- Chart of the Day

- July 23, 2025

- 2 min read

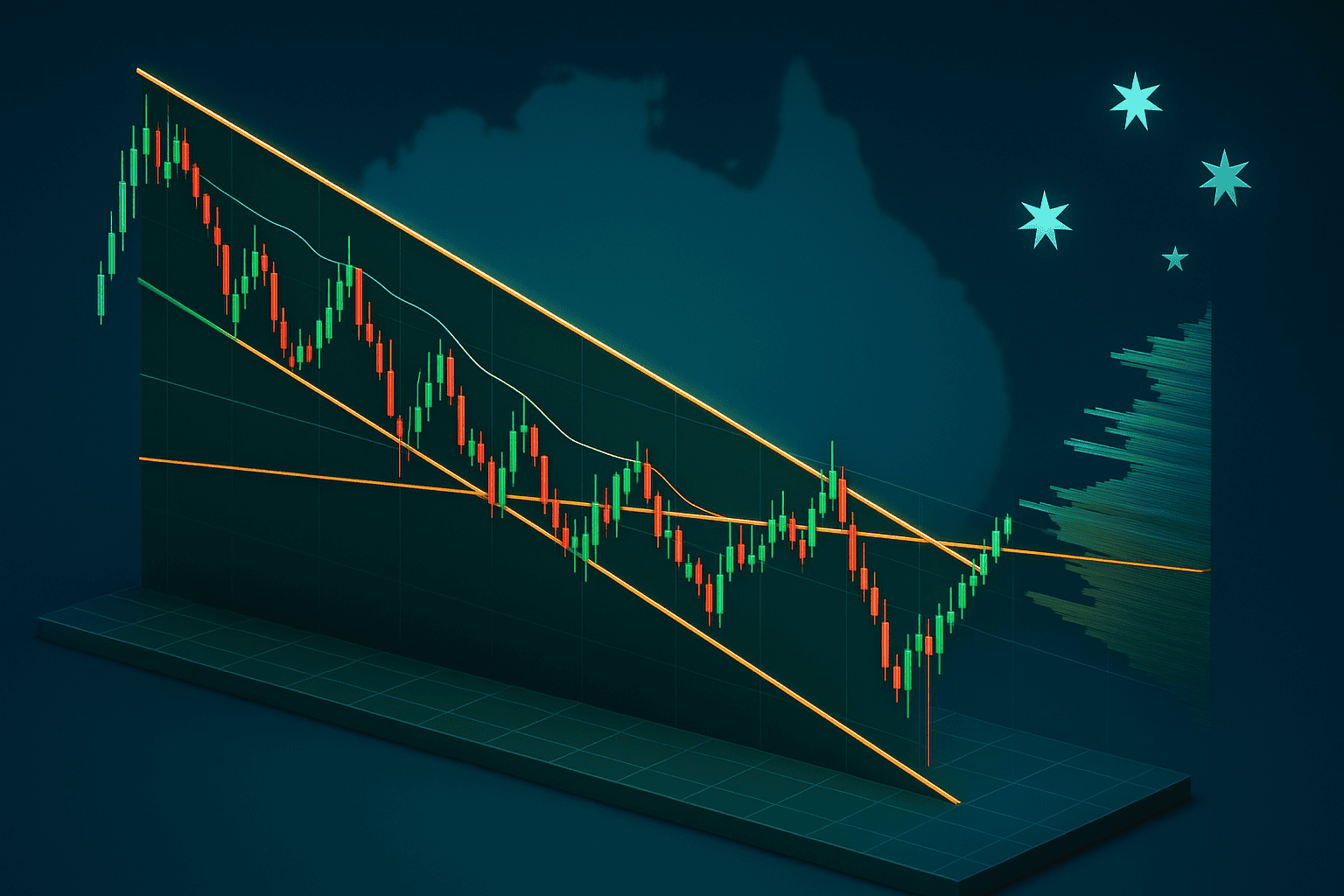

AUD/USD Faces Major Volume Resistance from Multi-Year Downtrend

Aussie-Dollar has been pushing higher continuously in a bullish directional leg since April. Now, it’s approaching a volume resistance zone — the anchored vWAP of February 2021 ($0.6795), and Point of Control since Feb 2021 ($0.6970).

A break above this zone would be significant, but it’s not the final hurdle. The Value Area High (VAH) at $0.6970 remains the key line in the sand. That’s the level where we can finally say the long-term downtrend has been broken.

Aussie-Dollar is in a Downtrend? But We’re So Bullish!

Yes, while AUD/USD has shown signs of strength in recent months, the long-term structure is still bearish. Since peaking in early 2021, the pair has been locked inside a descending channel — and price is approaching the top of that structure.

And yes, there’s been some recovery over the past year. But each rally has made lower highs, and until that changes, the overall bias remains cautious.

Macro Factors at Play

✅ Bullish Factors

- US–Japan trade deal has boosted global risk sentiment

- Weaker USD on tariff fears and soft US data

- Strong commodity demand, especially from China, backing AUD

⚠️ Bearish Factors

- Australian unemployment just rose to 4.3% — the highest in years

- RBA may pivot dovish, with markets pricing in a cut as soon as August

- Heavy resistance zone with long-term volume memory

Bottom Line: Remain Cautious As We Trend Higher

The momentum is real — but so is the resistance. We’re not just bumping into any ceiling; this is a multi-year volume cluster that has capped every major rally since 2021.

Until we get a confirmed weekly close above $0.6970, traders should stay tactical. The structure hasn’t flipped yet.

KEY TECHNICAL RESISTANCES TO WATCH:

- Value Area High — $0.6970

- Anchored vWAP (Average Price since 2021) — $0.6795

- Point of Control — $0.6725

- Top of Channel — Approximately $0.66 to $0.67

Watch price action closely here, this is where trend and structure collide.

You may also be interested in: