- Chart of the Day

- November 13, 2025

- 2 min read

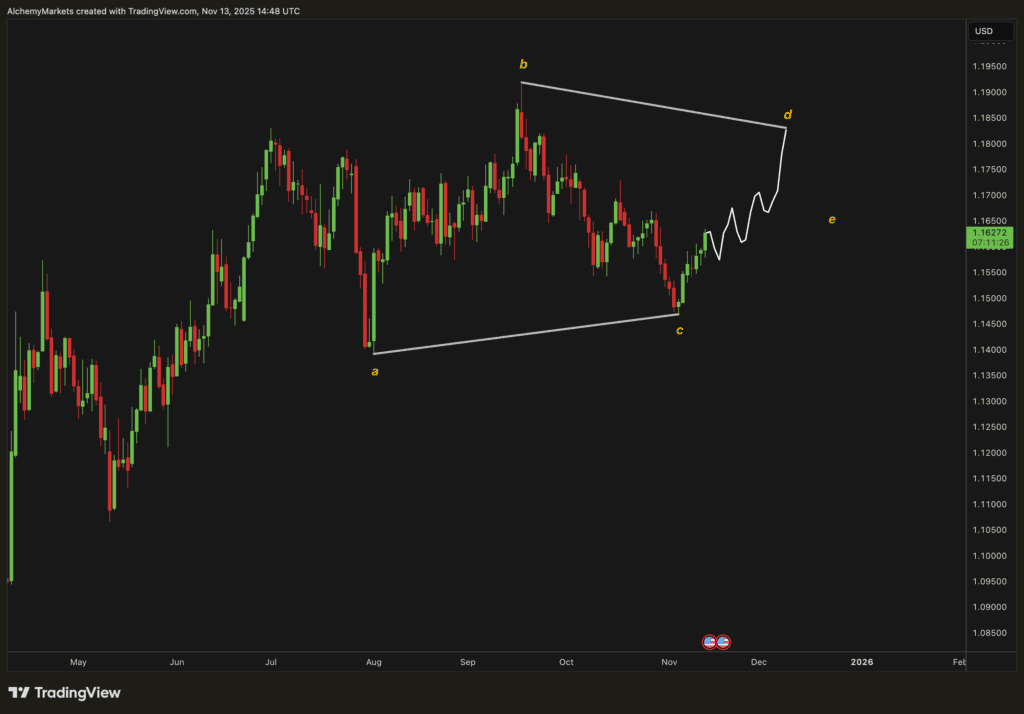

EUR/USD – Potential Running Triangle Taking Shape

EUR/USD has managed to hold onto its gains this week, though the move feels more like a reaction to a softer dollar than any real improvement in eurozone fundamentals. Yesterday’s German ZEW Expectations Index for November didn’t offer much optimism, continuing to signal that sentiment in Europe’s largest economy remains fragile. Interestingly, the aggregate ZEW reading for the wider eurozone ticked higher, which raises the question of whether Germany is increasingly becoming an outlier rather than the driver of broader regional momentum.

Price action over the past few months has been fairly well-behaved within a broad channel, giving traders plenty of clean technical levels to work with. However, the structure has begun to shift. The latest swing off the November low, combined with the overlapping nature of the past several legs, suggests we may be transitioning into a running triangle formation under Elliott Wave guidelines. This would imply a contracting, corrective pattern with the market potentially working its way towards a ‘d’ wave high before pulling back once more into ‘e’.

If the developing structure holds, EUR/USD could continue grinding higher in choppy fashion while staying capped beneath the upper boundary. It’s a pattern that often precedes continuation, but patience tends to be essential as the swings can become uneven and deceptively sluggish.