a pivotal point for the stock’s price action. Should the price sustain above this level, it could signal a bullish breakout, potentially targeting the $300 resistance level in the near term. This resistance level is a significant psychological and technical barrier that could define the upper boundary of McDonald’s trading range in the coming months.

4 Hour Timeframe – Inverse Head and Shoulder

Historical and Projected Free Cash Flow Analysis

Source: Stock Unlock | DCF Calculator

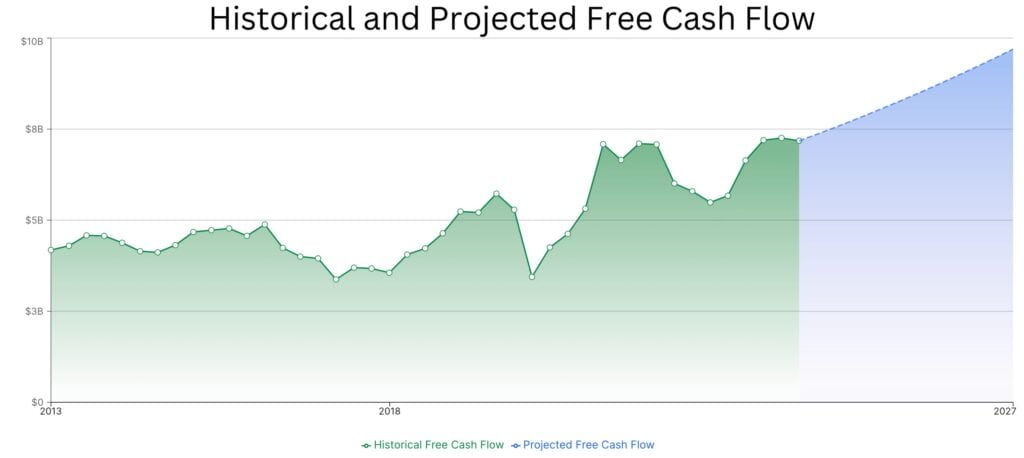

McDonald’s historical free cash flow (FCF) data, as depicted in the chart, showcases a generally stable upward trend from 2013 to 2023, despite some fluctuations. The chart indicates periods of both growth and slight declines, reflective of various operational and market conditions over the years. Notably, the FCF peaked at approximately $8 billion, indicating robust operational efficiency and profitability.

Looking ahead, the projection suggests a continued positive trajectory, with free cash flow expected to surpass $9 billion by 2027. This projected growth is likely driven by McDonald’s strategic expansion plans, including the opening of new restaurants and enhanced operational efficiencies. The company’s focus on maintaining capital expenditure guidance while targeting a 5% net restaurant growth rate through 2027 further supports this optimistic outlook.

The steady increase in projected free cash flow highlights McDonald’s ability to generate significant cash from operations, which is crucial for funding expansion, dividend payouts, and other strategic initiatives. This positive financial outlook positions McDonald’s favorably in the fast-food industry, providing a solid foundation for future growth and shareholder value creation.

Key Metrics and Considerations:

- Historical Peaks and Troughs: The chart shows notable peaks around 2018 and 2021, and a dip towards 2022. These fluctuations could correspond to various economic cycles, changes in consumer behavior, or company-specific initiatives.

- Projected Growth: The upward-sloping projection indicates confidence in McDonald’s ability to sustain and grow its cash flow, possibly due to expanding digital initiatives, menu innovations, and global market penetration.

- Operational Efficiency: The consistent generation of high free cash flow suggests that McDonald’s is managing its operational costs effectively, which is crucial for long-term sustainability.

This analysis provides investors and stakeholders with a comprehensive understanding of McDonald’s financial health and growth prospects, underpinned by strong cash flow generation capabilities.

Final Thoughts….

As McDonald’s navigates through mixed earnings results and ambitious expansion plans, the stock’s technical setup suggests a possible bullish movement. Investors should closely monitor the $263.09 level for signs of sustained momentum, which could lead to a challenge of the $300 resistance mark. This technical analysis, combined with McDonald’s growth strategy, paints an optimistic picture for potential upward movement in the stock’s price.