- Chart of the Day

- August 18, 2025

- 2min read

Crypto ABC Correction: 5-Wave Rally May Be Over for Ethereum

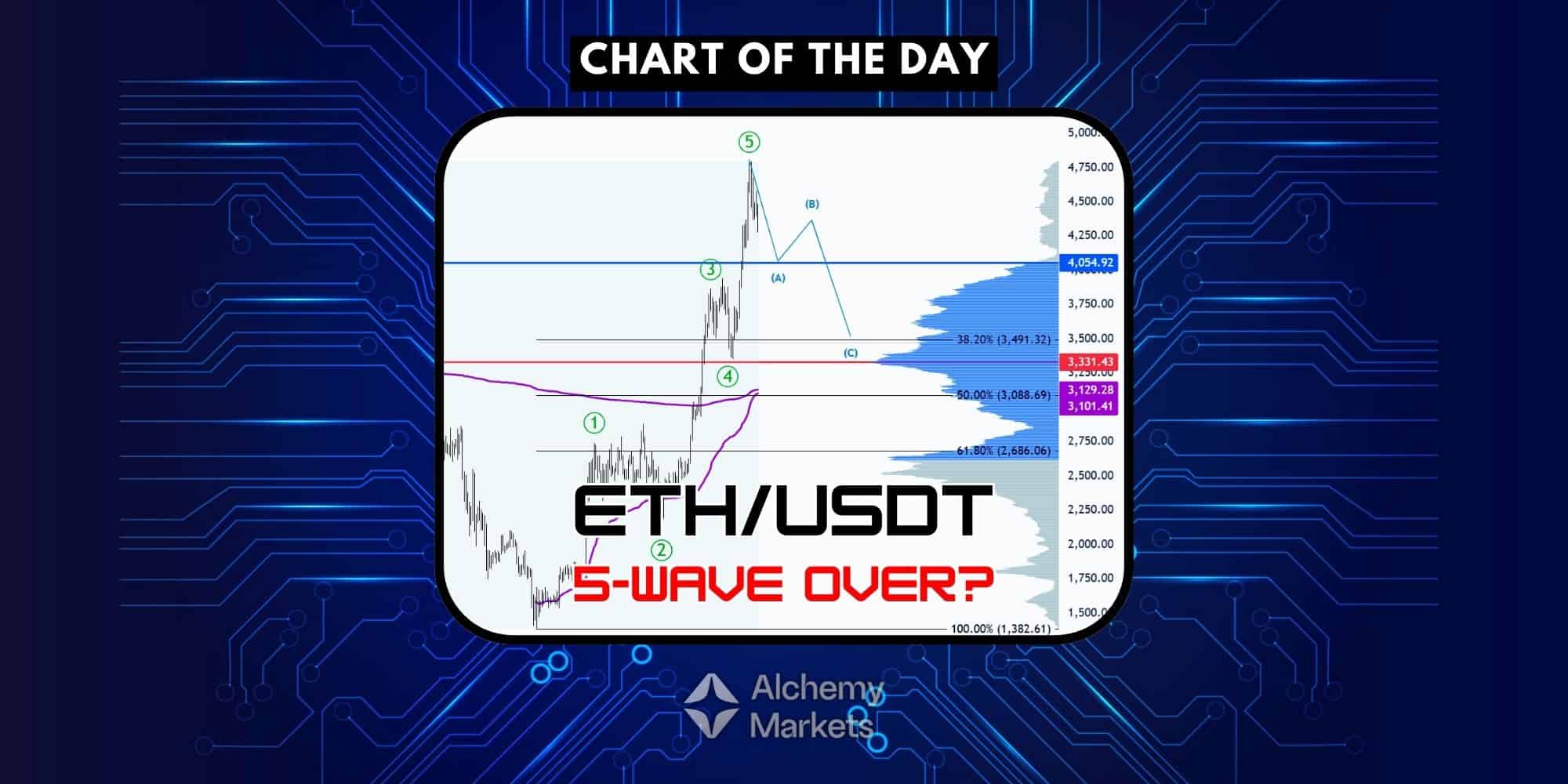

After tapping into $4,750, Ethereum has potentially completed a 5-wave rally structure — making an ABC correction towards $4,000 or deeper to $3,100 a possibility.

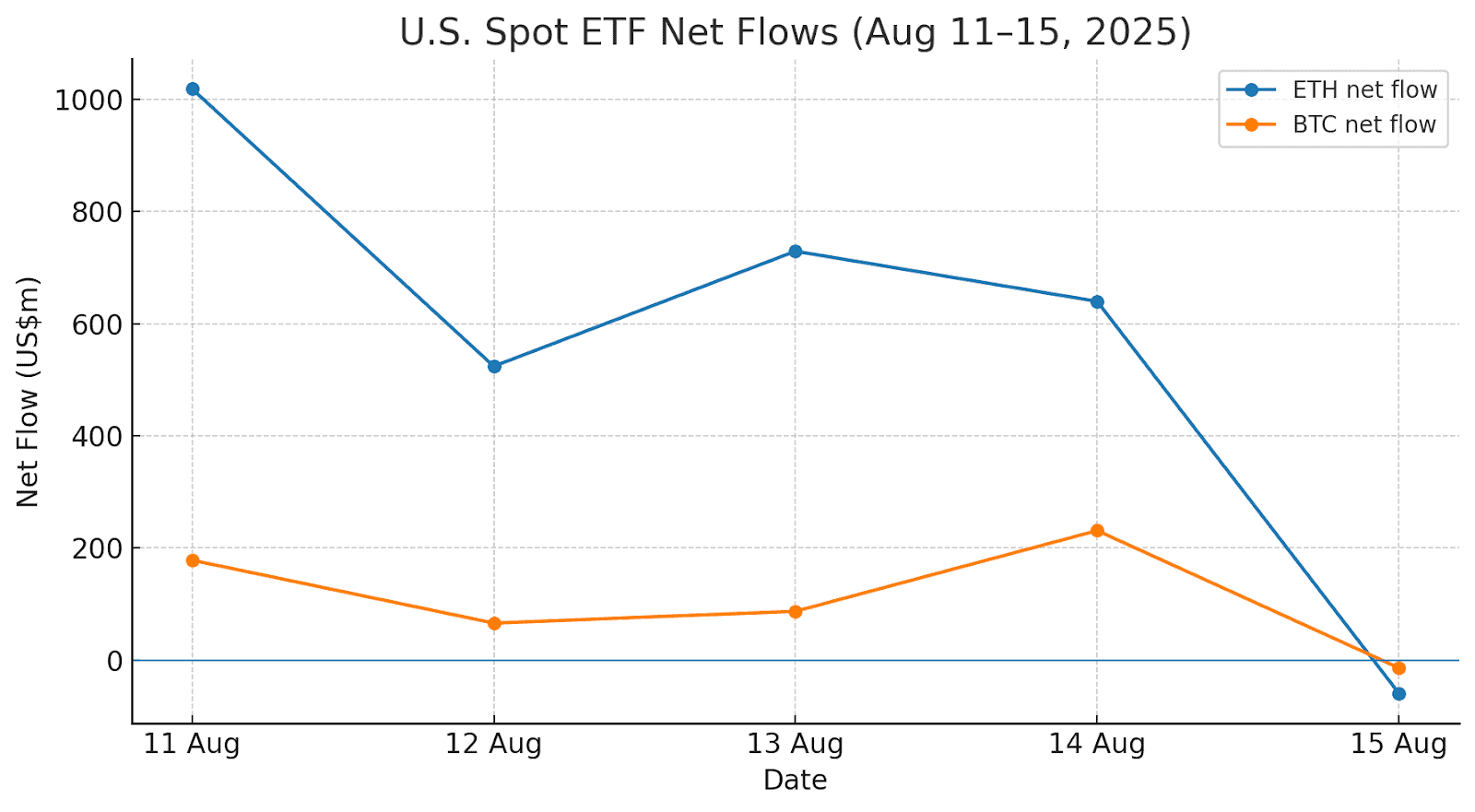

Perhaps the first warning sign we should have noticed was Ethereum’s Spot ETF net flows. Last week, it totalled at around $3.5 Billion USD and eclipsed Bitcoin’s net flows for 4 days in a row, indicating that institutions were accumulating. ETHA, Blackrock’s Ethereum Spot ETF, has been confirmed to have accumulated over 100,000 ETH (~433 million) alone in the past week.

The warning sign occurred on Friday, where Ethereum Spot ETFs experienced a sharp drop in net flows, reaching a net flow of -59.3 million USD and finally ending that accumulation strength over Bitcoin ETFs.

Technical Analysis of ETH/USDT Daily Chart

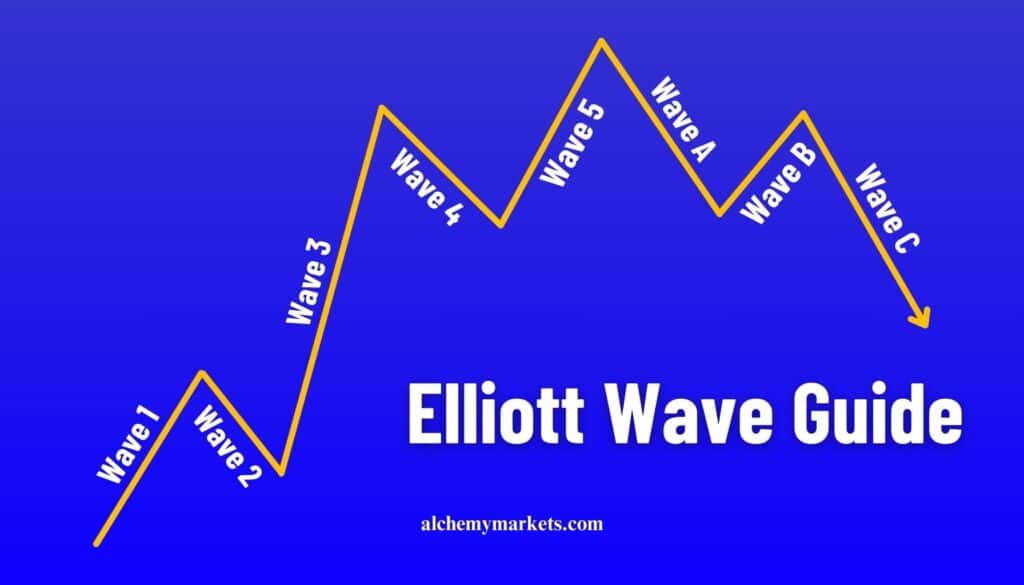

On the daily timeframe, we can spot a clear 5-wave structure on the Ethereum/USDT chart. What usually follows after is an ABC correction to the downside, before continuing in a bullish trend direction.

Let’s break down scenarios to consider for a retracement; if we don’t just continue higher now and invalidate the completed 5-wave idea.

Scenario 1: Shallow Pullback to ~$3,500

Elliot Wave Theory dictates that ABC corrections following a 5-wave rally would at least tap into the 38.2% Fibonacci retracement of the entire structure. If it pivots from here, it signifies that ETH is in a strong uptrend.

Wave A — Reach $4,000, which aligns with previous highs and the Value Area High since March 2024

Wave B — Retrace back to $4,400 to $4,500 (Fib levels)

Wave C — Continue to 38.2% Fib Retracement at $3,491.32

Scenario 2: Deeper Correction to ~$3,100

The usual suspects for a stop and reverse in a 5-wave rally are the 50% and 61.8% Fib retracements. This would align strongly with an anchored vWAP cluster at around $3,100.

Wave A and B — Same as above

Wave C — Continue to 50% Fib Retracement at $3,088.69

Alternative Bullish Case: Stop and Accumulate at ~$4,000

This would imply a running flat correction where ETH never breaks significantly lower. It’s rare, but strong institutional accumulation (Blackrock, inflows) makes it a scenario worth watching.

$4,000 is also a significant level as it acted as the top for ETH/USDT for the entirety for 2024.

Closing Thoughts

For now, the 38.2% retracement near $3,500 remains the base case. But if $4,000 holds, it signals institutions are stepping in aggressively, shortening the correction phase.