- Chart of the Day

- February 12, 2025

- 1min read

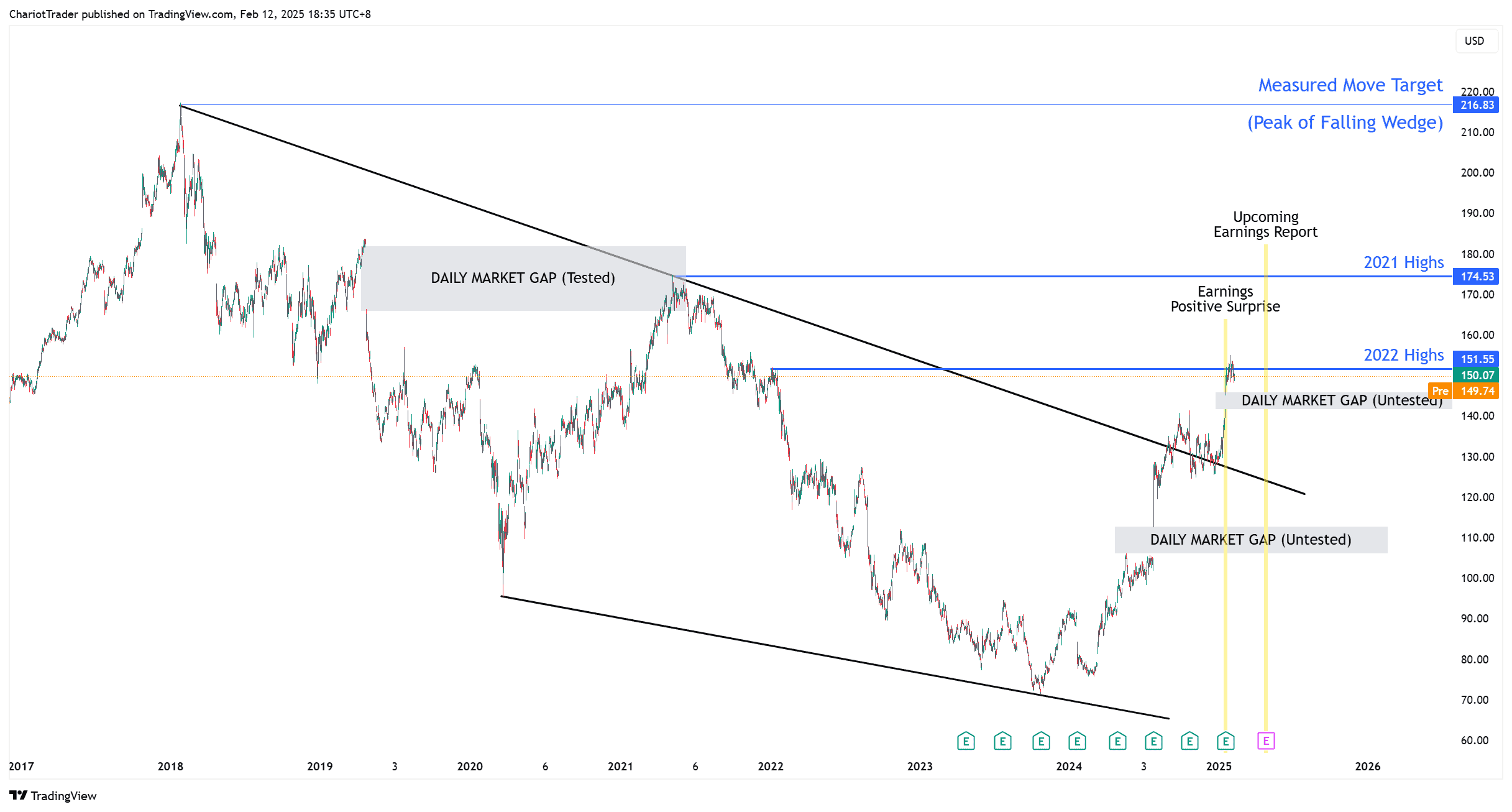

3M Stock at Resistance After Bullish Break of Falling Wedge

The 3M stock (MMM) has seen a major break of a falling wedge pattern, developed since 2018. It is currently meeting some resistance at its 2022 Highs of $151.55.

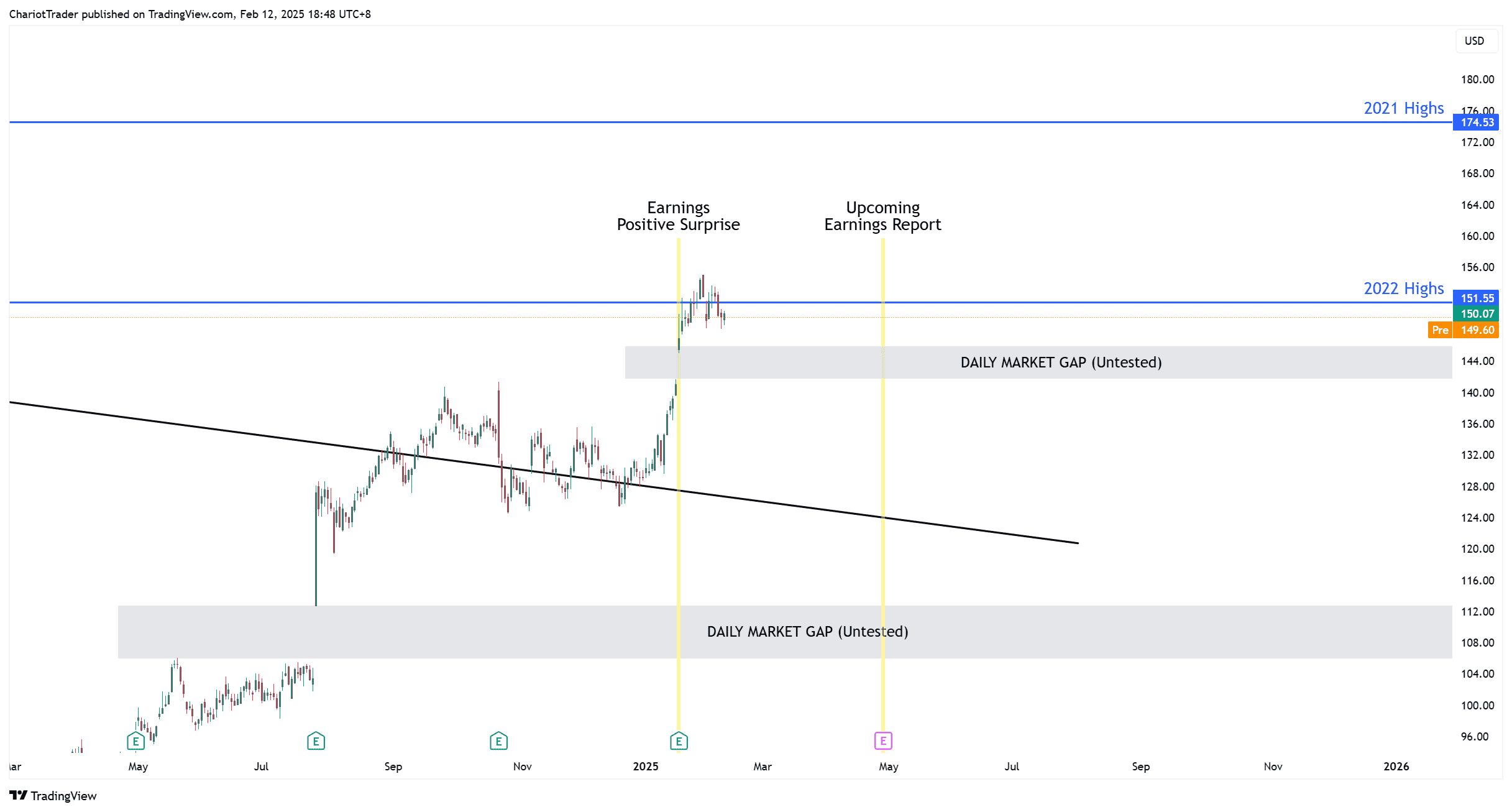

A rejection from here could send the asset back down to test a Daily Market Gap between $141.70 to $145.94, which was created in January with 3M’s positive earnings report.

If the gap does not hold, 3M stock does have the potential to retest its Falling Wedge trendline, which now sits between $128 to $120.

However, if a rejection does not occur now, the next bullish pit stop for the stock would be at $174.53, its 2021 Highs. With the CPI data coming out today, traders are advised to stay cautious while watching for opportunities.

News to Keep Track Of

Today, the US CPI data is releasing, which could impact dollar’s strength and the short term direction of stocks. The next earnings report is on April 29th, 2025, which could act as a catalyst for a major rally or rejection, depending on where the 3M stock price is at the time of the news.

You may also be interested in: