- May 20, 2025

- 21 min read

CFD vs Futures: What Are the Differences?

Contracts for difference (CFDs) and futures are popular financial derivatives that allow traders to gain exposure to multiple markets without direct ownership. This post will outline the key differences between the two.

What’s the Difference Between Trading CFDs and Futures?

CFDs and futures share many similarities, as they’re both derivatives providing exposure to a wide range of assets. However, there are significant differences between the two. Understanding the differences will help you make the right choice when investing.

In this post, we’re about to discuss the main differences between the two. After reading this, you will have all the cards on the table to decide which product works best for you, or maybe you may consider both of them for different asset classes.

Here are the key differences between CFDs and futures.

Expiration

CFDs have no expiration date. You can hold a CFD position for as long as you want. However, note that some CFD brokers charge a fee for holding positions overnight, which makes long-term holding more costly.

In contrast, futures contracts traded on exchange always have an expiration date. Each contract has a predetermined quantity of the underlying asset and an expiration date when the contract must be settled.

Ownership

Both CFDs and futures are derivatives that don’t represent ownership rights over their underlying assets. However, there is a major difference in how these are tied to the related asset.

When trading CFDs, you speculate on the price of the asset without owning it at any time. Think of it as a financial bet on the price movement.

Elsewhere, futures contracts are agreements to buy or sell the underlying asset at a predetermined price when the expiration date comes. This implies that a futures contract will provide ownership rights at a future date, although traders may choose to close positions before the contract expires.

Contract Types and Size

CFDs are more flexible than futures in terms of position size. You can trade fractional units of any underlying asset. For example, you can trade one-tenth of gold or Bitcoin, which implies lower capital requirements. This is especially beneficial for retail traders starting with smaller deposits.

Conversely, futures contracts are standardised and more rigid, having predetermined terms, such as a fixed quantity of the asset. For example, a contract may represent 1 Bitcoin or 100 barrels of oil, and you can’t buy fractions of it.

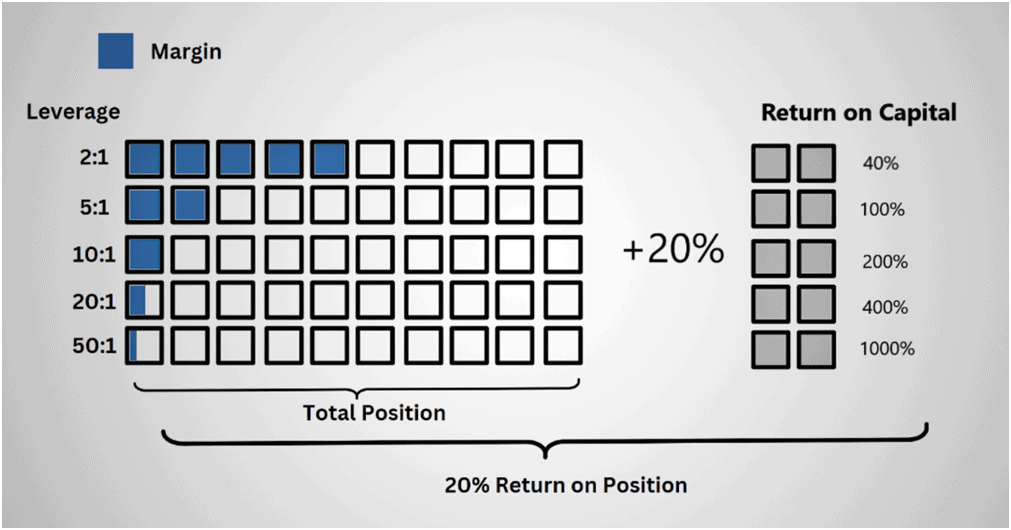

Leverage

CFDs typically offer higher leverage, enabling traders to open larger positions with less capital, although this increases the risk of loss as well.

Margin trading is also possible with futures, but the capital requirements are usually higher compared to CFDs. Even when you opt for the higher leverage with futures, the larger contract size requires a higher investment.

Settlement

With CFDs, gains and losses are determined by the difference between the contract’s opening and closing prices – you don’t physically own the underlying asset at any time.

In contrast, futures can be settled by physically delivering the underlying asset at expiry. For example, investors would get crude oil or gold at the open price. However, most traders close their positions before expiry to avoid physical delivery because they would then need a place to store it. Some futures, such as crypto or commodities, are settled in cash.

Market Access

CFDs are traded over the counter (OTC) and offered by brokerage firms off a centralised exchange. As a result, there could be different pricing and margin requirements from broker to broker with some even taking the opposite side of trades. Due to OTC trading, CFDs are usually open 24 hours a day, five days a week, or around the clock, depending on the underlying markets.

Futures contracts trade on centralised exchanges that match buyers and sellers of that specific market. These instruments are usually available during market hours based on the exchange they are listed on. Centralised exchanges will be a third party intermediary with consistent margin requirements and rules.

Also, futures are typically available for trading during business hours, though crypto futures offered by some crypto platforms are an exception.

Asset Choice

CFDs offer access to a broad range of asset types through a single platform, including stocks, forex pairs, indices, commodities, cryptocurrencies, bonds, and exchange-traded funds (ETFs).

Futures are also available for a wide range of asset classes, but the choice is limited to major assets. For example, you can find popular indices like the S&P500 and Nasdaq traded in a CFD or on a futures exchange. Popular commodities like gold, silver, and crude oil can also be traded as a CFD or on a futures contract.

Liquidity

With CFDs, liquidity depends on the broker, but major assets usually have enough liquidity to avoid slippage.

Futures are traded on centralised exchanges (such as Chicago Mercantile Exchange [CME], New York Mercantile Exchange [NYMEX], and Intercontinental Exchange [ICE]), offering high liquidity for major assets.

Costs

CFDs involve spread costs that represent the difference between bid and ask prices. As mentioned, they may also include financing fees if a trade is held overnight. For shorter-term trading, CFDs are a cost-effective way to trade.

Futures contracts usually have lower spread costs, but you should be ready for exchange fees, brokerage commissions, and higher initial margin requirements. There are no overnight fees for holding futures contracts since they have a fixed expiration date.

Regulation

CFD regulation differs from place to place, and in some regions, such as the US, they are banned altogether.

Futures are more strictly regulated and available for trade in the US and most jurisdictions.

Purpose

CFDs are mainly used to speculate on the short and medium-term price movements. They allow traders to profit from both rising and falling markets.

Futures can also be used for speculation, but many investors consider them for hedging purposes. For example, a construction company may use futures to lock in the oil price it needs in the future to protect against price volatility.

| CFDs | Futures | |

| Expiration | No | Yes |

| Ownership | No | Yes |

| Contract size | Flexible | Standardized |

| Leverage | Yes | Yes |

| Settlement | Cash settlement on close of the position | Cash/physical settlement on expiration |

| Market Access | Varies by asset | Trading hours |

| Asset Choice | Broad | Moderate |

| Liquidity | High | High |

| Costs | Low | Low |

| Regulation | Moderate | High |

| Purpose | Speculation | Speculation, hedging |

What are CFDs?

CFDs are financial instruments classified as derivatives, which means they don’t provide ownership rights over the assets they represent. Instead, a CFD mirrors the price of that asset, enabling traders to speculate on its price movement.

You would buy a CFD if you think that the underlying asset’s price will rise and would sell if you expect the underlying market to decline. The profit or loss is realised when the position is closed, and it represents the difference between the open and close prices.

CFDs are popular among retail traders willing to take short- and medium-term exposure to multiple markets. Traders can amplify potential profits through margin trading, which implies the use of leverage to fund the position with only a portion of their own money.

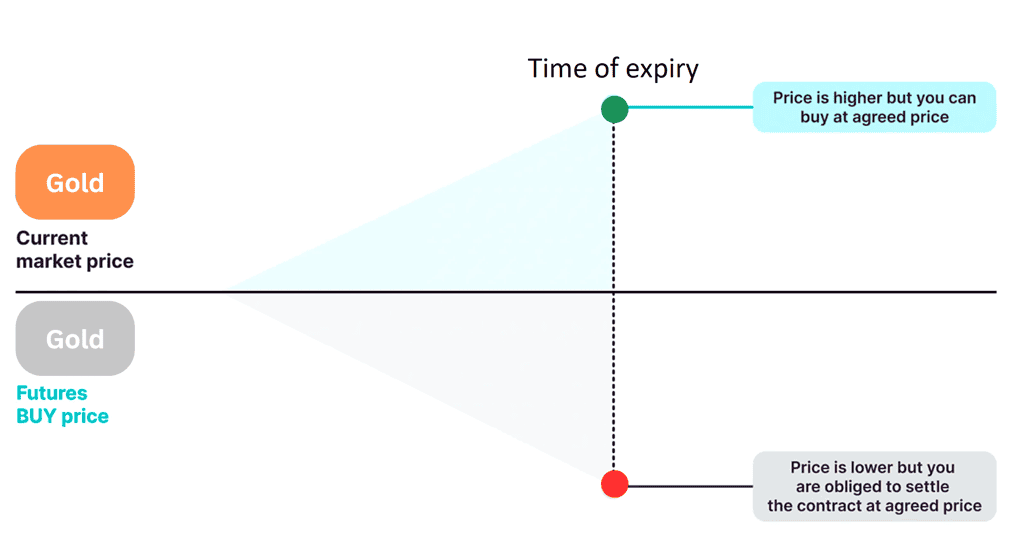

What are Futures?

Futures are another type of financial derivatives. A futures contract implies that a buyer and seller agree to trade an underlying asset for a predetermined price at a future date. The buyer is obligated to purchase the asset at the agreed price, while the seller is obligated to sell it, regardless of whether the asset’s value increases or decreases by that time.

These instruments were designed to hedge against potential price increases in an underlying market. Large companies and investors have been using futures to lock in prices to avoid price volatility. With time, futures started to offer access to a broad range of underlying assets, enabling institutional and retail investors to speculate on their price changes.

How CFDs Work

A CFD usually represents a contract between the trader and the broker. The latter offers a platform to make the trading process intuitive and seamless. If the trader believes the price of a listed asset will increase, he buys the CFD at the ask price or opens a ‘long position.’ If he expects the market to decline, he sells the CFD at the bid price or opens a ‘short position’ to profit from the bearish market.

The broker pays the trader the difference between the position’s open and close prices if the trader accurately predicts the price movement. However, if the price moves against the trader, closing the position will result in a loss, and the trader will be required to pay the difference to the broker. If the unrealised loss exceeds the trader’s initial investment, the broker may automatically close the position with a loss for the trader.

CFDs attract many retail traders thanks to margin trading – an option where one can use leverage to amplify the trade’s results requiring less upfront capital. With leverage, the trader borrows funds from the broker to increase the position’s size while investing only a portion of personal funds. For instance, 5:1 leverage requires a 20% margin. A 10% increase in the CFD position would convert into a 50% return on personal investment.

However, losses are amplified in the same way. In this example, the broker may automatically liquidate the position if the price goes against the trader only by 20%, which means a near total loss for personal investment (except for any potential margin remaining).

Trading CFDs

CFDs mimic the price movements of their underlying markets, offering the most convenient way to get exposure to these markets from a single platform.

Buying or selling a CFD works like the market it represents, but it’s more convenient for short-selling. For example, it would be simple to profit from the falling gold market by short-selling the CFD.

Additionally, CFDs allow traders to trade financial markets using leverage, which boosts potential gains and losses.

Advantages of Trading CFDs

- No expiry – unlike futures, CFDs have no expiry, enabling traders to hold positions for as long as they want. However, as mentioned earlier, some CFD brokers may charge overnight fees.

- Higher leverage – while futures contracts support margin trading, CFDs typically offer higher leverage, allowing traders to open larger positions with smaller initial investments. Alchemy Markets offers up to 20:1 leverage for stocks and up to 5:1 leverage for commodities. Thanks to higher leverage, CFDs offer higher profit potential.

- Convenience – with no expiry and physical delivery, CFDs are more convenient to trade. Alchemy Markets provides a wide range of educational guides and strategies for a better CFD trading experience.

- Market choice – CFD brokers offer a wider choice of markets compared to futures exchanges. Alchemy Markets supports stocks, indices, commodities, and foreign exchange (forex) currencies, which are not available with futures.

- Direct price relationship – CFDs have a direct relationship to the price movement of the underlying asset. In contrast, the price of futures may differ from the current price as the contract tries to price in possible movements.

- Practice Demo Account – Beginners who are exploring CFDs for the first time can practice trading CFDs in a demo account prior to committing capital.

Disadvantages of Trading CFDs

- Higher risks – leverage is great but it also increases the risk of losses by the same magnitude, which is higher compared to futures trading. Alchemy Markets offers risk management tools to limit potential losses.

- High finance costs – when holding the trade overnight with a CFD you’ll incur finance charges. Those finance charges can add up quickly if you hold the CFD position open for long periods of time with little price movement of the asset.

How Futures Work

Futures contracts are derivatives that set the parameters of a trade well before its actual settlement. For example, imagine you need oil three months from now, but you’re concerned that it will become more expensive by then.

A futures contract allows you to pay for oil at current prices and get the product in three months. If the crude price drops in the meantime, you won’t get any compensation while being obligated to purchase the product at the agreed price. If the oil price increases during the three months, you end up winning by using the futures contract to lock in the price.

Originally designed for commodities like agriculture and energy, futures have extended to other assets.

Today, many futures, including crypto, support cash settlement upon expiry instead of physical delivery. This means you would receive or pay the cash difference between the closing price and the contract price.

Futures contracts are traded on centralised exchanges, and some platforms focus on certain assets. For example, most gold futures in the US are through CME Group’s COMEX division.

Advantages of Trading Futures

- Standardisation – futures are highly standardised. Each contract stipulates fixed terms like size, expiration dates, and underlying asset specifications. Elsewhere, CFD terms vary by broker.

- Regulation – futures are regulated by major financial authorities and involve central exchanges and clearinghouses, offering greater security and transparency. CFDs, being OTC products, are associated with lighter regulatory oversight. In the US, most futures are regulated by the Commodity Futures Trading Commission (CFTC).

- Lower spreads – due to the high liquidity in futures markets, especially for popular assets like oil, gold, and financial indices, traders often benefit from tighter spreads compared to CFDs. The latter are traded directly with brokers that set their own spreads. Therefore, futures can have lower costs, which is especially relevant for larger trades.

Disadvantages of Trading Futures

- Higher capital requirements – due to lower leverage and higher contract size, futures typically have higher capital requirements per position, which can be a problem for many retail traders.

- Complexity – futures are highly standardised and involve rigid contract sizes and expiration dates, limiting trading flexibility. Additionally, traders must manage positions before expiration or face physical delivery or cash settlement, unlike CFDs.

- Asset choice – while futures are available for major assets like commodities, indexes, and even cryptocurrencies, the asset choice is more limited compared to CFDs, which provide exposure to individual stocks, more cryptocurrencies, and other assets.

- Trading hours – Futures markets have specific trading hours based on the asset and exchange, while CFDs are generally available for trading 24/5 (or 24/7 depending on the asset), especially for global markets like forex and cryptocurrencies.

CFD vs Futures Example

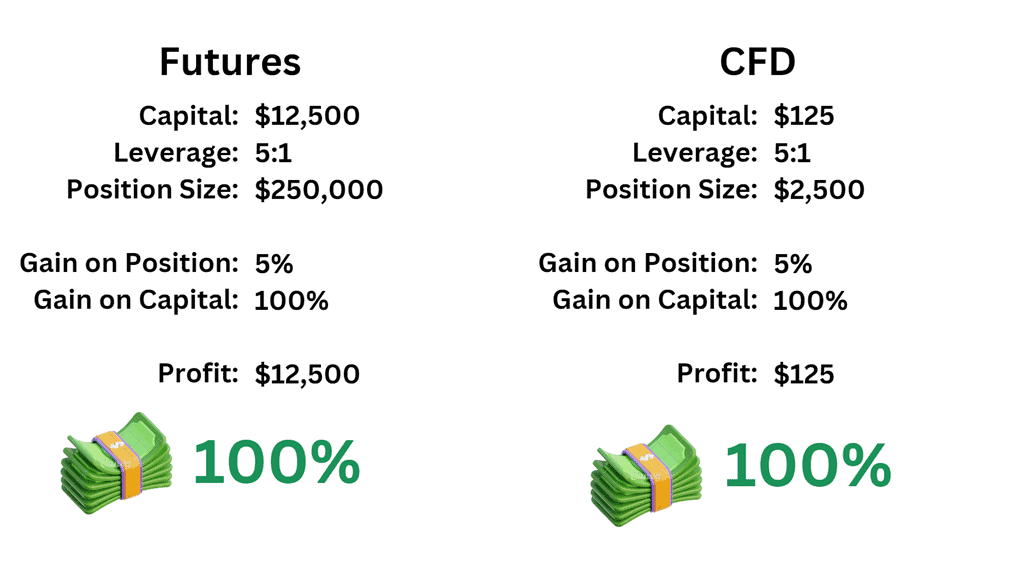

Now that you know the major differences between CFDs and futures, let’s see what it is like trading them in real life. In our example, we’ll use gold as the underlying asset.

- Futures example – to gain exposure to the price of gold, you can buy a gold futures contract on the CME exchange. Each contract typically represents 100 ounces of gold. If the troy ounce is priced at $2,500, the contract will represent $250,000 worth of gold.

Futures exchanges typically require an initial margin of about 5-10%. In our example, if the margin requirement is 5%, you’ll need to deposit $12,500 to open the contract.

If the metal’s price increases by 5% within a week, the contract’s price would increase to $2,625 per ounce, making the contract worth $262,500. This would represent a $12,500 gain or 100% return on the initial investment.

However, if the price drops by 5% to $2,375 per ounce, the contract value decreases to $237,500, resulting in a $12,500 loss, or 100% of the initial margin deposit, with the position being closed automatically. - CFD example – instead of buying a full futures contract, you can trade gold CFDs. To begin with, while the contract size for gold CFD is also 100 ounces, you can trade fractions of it, like buying 0.01 lots. With Alchemy, maximum leverage for gold would range from 5:1 up to 100:1, depending on your geographic location.

The conditions would be the same as above, but you will be able to start with as little as $125 since the position size would be worth $2,500.

Therefore, the winning and losing scenarios will be the same, but you will be able to make smaller deposits.

This example shows that CFDs and futures offer similar trading experiences, but CFDs provide greater flexibility.

CFDs vs Futures: How to Trade Profitably

CFDs and futures are both derivative instruments offering exposure to a wide range of assets, but how do you trade them profitably? Let’s explore some of the key aspects:

Your Trading Style and Goals

When choosing between CFDs and futures, think about your style, goals, and initial capital. If you prefer short-term trading with smaller deposits, CFDs are the right option due to their flexibility and higher leverage. On the other side, futures work best for passive, long-term investors to minimise overnight costs. Also, CFDs are suitable for speculative trades, while futures work best for hedging.

Market Conditions and Trading Opportunities

Market conditions play a key role in making the right choice. CFDs provide exposure to a broader range of assets, many of which represent volatile markets that offer great speculative opportunities. Also, CFDs offer more flexibility in terms of trade sizes.

Futures are generally better suited for long-term investment during established markets like gold or oil.

Market Access and Flexibility

As mentioned, CFDs offer access to a wide range of financial markets, including forex pairs, stocks, indices, cryptos, and commodities. All of these can be traded from a single platform, such as Alchemy Markets.

Futures contracts are limited to specific exchanges and markets, while their contract sizes are more rigid.

Day trading

Day traders open and close positions within the same day. CFDs are better suited for this style because of their direct relationship with the asset price, high leverage, and lower capital requirements. Thanks to their flexibility, CFDs are favoured by scalpers, who open multiple trades that last minutes or even seconds.

Swing trading

Swing trading is a style where positions are held for several days or weeks. Both CFDs and futures are suitable for swing trading for the same markets. CFDs give exposure to individual stocks and a wider range of cryptocurrencies, offering greater flexibility and leverage.

Position trading

Position traders hold positions for longer periods, such as weeks or months. Futures would be more suited for this style as they don’t charge overnight fees.

Possibility of Ownership

While both CFDs and futures are derivatives, the latter may provide ownership rights upon expiry. However, few traders hold positions open until futures contract settlement.

Product Pricing

CFDs typically incur costs in the form of spreads and overnight fees. Futures are associated with lower spreads and lower commissions.

CFD vs Futures: Key Similarities

- Both are derivatives – CFDs and futures are derivatives that mirror the performance of an underlying asset without offering direct ownership rights.

- You can go long or short – both CFDs and futures allow you to profit from rising and falling markets with ease.

- You can use leverage – both CFDs and futures support margin trading, allowing you to open larger positions with a fraction of personal funds.

- Both provide access to multiple markets – while CFDs offer exposure to a wider range of assets, both products support multiple markets.

- Liquidity – CFDs and Futures have high levels of liquidity in the market. You can use both instruments to get into markets or liquidate contracts.

CFD vs Futures Trading: Which is Better?

Both CFDs and futures have their advantages and drawbacks. Active traders looking to speculate on the price of multiple assets should consider CFDs.

Experienced traders who prefer to hold positions for a more extended period and are ready to invest higher amounts would prefer futures contracts.

Whether futures or CFDs suit you depends on what you seek as an investor, including asset choice, transparency, and complexity.

CFDs vs Perpetual Futures

A popular type of futures contracts is perpetual futures, also known as perpetuals or perps. They are particularly popular among cryptocurrency traders.

Unlike regular futures, perps don’t have an expiry time. Instead, they use funding intervals, such as every six or eight hours, to continuously reset and rollover. Trading perpetuals is very much the same as trading CFDs: they do not expire, and you can hold them indefinitely.

Crypto traders prefer perpetuals because they offer leverage and can be more liquid than spot markets.

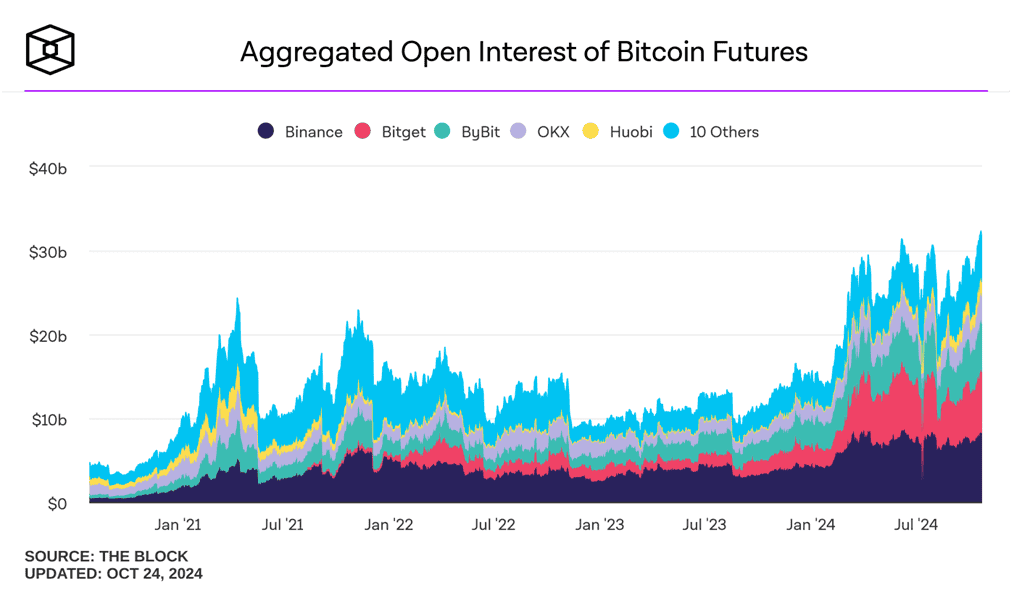

Currently, the total open interest in Bitcoin futures, including perpetuals, is at a record high.

Role of CFD Brokers vs Futures Brokers

One of the fundamental differences between CFDs (Contracts for Difference) and futures contracts lies in where and how they are traded. CFDs are over-the-counter (OTC) instruments, which means they are traded through brokers and not on an exchange. Futures contracts, on the other hand, are traded on an exchange, and therefore require a different type of brokerage. Let’s take a look at the roles of CFD brokers and futures brokers.

1. Market Structure and Execution

- CFD brokers act as market makers or direct market access (DMA) providers. In the market-maker model, they provide liquidity by posting bid and ask prices, taking the other side of the trade. In the DMA model, they act as a bridge between the trader and the external liquidity providers, providing direct access to the market.

- Futures brokers act as a bridge between the trader and the futures exchange, such as the CME or ICE. They provide direct access to the exchange order book, where trades are matched with counterparties.

2. Counterparty and Risk Management

- In most cases, CFD brokers act as the counterparty to the trade, meaning that clients do not trade on a centralized exchange. This allows for tighter spreads, customized contract sizes, and no fixed expiration dates, but also introduces counterparty risk.

- Futures brokers, on the other hand, clear trades through a clearinghouse, ensuring that all trades are settled. They are responsible for managing margin requirements, risk assessment, and regulatory compliance.

3. Margin and Leverage Differences

- CFD brokers are known for offering higher leverage, allowing retail traders to take on larger positions with a smaller initial deposit. However, it’s important to note that leverage levels are often capped by regulatory requirements.

- Futures brokers also offer leverage options, but margin requirements are set by the exchange and can vary by contract type, market conditions, and liquidity.

5. Fees and Costs

- CFD brokers generate revenue primarily through spreads, overnight financing fees (swap rates), and in some cases, commissions for DMA accounts. Their fee structures can be diverse and less predictable.

- Futures brokers charge commissions for each contract traded, and traders must also consider exchange fees, clearing fees, and potential charges for inactivity or platform usage.

In summary, the main difference between CFD brokers and futures brokers is that CFDs are a decentralized market, while futures exchanges are a centralized, regulated market. CFD brokers offer flexibility, lower barriers to entry, and greater access to global markets, while futures brokers provide direct market access with standardized contracts and institutional-grade risk management. Understanding these differences is important for traders looking to choose the right instrument for their trading strategy and risk profile.

Prop Trading Firms

A proprietary trader is one that trades with the firm’s capital. For retail traders who might want to trade their strategy with a prop firm, there are plenty of prop trading firms that use CFDs like FXIFY. Futures trading prop firms for retail traders is starting to gain popularity with FXIFY Futures coming online.

FAQ

Do professional traders prefer CFDs or futures?

Professional traders often prefer futures for their higher liquidity, standardisation, and lower spreads, while retail traders may favour CFDs for flexibility, asset choice, and lower capital requirements. However, both instruments can be considered by professional traders.

Are CFDs futures?

No, CFDs and futures are both derivatives, but they differ significantly. The former allows you to speculate on price movements without contract expiration, while futures have predetermined terms and an expiry date.

Are CFDs riskier than futures trading?

CFDs can be riskier due to typically higher leverage, but the risk can be managed by sticking to strategies and limiting damage with stop-loss orders.

Why are CFDs illegal in the US?

CFDs are banned by the US Securities and Exchange Commission (SEC) because of regulatory concerns over their high leverage and the potential for investor losses.

What is the difference between CFD and perpetual futures?

CFDs and perpetual futures both have no expiration date, but the latter use periodic funding rates to maintain price alignment with the underlying market, whereas CFDs mirror the asset price directly.