- Opening Bell

- Januar 15, 2026

- 4 Min. Lesezeit

Trump’s Pause on Critical Mineral Tariffs Sparks Silver Pullback, But Fundamentals Stay Firm

Policy Update: Tariffs on Hold

Silver prices saw a sharp correction after President Trump announced that new tariffs targeting critical minerals will be put on hold. The move eased short-term trade disruption risks that had been driving metals higher.

Silver briefly tumbled more than 7%, retreating from record highs above $93 per ounce, before stabilizing as traders reassessed the broader picture. Despite the pullback, prices remain more than 25% higher year-to-date, highlighting the market’s structural strength.

The White House plans to explore bilateral supply agreements with key trading partners and may consider setting a price floor on critical mineral imports. Officials are expected to report back within 180 days. While tariffs haven’t been ruled out, the policy shift signals a preference for strategic cooperation over confrontation — at least in the near term.

Market Context: A Tight Physical Silver Market

The recent volatility underscores silver’s dual nature — part safe-haven metal, part industrial commodity. Strong demand from the solar, electrification, and electronics sectors continues to absorb available supply.

At the same time, global mine production remains constrained, as most silver is produced as a by-product of other metals such as zinc, lead, and copper. This limits how quickly supply can respond to rising prices, keeping the physical market tight.

US tariff uncertainty earlier this year triggered a historic squeeze in physical silver, with significant volumes moving from London into US warehouses. That shift reduced global liquidity and amplified price swings, reflecting how sensitive silver’s balance is to trade and logistics disruptions.

Structural Drivers: The Bullish Case Remains

Even after the recent correction, the macro and industrial drivers for silver remain firmly in place:

- Industrial demand tied to renewable energy and electronics continues to grow.

- Mine supply remains capped by structural production limits.

- Investment demand stays robust amid inflation concerns and ongoing policy uncertainty.

These factors have kept silver prices well-supported over the past year, and they continue to provide a strong long-term foundation for the market.

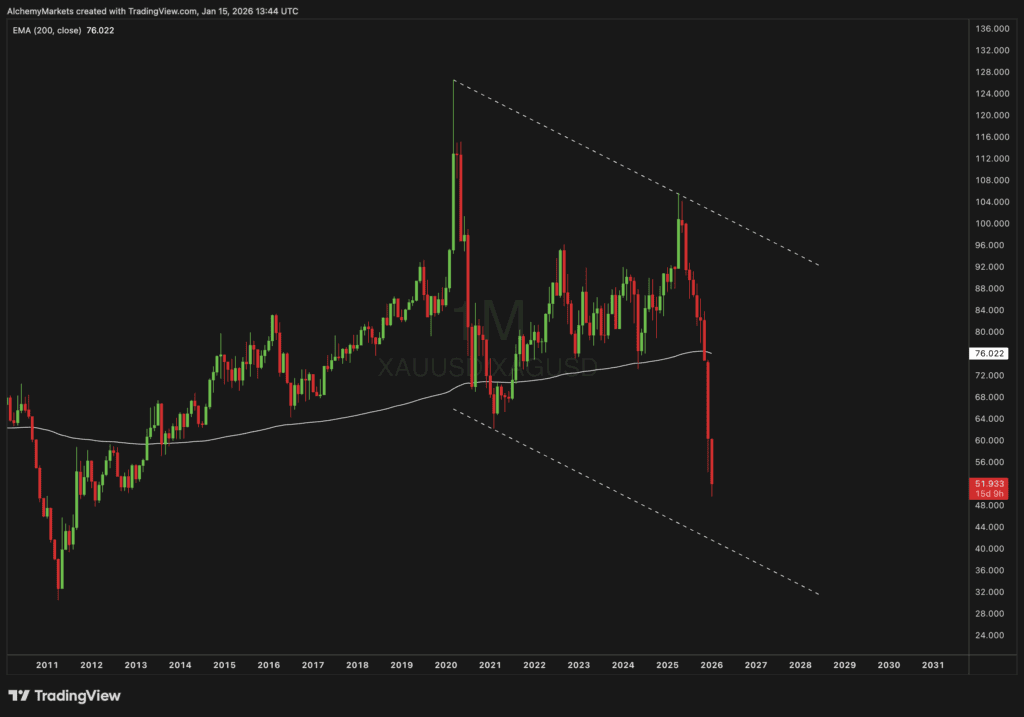

Technical Analysis: Gold-to-Silver Ratio at 15-Year Lows

From a technical standpoint, the gold-to-silver ratio (XAU/XAG) has been steadily declining and now sits near 50, the lowest level since 2011. This signals that silver has been consistently outperforming gold over the past year.

The ratio has been trending lower within a descending channel, suggesting ongoing relative strength in silver. A sustained break below the 50 level could open the door toward 45 or even 40, implying continued upside momentum for silver in relative terms.

However, it’s worth noting that silver is currently trading below its 200-day moving average, reflecting the recent loss of near-term momentum following the sharp correction. While this signals short-term pressure, the broader trend structure remains intact above key support levels around $48–50.

Overall, the longer-term chart setup still favours a gradual recovery once the market digests the recent volatility.

5. Outlook: Consolidation Likely, But Support Intact

Volatility will likely remain elevated as markets digest shifting US trade policies and evolving macro conditions. Prices may consolidate in the near term, especially after such a steep rally.

However, silver’s tight supply, robust industrial demand, and renewed investor interest all suggest limited downside. Any dips are likely to attract fresh buying interest, keeping silver well-supported through the next quarter.

Bottom Line

Trump’s tariff pause removed a short-term risk premium, but it hasn’t changed silver’s core story. The metal remains structurally undersupplied, industrial demand is resilient, and momentum relative to gold continues to strengthen.

Silver may trade sideways in the short run, but the long-term bias remains bullish — supported by a powerful combination of industrial growth, supply constraints, and macro uncertainty.