- Chart of the Day

- February 20, 2025

- 2 min read

Gold Audit May Send Price Higher – $3,000 Mark in Sight

As of February 20, 2025, gold prices have been on an unprecedented 63-day uptrend, with the current price nearing the significant $3,000 per troy ounce mark. This surge is attributed to various factors, including global economic uncertainties, inflationary pressures, and recent discussions about the integrity of the United States’ gold reserves at Fort Knox.

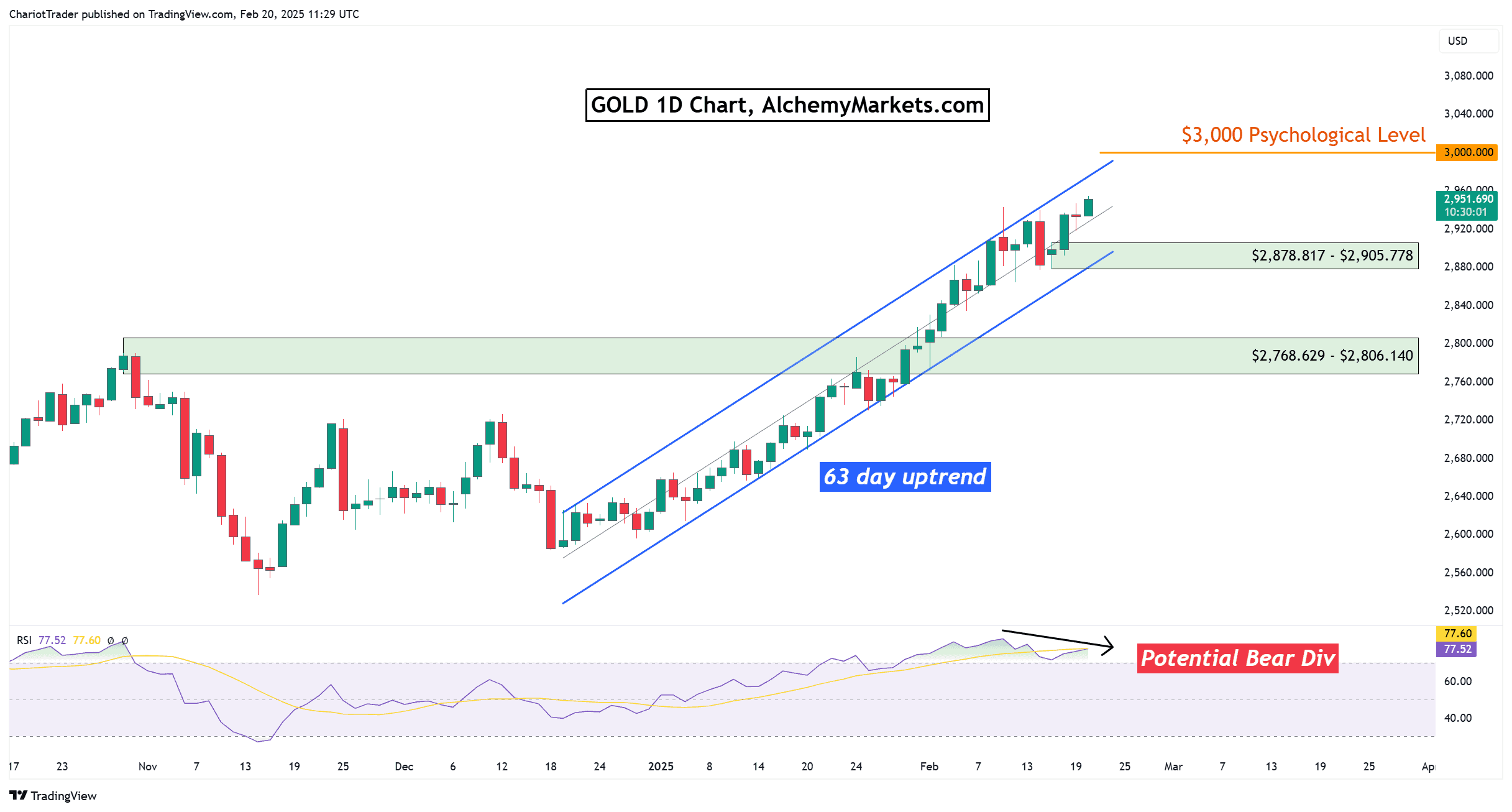

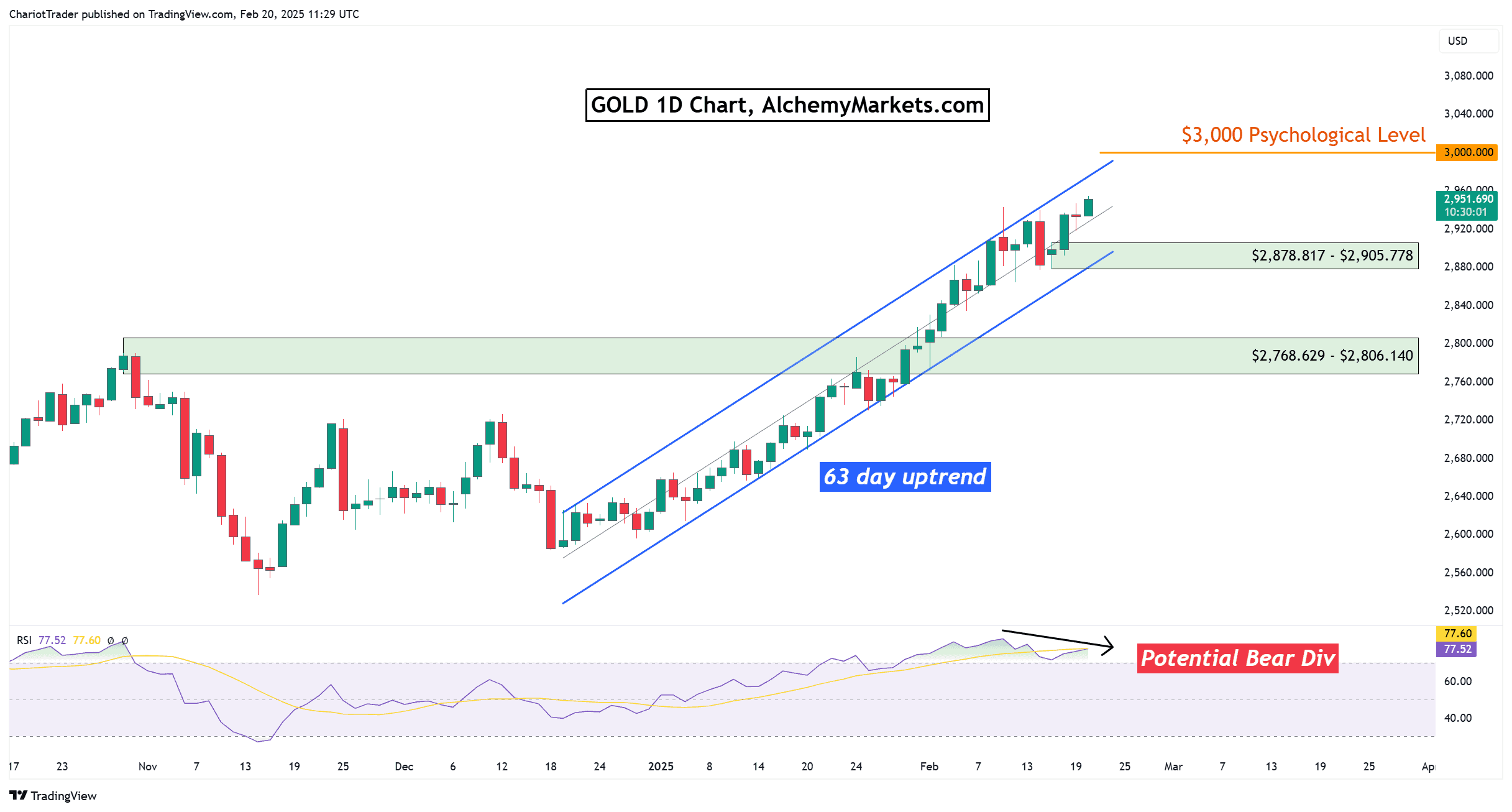

Technical Analysis: $3,000 in Sight

Gold continues to trade within an ascending parallel channel, approaching the psychological resistance level of $3,000. A bearish divergence is emerging on the Relative Strength Index (RSI), indicating potential weakening momentum. If this divergence confirms, prices may correct to the nearest support zone between $2,878 and $2,905, aligning with the channel’s lower trendline. A breach of this support could lead to a retest of the previous all-time high from 2024, situated between $2,768.6 and $2,806.

Elon Musk’s Call for a Gold Audit

Recent events have intensified focus on the U.S. gold reserves. Elon Musk, head of the Department of Government Efficiency (DOGE), has publicly questioned the authenticity of the gold stored at Fort Knox, suggesting a live-streamed audit to verify its presence.

This initiative has garnered support from figures like Senator Rand Paul, who advocates for increased transparency regarding the nation’s gold holdings. The last comprehensive audit of Fort Knox was conducted in 1953, with subsequent inspections in 1974 and 2017, but full audit reports have not been made public.

The U.S. Treasury asserts that annual audits confirm all gold is accounted for, yet the lack of recent comprehensive audits fuels public scepticism. If an audit reveals discrepancies in the reported 147.3 million troy ounces (approximately 4,581.5 metric tons) of gold, it could lead to significant market reactions.

Potential outcomes include legal actions from private gold holders, increased government purchases to cover shortfalls, or monetary policy adjustments such as increased money supply, all of which could devalue the U.S. dollar and further elevate gold prices.

Global Implications

Internationally, countries like Russia, which holds the second-largest gold reserves globally, might view this situation as an opportunity to strengthen their positions by increasing gold acquisitions. Such actions could trigger a competitive gold accumulation among nations, propelling prices even higher.

In summary, while technical indicators suggest a possible short-term correction in gold prices, the fundamental backdrop—highlighted by potential audits of national reserves and geopolitical dynamics—supports a bullish outlook for gold in 2025.

You may also be interested in: