- Chart of the Day

- May 2, 2025

- 2min read

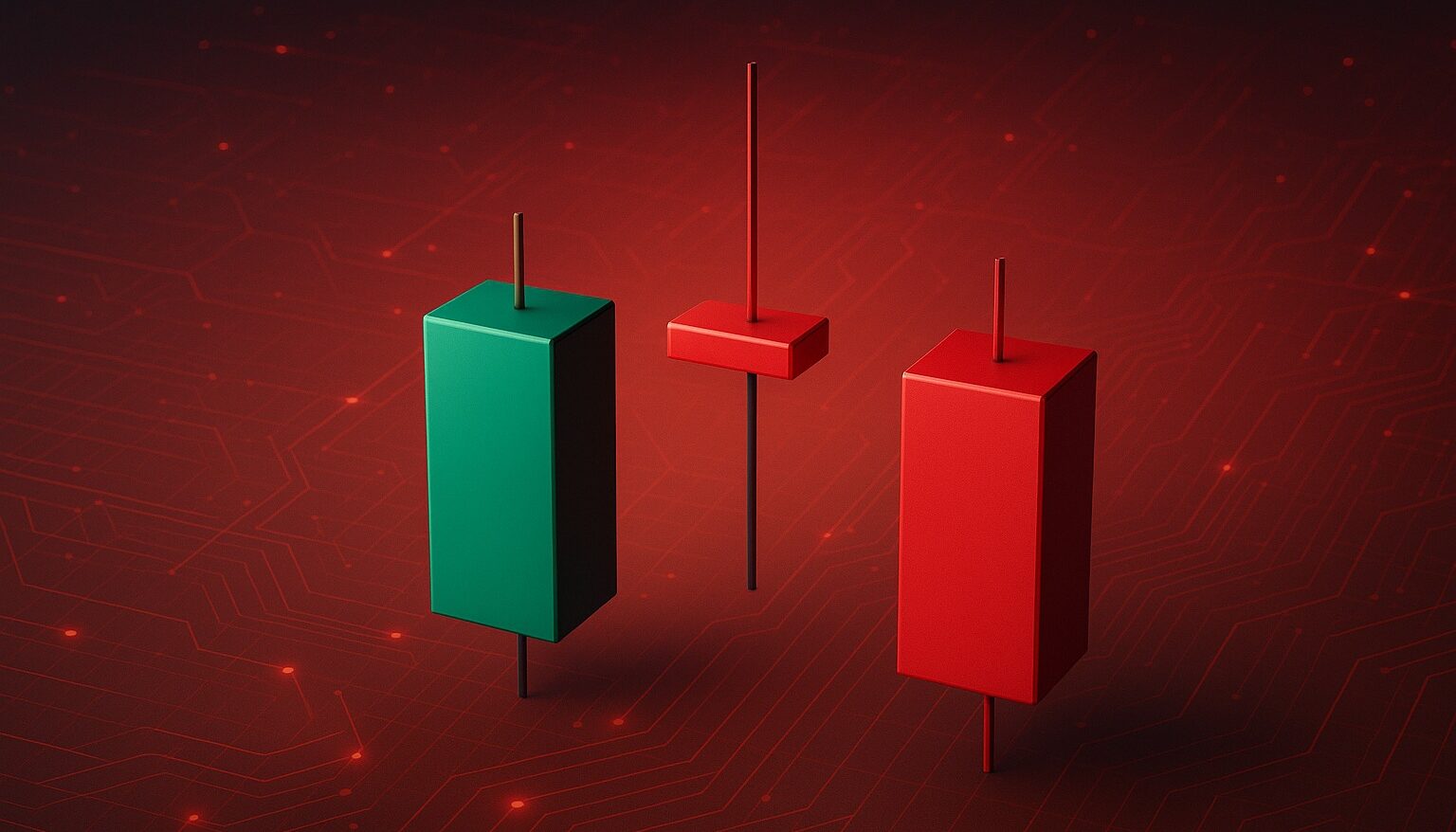

Weekly Evening Star Pattern on Gold—Start of a New Downtrend?

With Gold in a parabolic rise after breaking its All-Time High of $2,075 in March 2024, the price of this safe haven asset has not stopped for any significant retraces for an entire year.

That being said, the charts are now flashing a technical sign that we may be seeing the beginning of a new downtrend on Gold—an evening star pattern is about to be confirmed on the weekly timeframe with a regular bearish divergence.

For better confirmation, you can wait for another weekly close lower (or not above the midpoint of this week’s candle). This would create a fair value gap, where traders can potentially look for a short opportunity.

Is this the end of the bullish trend for Gold?

No, this does not necessarily mean gold’s uptrend will end. This just means Gold is finally exhausted after such an extended rally.

For context, this recent drop in Gold is a reflection of the markets’ recent shift to a risk-on appetite; much thanks to the positive earning reports of Mag 7 companies.

As long as Gold stays above the weekly trendline from March 2024, Gold remains a bullish asset.

Closing Thoughts

If gold manages to close below the midpoint of the first candle, then it will confirm the evening star pattern.

As it is currently, Gold is likely to close a Grade C evening star (the weakest type of evening star pattern) on the weekly timeframe.

If it does, we can switch our bias to bearish, and keep a close eye on the 50% and 61.8% Fibonacci retracement levels at $3,018.50 and $2,904.85 approximately.

Both levels align closely with the trendline and may act as support zones. Watch for bullish rejection signals here, or a brief break below followed by a swift recovery above the trendline — either scenario could justify flipping back to a bullish bias.

You may also be interested in: