- Chart of the Day

- May 21, 2025

- 3 min read

DXY Crashes Below Key Support – Here’s Why It’s Falling and What’s Next

What’s Going On With the Dollar?

The U.S. Dollar Index (DXY) has taken a sharp dip this week, breaking below key trendline support. One major catalyst behind this movement is a credit rating downgrade by Moody’s, a top-tier credit rating agency. Let’s break it down step-by-step so you can understand why this is such a big deal.

Why Did Moody’s Downgrade the U.S.?

1. What happened?

Moody’s issued a credit rating downgrade for the U.S. government. Think of this like your personal credit score dropping—from “excellent” to just “very good.” It’s not catastrophic, but it’s a warning sign.

2. Why did they do that?

The U.S. government has over $36 trillion in debt, and with plans for potential tax cuts and increased spending, that number could rise even higher. Moody’s is concerned about how the government plans to manage such a large amount of borrowing.

3. Why does this matter?

When a country’s credit rating drops, it’s seen as riskier to lend to. Investors then demand higher interest rates to compensate for that risk. That’s why yields on 30-year U.S. Treasury bonds have surged past 5%—a big and fast move.

4. And how does this affect the dollar?

As confidence drops, foreign investors begin to sell U.S. assets—including the dollar. This triggers a decline in dollar value compared to other currencies around the world.

In simple terms:

“The U.S. just got a warning for having too much debt. Investors are now a bit more cautious, so they’re selling U.S. bonds and dollars—which is why the dollar’s been dropping this week.”

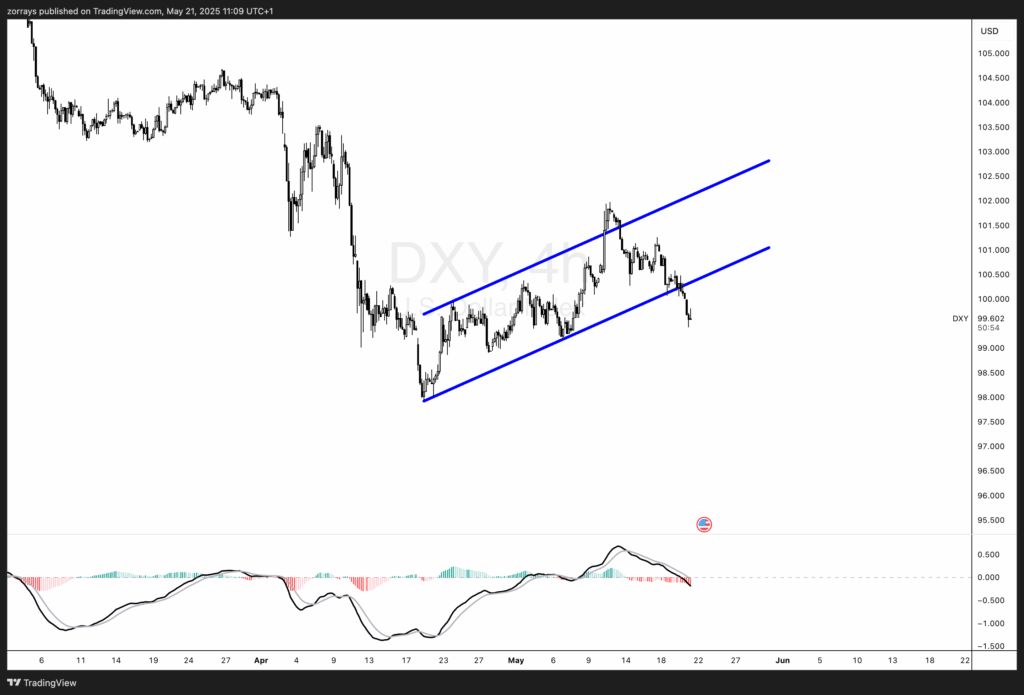

Technical Breakdown: DXY Breaches Trend Channel Support

Looking at the 4-hour chart of the U.S. Dollar Index (DXY), we can see a clear breakdown of the rising channel (marked in blue). Here’s what stands out:

1. Price Structure and Channel Break

- The dollar had been consolidating within a rising channel for most of May.

- That structure was violated to the downside, confirming a bearish breakout.

- Price has cleanly broken below the lower trendline, which often signals continuation of downside momentum.

2. Momentum Indicator: MACD Bearish Crossover

- The MACD (Moving Average Convergence Divergence) has formed a bearish crossover—the signal line has crossed above the MACD line.

- This indicates negative momentum is increasing.

- The histogram is also printing red bars, confirming bearish divergence and loss of bullish pressure.

What to Expect Next: More Downside Likely

Given both the fundamental backdrop (credit rating fears, rising debt concerns) and technical confirmation (channel breakdown + bearish MACD), the dollar is set for further downside in the short to medium term.

Key levels to watch:

- 99.00 – psychological round number and near-term support

- 97.80–98.00 – previous structure support from March/April

- Break below 97.00 – could trigger a deeper decline toward mid-95s