- October 7, 2025

- 28 min read

Copy Trading Explained: How to Get Started

Do you ever wonder if there is a way to trade like the professionals without spending years mastering charts and strategies? Copy trading makes this possible.

Copytrading allows you to connect your account to experienced traders and automatically copy their positions in real time. When the trader buys or sells, the same action is executed in your account, giving you direct access to their expertise while your funds remain under your control.

This guide explains how copy trading works, why it has become so popular, and how you can use it to build confidence and diversify your trading portfolio.

What is Copy Trading?

Copy trading simply means copying the trades of experienced traders into your own account. Rather than spending years building strategies, you can just pick traders whose style and results match your goals. When they buy or sell, your account does the same, keeping you in step with their moves.

The idea started with mirror trading. Back then, people mostly copied algorithms (trading bots which trade on fixed rules). Over time, platforms also allowed users to copy real traders, giving retail accounts access to the same opportunities as professional traders, not just automated systems.

Most modern platforms make this process transparent. You can check a trader’s history, see their past performance, and understand their risk levels (max drawdown and leverage) before deciding if they fit your style.

How Does Copy Trading Work?

When you copytrade someone, they trade on your behalf, and you pay them a cut of the profits as copier fees. If the trades don’t work out, you’re not charged extra fees, and simply take the same trading losses they do.

Copy trading typically does not add extra charges from the broker, only the standard spreads and commissions.

There are two main roles: the strategy provider (the trader whose positions are copied) and the copier (the investor who follows them). Providers trade as they normally would, while copiers automatically copy those trades in their own accounts.

Quick start (step-by-step)

- Open an account with Alchemy Markets, select “Be A Copier”, then verify to deposit funds.

- Download our copytrading app for mobile.

- Connect your Alchemy Markets trading account.

After connecting their account, users can begin browsing strategies to copy.

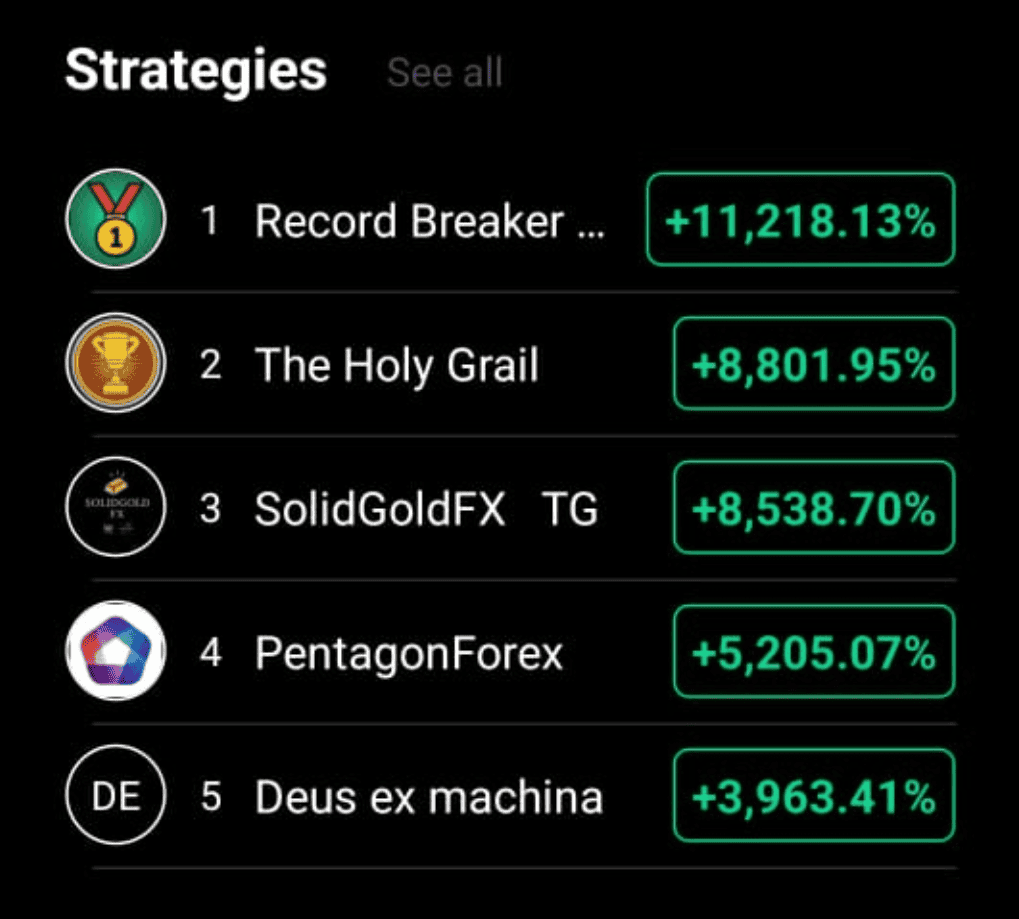

Navigate to ‘Discover’ to find a list of strategies you can copy. They are categorised from Low to High Drawdown strategies, and even Top Free Strategies, which do not incur copier fees.

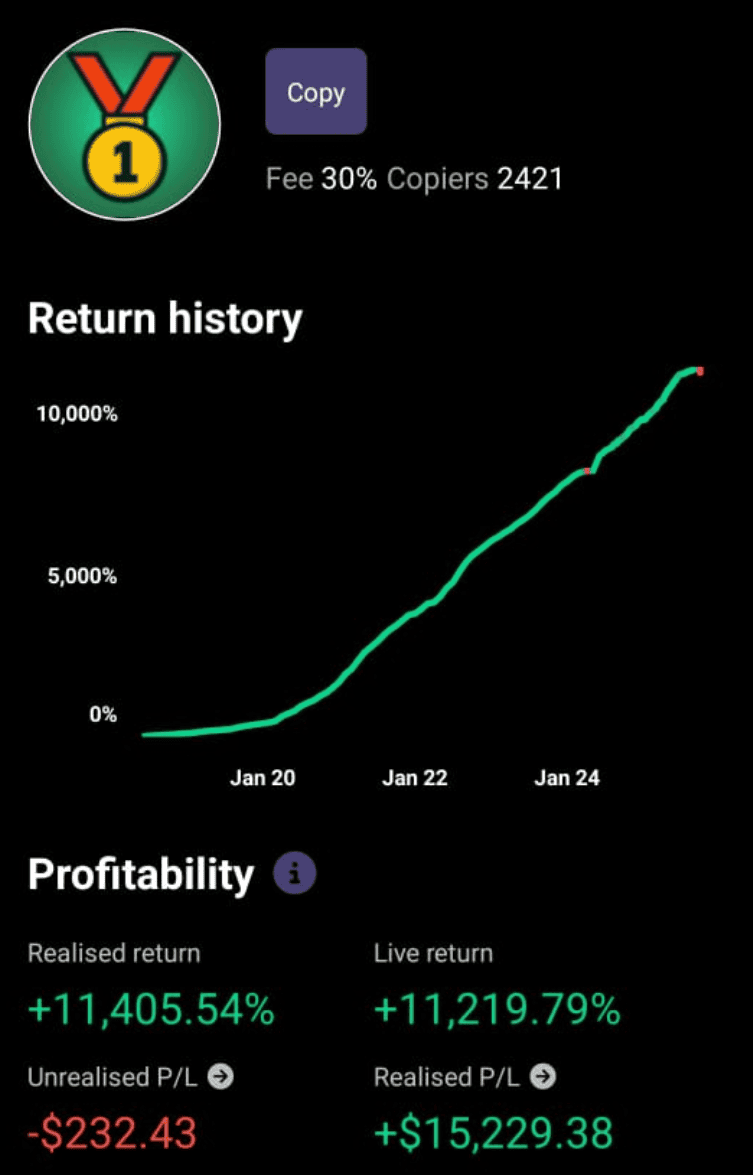

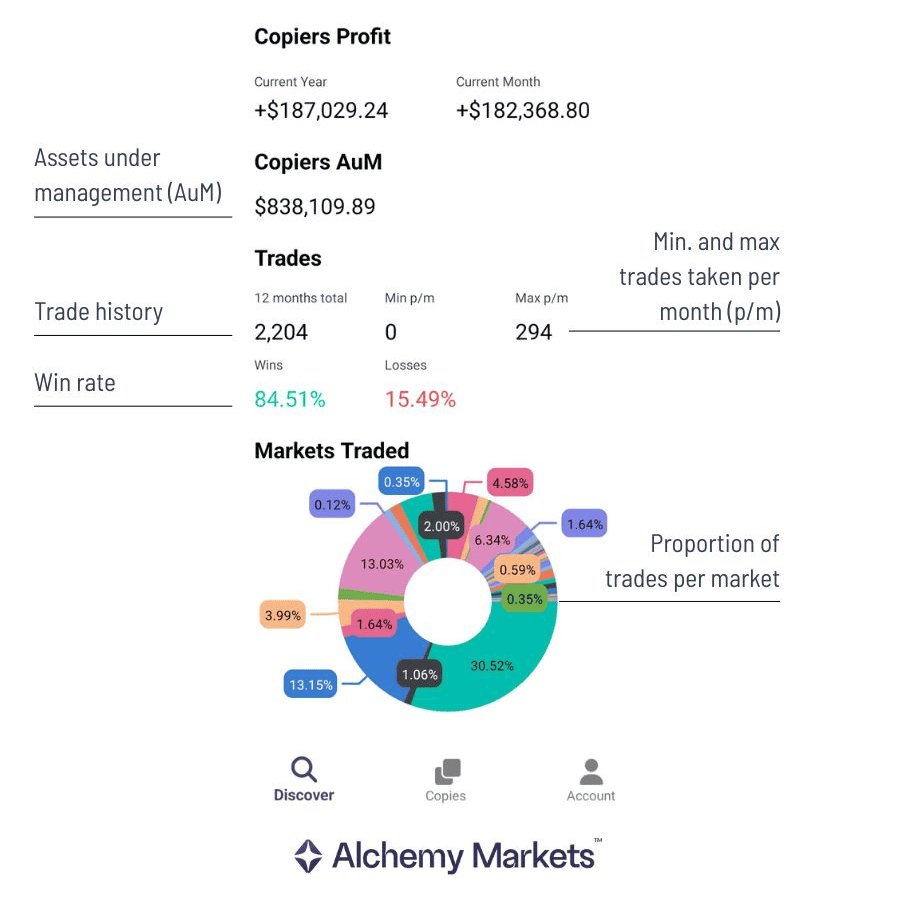

Tap a provider’s profile to review key details, such as their equity curve’s stability, fees, total trades, win rate, and even the amount of time they’ve been a provider.

Once you find a provider you’d like to copy, click on Copy and select your trade size. We provide several options in how you can your funds are allocated into a strategy:

- Fixed size

- Mirror master size

- Proportional by equity

- Proportional by balance

- Protections such as equity stop, maximum daily loss, per-trader cap, or auto-stop.

Once happy with your settings, you can tap on ‘Agree and copy’ to proceed.

After copying a strategy, you can manage your copy trades with these functions:

- Adjust or reduce the amount you allocate.

- Adjust stop losses if needed.

- Pause copying at any time.

- Close positions manually if needed.

Alongside these tools, remember that risks come in different forms in copytrading. It’s important to recognise them in order to make your best judgement in which provider(s) to follow:

- Liquidity risk — the ability to get the fills into and out of your trades. This comes into play if a provider trades thin markets, then you might experience slippage or worse pricing.

- Market risk — price moves against your position. You can gain a sense of how the trader manages this risk by looking at their equity curve and max drawdowns.

- Systematic risk — broader events like rate shocks or geopolitical news impact the entire market. Reviewing a trader’s max drawdown will give you a sense of systematic risk and impact to their strategy.

Protect Your Funds By Diversifying

To protect your account against drawdowns, it’s smart to diversify across multiple traders, strategies, and asset classes. This spreads exposure and avoids relying too heavily on a single provider’s performance.

Keep in mind though: Diversification reduces individual risk, but it can’t eliminate systematic risk — the type of market-wide shocks caused by events like interest rate changes or geopolitical news.

Most platforms help balance this out with built-in tools such as stop-loss limits and equity caps, giving you a mix of automation and control. That combination is what makes copy trading both practical and appealing.

How Does Copy Trading Work in Forex Trading?

Forex trading is the biggest part of the financial markets, moving more than $6 trillion every day. Copy trading platforms can execute positions in pairs like EUR/USD or GBP/USD almost instantly and at fair prices. The advantage is clear: you can take part in trading forex without spending hours on constant market analysis yourself.

Experienced traders in this space often combine technical and fundamental analysis to guide their decisions. They may study price action alongside factors such as central bank policy, interest rates, and inflation data. By following them through copy trading, you gain exposure to strategies shaped by both chart analysis and broader economic factors, an approach that can be challenging for beginners to develop on their own.

However, you still need to apply proper risk management, as no strategy can guarantee wins every time.

How Does Copy Trading Work in Cryptocurrency?

Cryptocurrency is a 24/7 market, making it one of the most dynamic areas for copy trading. Coins like Bitcoin and Ethereum can swing sharply, which means there is room for opportunity but also a high risk of losing money quickly if you are new to the asset class. By linking your trading account to professional traders who focus on crypto, you can take part in the market without needing years of trading experience.

These experienced traders look at more than just charts. They study blockchain projects, token fundamentals and the news that often moves prices, for example new listings or changes in regulation. They also keep track of the crypto cycle, recognising when the market is in a bullish run and when it is moving into correction. But because cryptocurrency is an inefficient market, predicting movements is challenging. Outcomes can vary, which is why proper risk management remains essential.

Why Use Copy Trading?

Copy trading has gained popularity because it makes participation in the financial markets easier and more practical for every trader.

| Accessibility |

| Copy trading opens the financial markets to almost anyone. Even without prior trading experience, you can follow expert traders and begin trading straight away. |

| Time-Saving |

| Analysing charts and news can take hours. With copy trading, your trading account can automatically copy trades from top traders while you focus on other things. |

| Diversification |

| Relying on one strategy is risky. For example, if you mainly trade forex but want to add shares to your portfolio without the trading experience, you can copy an experienced stock trader instead of spending months learning the stock market. |

| Learning |

| It is not just about profit. Watching experienced traders analysing markets, making trading decisions, and managing risks helps you improve your own trading skills. |

Together, these benefits explain why copy trading continues to attract both beginners and more experienced retail traders who want a simpler, more balanced approach to participating in global markets.

How to Get Started with Copy Trading

Getting started with copy trading is simple, but success depends on making the right choices from the beginning. The key is to select a trustworthy platform, evaluate traders carefully, and manage your capital with discipline. By following a structured approach, you can reduce unnecessary risks and build a more sustainable trading journey.

Step 1: Choose a Regulated Broker

- Pick a regulated broker which offers copy trading with transparent fees, such as Alchemy Markets.

Step 2: Review Traders Carefully

- Check trading history, drawdowns and trading style. Make sure it fits your risk tolerance, since even top performing traders face losing periods.

Step 3: Decide on Capital Allocation

- Determine how much capital you want to use. Spread funds across various traders in different markets to diversify risk.

Step 4: Practise with a Demo Account

- Most trading platforms include demo accounts. They let you test trading signals in real time without risking money.

Step 5: Monitor and Adjust Regularly

- Copy traders cannot guarantee future results. Review your account, adapt to market conditions, and replace followed traders if performance slips. Treat copy trading as active investing to achieve steady long-term outcomes.

Copy Trading Strategies

Once you understand how copy trading works, the next step is deciding which strategies suit your goals. When you follow professional traders, you are not just copying their trades; you are effectively adopting their trading style and risk approach to the market.

Each strategy carries unique advantages and risks involved, so it is essential to know what you are signing up for.

Scalping

Scalping is one of the fastest-paced strategies in copy trading. A scalper looks for tiny market movements, opening positions that last only minutes or seconds. The goal is to make numerous small profits that accumulate over time.

When you copy scalpers, you’ll see frequent trades in your account. This method thrives in highly liquid markets like forex, where tight spreads and fast execution are critical.

The main benefit of scalping is steady returns, but it carries high risk. Scalpers rely on leverage and rapid execution, so small delays or slippage can affect performance. Your account may see many trades in a day, leading to higher transaction costs.

When it comes to scalping, fast execution and low commissions matter most. If you decide to follow scalpers, choose an account that provides these advantages, such as Alchemy Markets, which offers accounts with fast execution and zero commission for assets like forex, metals, or indices.

| Advantages • Many opportunities in liquid sessions and news periods • Tight invalidation with small, predefined stops • Minimal overnight risk due to short holding times |

| Drawbacks • Highly sensitive to latency, spreads, and slippage • Higher cumulative costs from frequent trading • Performance can degrade in choppy, low-volatility markets |

High-Frequency Trading

High-Frequency Trading (HFT) takes scalping to a more technical level. Advanced algorithms and automated systems execute hundreds or thousands of trades in fractions of a second.

While retail traders rarely run true HFT models, some copy trading platforms let you follow traders or funds using systematic, high-frequency strategies. These strategies share characteristics with HFT but aren’t pure institutional models.

Copying these strategies offers access to systematic methods that are hard to replicate manually. The trades are usually small and frequent, aiming to capture market inefficiencies.

However, HFT is highly sensitive to market shocks, and competition is fierce. Results can fluctuate with changing conditions, so beginners should allocate only a portion of their account to these strategies.

| Advantages • Rules-based and emotion-free execution • Diversifies away from purely discretionary approaches • Typically low per-trade risk with quick position turnover |

| Drawbacks • Edge can decay when market microstructure shifts • Requires very low latency to track provider fills closely • Higher cumulative costs from spreads, commissions, or fees due to the large number of trades |

Trend Following and Copy Trading

Trend following is a popular strategy among both manual and copy traders. The principle is simple: identify the market’s direction and follow it until the trend weakens or reverses. Traders focus on market momentum, allowing them to capitalize on longer price movements.

When you copy a trend follower, trades may stay open for days, weeks, or even months. Traders use technical tools like moving averages, trendlines, or momentum indicators to confirm trends and determine entry and exit points. For example, a trend trader might buy gold when the price makes higher highs and hold the position until signs of a reversal emerge. This approach relies on the idea that trends tend to persist in the market for extended periods.

| Advantages • Captures large directional moves with fewer decisions • Clear rule sets for entries and trailing exits • Works across forex, commodities, indices, and crypto |

| Drawbacks • Whipsaws in ranges can erode returns • Patience required during pullbacks and consolidations • Late entries after breakouts can reduce reward-to-risk |

HODLing in Copy Trading

In cryptocurrency markets, the term HODL (short for “Hold On for Dear Life”) refers to the strategy of buying coins like Bitcoin or Ethereum and holding them for long periods, regardless of short-term volatility. This strategy is based on the belief that despite market fluctuations, the long-term growth potential of these digital assets will outweigh the short-term challenges.

When you copy traders who use HODLing, your account may show fewer trades, but with larger, longer-term positions. The idea is that, despite temporary downturns, the overall value of cryptocurrencies will rise over time. This approach requires patience, as it focuses on long-term trends rather than short-term market noise.

| Advantages • Low maintenance with clear long-term thesis • Fewer trading fees due to reduced turnover • Potential to capture multi-year adoption cycles |

| Drawbacks • Large drawdowns are common in crypto cycles • Thesis risk from regulation, liquidity, or protocol issues • Opportunity cost during prolonged consolidations |

Swing Trading

Swing trading aims to capture medium-term price moves, typically lasting a few days to a few weeks. Swing traders look for opportunities in the natural “swings” of the market, often using technical tools such as support and resistance levels, Fibonacci retracements, or momentum indicators.

By copying swing traders, you gain exposure to positions that are not as frantic as scalping but still more active than long-term investing. This strategy can be applied across forex, stocks, commodities, and crypto, making it versatile for those who want exposure to multiple traders in different markets.

| Advantages • Balanced pace with clear invalidation and targets • Works well on 4H and Daily charts to reduce noise • Suits multiple asset classes for broader diversification |

| Drawbacks • Vulnerable to news shocks and gaps • Choppy phases can trigger a series of small losses • Requires trust in the provider’s patience and plan |

Diversification Strategy

Diversification is less of a trading style and more of a portfolio approach. Instead of putting all your funds behind a specific trader, you spread your capital across different traders and markets.

In practice, this might mean allocating part of your copy trading account to a scalper, another portion to a trend follower, and some to a value investor. By doing so, you reduce reliance on a specific trader and create a balance between high risk and more stable strategies.

Many copy trading platforms encourage this approach, giving you tools to manage allocations across multiple traders. It is one of the most effective ways to manage risk and can help smooth out trading results over time.

| Advantages • Reduces single-provider and single-strategy risk • Smoother equity curve through regime changes • Flexible rebalancing as conditions evolve |

| Drawbacks • Can dilute standout performers • More lines to track and review • Fees and spreads accrue across multiple allocations |

Value Investing in Copy Trading

Value investing is more common in traditional equity markets, but some copy trading providers apply value-based principles as part of their strategy. These investors look for assets that appear undervalued relative to their intrinsic worth, often holding positions for months or even years. However, this approach is less common on short-term CFD platforms, where more active trading strategies are typically favored.

When you copy value investors, you may see fewer trades, but the focus is on long-term growth. For example, they may buy shares in companies they believe are underpriced and hold them until the market recognizes their true value.

| Advantages • Emphasis on quality, cash flow, and margin of safety • Lower turnover with potentially lower trading costs • Diversifies against short-term technical noise |

| Drawbacks • Patience needed while catalysts play out • Risk of value traps if fundamentals keep deteriorating • Equity-specific risks such as earnings and guidance shocks |

Copy Trade the Best Traders in Alchemy Markets

Alchemy Markets makes copy trading simple by connecting you directly with professional traders — whether you want to copy their strategies or provide your own.

As a copier, you can browse providers, review their profiles, and allocate funds to those that fit your goals, with the flexibility to adjust or withdraw at any time. As a provider, you can showcase your track record, build a following, and earn performance fees when others copy your trades.

Whichever role you choose, the platform supports you with lightning-fast execution, transparent performance data, diversification tools, flexible risk settings, customisable fees, fast payouts, and personalised performance pages for providers.

Automatic Execution

Every trade a chosen provider opens, adjusts, or closes is instantly reflected in your account at a proportional size. This keeps you active in the markets without monitoring charts or worrying about missed signals. Ultra-low latency technology ensures Trades are copied instantly and accurately, with no manual input needed.

Access to Proven Strategies

Each trader has a transparent profile with trading history, past performance, drawdowns, and trading style. This allows you to assess consistency, risk appetite, and alignment with your own goals. Whether you prefer steady returns or higher risk exposure, you can base decisions on real trading results rather than theory.

Diversify with Ease

Instead of relying on a single trader, you can follow multiple strategies across forex, crypto, commodities, indices, and 300+ products in over 10 asset classes. Diversification spreads risk, smooths performance, and makes copy trading more resilient over time.

Full Control

Automation does not remove your authority. You decide how much capital to allocate, and you can pause copying, stop entirely, or close individual trades yourself. Advanced allocation and risk tools let you apply multipliers, fixed lot sizes, slippage limits, and even reverse copy trade if needed. This flexibility ensures your strategy remains aligned with your risk profile.

Earn While You Learn

By reviewing traders’ performance data and trading history, you learn how decisions are made under different market conditions. Over time, this knowledge helps you recognise patterns, refine your own strategies, and trade with greater confidence.

Performance-Based Rewards

Strategy providers only earn when they deliver results for their followers. Instead of fixed management fees, Alchemy Markets allows flexible and customisable fee structures such as subscription fees, performance fees, or management fees. Incentives are fully aligned with your success. Providers also benefit from fast payouts via Stripe, Bank Wire, or Credit Card.

Why Choose Alchemy Markets?

What sets Alchemy Markets apart is its balance of low costs, fair execution, and simplicity. Copy trading here isn’t just convenient — it’s built on competitive pricing and institutional-grade infrastructure.

- Market Leading Costs: Zero commissions on FX, metals, and indices, with spreads as low as ~0.2 pips on Gold for VIP accounts (~0.25 pips on Classic).

- Fair Execution: 100% STP (straight-through processing) ensures trades are executed directly with liquidity providers, free from dealing-desk intervention.

- Fast Onboarding: Open an account, verify your details, and connect via our app (available on Google Play or the App Store). From there, you can explore copytrade providers, review their track records, and copy strategies that fit your goals.

Advantages of Copy Trading

Copy trading offers a simple and efficient way to engage in the markets, allowing you to benefit from experienced traders’ strategies without the steep learning curve. Below are some of its key advantages:

| Advantage | Key Description |

| Accessibility | Allows beginners to start trading without prior experience by copying professional traders, eliminating the steep learning curve. |

| Time-Saving | Automates the trading process, saving time spent on market analysis, allowing you to focus on other commitments while participating in the markets. |

| Diversification | Follow multiple traders with varying strategies and markets, helping to spread risk and improve overall portfolio performance. |

| Learning Tool | Provides an opportunity to learn by tracking traders’ performance, decisions, and strategies, building skills over time without large risks. |

| Performance-Based Fees | Traders pay fees only when they generate profits, aligning their success with yours and encouraging disciplined, goal-oriented trading. |

Copy trading simplifies the trading process, making it accessible, time-efficient, and educational, all while reducing risks and enhancing portfolio diversification.

Disadvantages of Copy Trading

While copy trading offers several benefits, there are notable drawbacks to consider. Below are the key disadvantages that can affect your trading experience:

| Disadvantage | Description |

| Risk of Underperformance | Copy trading depends on the performance of the trader you follow. If they underperform, you risk losing money. Past performance is not a guarantee of future success. |

| Over-Reliance on a Single Trader | Relying on one trader can increase your risk. Even top traders face losses, so diversification across multiple traders is essential. |

| Costs | Fees such as spreads, commissions, and performance charges can reduce your overall profits over time. |

| Lack of Control | You lose some control when trades are copied automatically. While you can stop copying, you cannot influence real-time decisions. |

| Platform Risks | Using an unregulated or unreliable platform can expose you to additional risks. Always choose a secure and transparent platform. |

Although copy trading simplifies the process, it carries risks like relying too heavily on one trader, high costs, and limited control. Diversifying and choosing a reliable platform can help mitigate these drawbacks.

Copy Trading vs Traditional CFD Trading

In traditional CFD trading, you’re responsible for conducting your own market analysis, deciding when to enter and exit trades, and managing risk. This requires a solid understanding of market trends, technical analysis, and strategy development. It’s a more hands-on approach, where experience and skill play a significant role in success.

In contrast, copy trading removes much of this responsibility. Instead of conducting your own analysis, you follow the trades of experienced traders. The platform automatically replicates their trades in your account, so you don’t need to make active trading decisions. This allows beginners or those with limited experience to participate in the markets by leveraging the expertise of others.

With Alchemy Markets, both methods involve CFDs, which allow you to buy and sell markets without owning the underlying asset, while using leverage to trade at a fraction of the cost, though this also increases risk.

- Traditional CFD trading demands strong trading skills and the ability to analyze and interpret the market effectively.

- Copy trading offers a more accessible entry point for those who may not have the expertise to make independent decisions.

Copy Trading vs Mirror Trading

While both copy trading and mirror trading replicate trades, they differ in flexibility and control:

Copy Trading: You follow individual traders, replicating their trades in real-time. This method offers flexibility, as you can choose different traders, asset classes, and adjust your portfolio according to your preferences. The trades reflect human decisions based on personal market analysis.

Example: In copy trading, for example, you can allocate 30% of your capital to a forex trader, 20% to a crypto trader, and 50% to a stock trader. You can also adjust risk per trade, such as setting 1% or 2% risk for each trader based on your tolerance.

Mirror Trading: You follow a predefined strategy based on an algorithm, replicating the exact trades in the same portfolio. This is less flexible as you are bound to the strategy and cannot adjust asset classes or traders. The process is based on automated systems and consistent rules.

Example: If you follow a trend-following strategy that risks 2% per trade, your entire portfolio mirrors that strategy’s risk profile. If you allocate 100% of your capital, you risk 2% of your total portfolio per trade.

Key Differences:

- Copy Trading: Offers more flexibility to choose traders, asset classes, and adjust your portfolio.

- Mirror Trading: Replicates the exact portfolio of a strategy with fixed risk per trade.

Copy Trading vs Manual Trading

In manual trading, you execute every part of the process yourself, whether trading CFDs, Futures or other markets. You analyse charts and fundamentals, decide when to enter and exit, and manage risk based on your own judgment. This requires significant experience, technical knowledge and the ability to react quickly to market fluctuations. It is a more active and hands-on style of trading where discipline and expertise are essential.

By contrast, copy trading offers a far easier way to participate. The platform automatically mirrors the trades of experienced traders in your account, removing the need for constant analysis or manual execution. This makes it accessible for beginners or for those who prefer a simpler, more passive approach while still engaging with the markets.

Both methods involve risk, but the key difference lies in the level of involvement:

- Manual trading requires hands-on analysis and decision-making.

- Copy trading provides an easier, more passive way to trade without requiring deep expertise.

Copy Trading vs Automatic Trading

Automatic trading relies on algorithms or bots that execute trades based on predefined rules. Once set up, the system operates autonomously, making trades according to fixed criteria without human involvement. This method is fully mechanical and doesn’t adapt to market conditions beyond its programmed parameters.

In copy trading, you can follow both human traders and automated strategies. The platform replicates trades from chosen traders, whether they are making decisions based on their analysis or using automated strategies. This gives you the benefit of human judgment alongside the option for more systematic, rules-based approaches.

Both save time and reduce emotional bias, but the key difference lies in the source of decisions:

- Automatic trading operates on predefined algorithms and rules.

- Copy trading allows you to follow human traders or automated strategies, giving you more flexibility.

Copy Trading vs Social Trading

Both copy trading and social trading allow you to benefit from others’ expertise, but they differ in terms of interaction and control:

Copy Trading: This is a more automated approach where you follow individual traders and their trades are automatically copied into your account. You can adjust capital allocation and risk per trade, but the decision-making is done by the trader you follow.

Social Trading: This is more interactive. It allows you to follow traders who share insights and signals, but you’re responsible for executing the trade yourself. You need to analyze the shared information and decide when to act.

Key Differences:

- Copy Trading: The trades are automatically copied from the trader you follow, requiring minimal involvement.

- Social Trading: You interact with the community, receive signals, and make your own decisions based on shared insights.

FAQ

Is Copy Trading Legal?

As of October 2025, copy trading is permitted in many jurisdictions, though the rules can differ widely from one region to another. Because financial regulations continue to evolve, it’s essential for both investors and platforms to monitor the latest legal requirements in their specific markets to ensure compliance.

Alchemy Markets is fully regulated under MFSA and FSA to deliver our services to users based in Europe and anywhere in the world, only with major exceptions are to users based in the U.S. and Iceland.

Do I need prior trading experience to engage in copy trading?

No, you don’t need prior trading experience to start. Copy trading platforms automatically copy trades from professional traders, making it suitable for beginners. Still, reviewing the trader’s performance history helps align results with your risk appetite.

Which copy trading strategy is the best?

There is no single “best” strategy. Scalping, swing trading, trend following, or long-term investing can all work depending on your goals. The key is choosing followed traders whose trading style matches your tolerance for risk.

Is copy trading too risky?

Like all trading CFDs, copy trading involves risks. Accounts lose money if chosen traders underperform, and past performance does not guarantee future results. Managing exposure across multiple traders and using risk controls helps reduce the high risk of losing.

How can I find good traders to copy?

Most copy trading platforms show performance data, risk metrics, and trading history. Look for consistency rather than extreme profits, and consider how traders behave under different market conditions. Diversifying across top traders lowers overall risk.

What markets can I access with copy trading?

You can access global markets including forex trading, stocks, commodities, indices, and cryptocurrencies. The range depends on the platform, but most offer a wide choice of tradeable markets so you can diversify your portfolio easily.

How much will copy trading cost me?

Costs vary by platform. Some charge spreads or exchange commission, while others apply a performance fee where a percentage of profits goes to the signal provider. Always check the fee structure before opening a copy trading account.

What is the minimum amount required to copy a trader?

The minimum amount depends on the platform. On some, you can start with as little as $100, while others set higher requirements. It’s best to begin with an amount you can afford to lose as results vary with market conditions.

How long does it take for copied trades to be executed in my account?

Copied trades are executed almost instantly. When a provider opens or closes a trade, the same trade appears in your account in real time, ensuring you automatically replicate their activity without delay.

What are the fees associated with copy trading?

Fees differ across platforms. Some charge only spread, others add performance-based fees or maintenance charges. For example, Bybit and Pepperstone may take a percentage of profits. Understanding all fees helps protect your trading results.

Is copy trading profitable?

Copy trading can be profitable, but there are risks involved. Success depends on choosing disciplined traders, using sound risk management, and diversifying across multiple traders. Remember, future results cannot be guaranteed.

How many copy trade accounts can I open?

On Alchemy Markets, you can open more than one copy trading account if needed. This flexibility allows you to separate strategies or manage risk more effectively by running multiple accounts side by side.

Can I close the position anytime?

Yes. With Alchemy Markets and most platforms, you can close positions at any time, even if the provider keeps theirs open. This ensures you stay in control of your copy trading account.

Can I partially withdraw funds while following a strategy provider?

Yes, you can withdraw part of your funds while continuing to copy. This lets you manage liquidity without fully disconnecting from a provider, though it reduces your allocation to their trades.

Can I become a strategy provider?

If you have strong trading skills and a record of consistent results, you can apply to become a provider on Alchemy Markets. This allows you to earn performance fees from other users who copy your trading decisions.

Can I copy trade on a demo account?

Yes, Alchemy Markets offers a demo account. This allows you to automatically copy trades in a risk-free environment, giving you a chance to practice before committing real capital.

Who can use the copy trading platform?

Anyone over 18 with a verified account can use Alchemy’s copy trading service, provided they are not in restricted jurisdictions. This makes it available to both beginners and experienced investors.

What is the performance fee?

The performance fee is a percentage of profits paid to the strategy provider. For example, if you earn $500 and the fee is 20 percent, $100 goes to the provider. This aligns incentives with your success.

How can I set a performance fee?

If you are a strategy provider on Alchemy Markets, you can set your performance fee within the platform’s limits. Clear terms are shown to copiers before they start following your strategy.

How do strategy providers receive their payment?

Payments are processed automatically by the platform. When profits are realised, the exchange commission or performance fee is deducted and credited to the provider’s account securely.

I already have an Alchemy Classic account. Will I need a new one?

No, you can use your existing Classic account. You simply need to register a copy trading profile within the app to start copying or providing strategies.

Can I be both a strategy provider and a copier?

Yes, Alchemy Markets allows you to be both. You can copy other traders while also having followers copy your trades, giving you dual benefits from the same platform.

Do I need approval to become a strategy provider?

Yes, approval is required. Alchemy Markets reviews your trading history and consistency before allowing you to offer strategies to others. This protects copiers by ensuring only credible providers are listed.

Are there any trading restrictions?

Yes, some restrictions apply. For example, certain high-risk products or practices may be limited depending on regulations. Always check platform rules and your region’s compliance requirements before you start trading.

Is Copy Trading for beginners?

Copy trading is good for beginners because it removes much of the technical chart analysis and simplifies the process to two key decisions: which traders to follow, and how much capital to allocate.

The copier needs to understand the provider’s risk style and risk appetite. Looking at factors like drawdowns, consistency, and equity curve helps ensure you’re following someone whose approach fits your goals.